The motivation to build more homes grows as prices continue to steadily increase heading into the spring home-buying season.

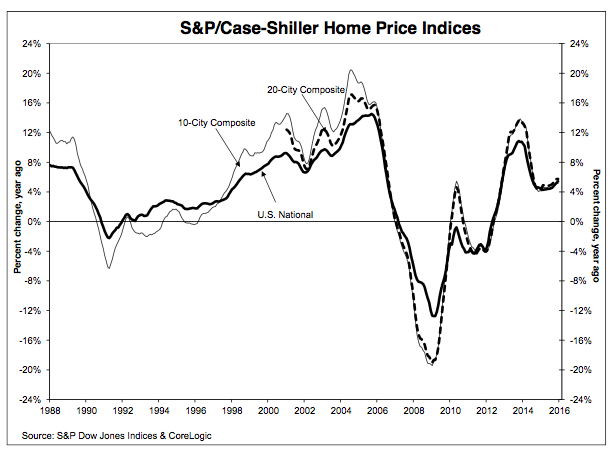

Home prices posted a slightly higher year-over-year gain with a 5.4% annual increase in December 2015 versus a 5.2% increase in November 2015, according to the latest S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions.

Click to enlarge

(Source: Case-Shiller)

While numbers continues to rise, David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, noted that the pace is slowing a bit.

“Sparked by the stock market’s turmoil since the beginning of the year, some are concerned that the current economic expansion is aging quite rapidly. The recovery is six years old, but recoveries do not typically die of old age,” said Blitzer.

Blitzer explained that housing construction, like much of the economy, got off to a slow start in 2009-2010 and is only now beginning to show some serious strength.

“Continued increases in prices of existing homes, as shown in the S&P/Case-Shiiller Home Price Indices, should encourage further activity in new construction. Total housing starts have stayed above an annual rate of one million starts per year since last March and single family homes have been higher than 700,000 units at annual rates since June. Housing investment continues its positive contribution to GDP growth,” added Blitzer.

The 10-City Composite increased 5.1% in the year to December compared to 5.2% previously, while the 20-City Composite’s year-over-year gain was 5.7%, the same as November.

Month-over-month, after seasonal adjustment, the National and 20-City Composites Index both recorded a monthly increase of 0.8%. The 10-City Composite increased 0.7% month-over-month in December.

Additionally, 10 of 20 cities reported increases in December before seasonal adjustment; after seasonal adjustment, 19 cities increased for the month.

“There are a lot of economic forces at work behind the scenes that will have a big impact on housing as we enter the busy home-shopping season,” said Zillow Chief Economist Svenja Gudell. “Low inventory is a factor in almost every market, so buyers should be prepared for a limited selection in the months to come.”

As far as other factors impacting the market, Gudell said, “Low oil prices are weighing on growth and employment in the Dakotas, Alaska and Texas, softening rental appreciation and home value growth in those states’ most oil-dependent communities. And global economic volatility is contributing to a strengthening U.S. dollar, which will impact demand from foreign buyers, and help keep mortgage interest rates low.”

Quicken Loans vice president Bill Banfield added that the continued deceleration of price gains is likely to continue as prices normalize in much of the country. “Prospective homebuyers are having trouble keeping up with price increases that outpace inflation and average wage growth. However, the especially tight housing markets in the west could see sustained growth as long as the number of prospective homebuyers continue to outnumber available homes,” continued Banfield.