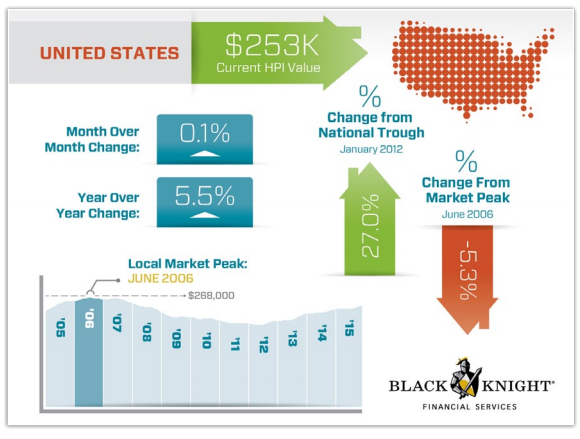

Once again, home prices are trending higher, rising 0.1% from October, and 5.5% on a year-over- year basis, the November Black Knight home price report found.

As a result, national home prices are up 27% since the bottom of the market at the start of 2012 and are just 5.3% off the June 2006 peak.

Click to enlarge

(Source: Black Knight)

The Black Knight HPI utilizes repeat sales data from the nation’s largest public records data set, as well as its “market-leading, loan-level mortgage performance data, to produce one of the most complete and accurate measures of home prices available for both disclosure and non-disclosure states.”

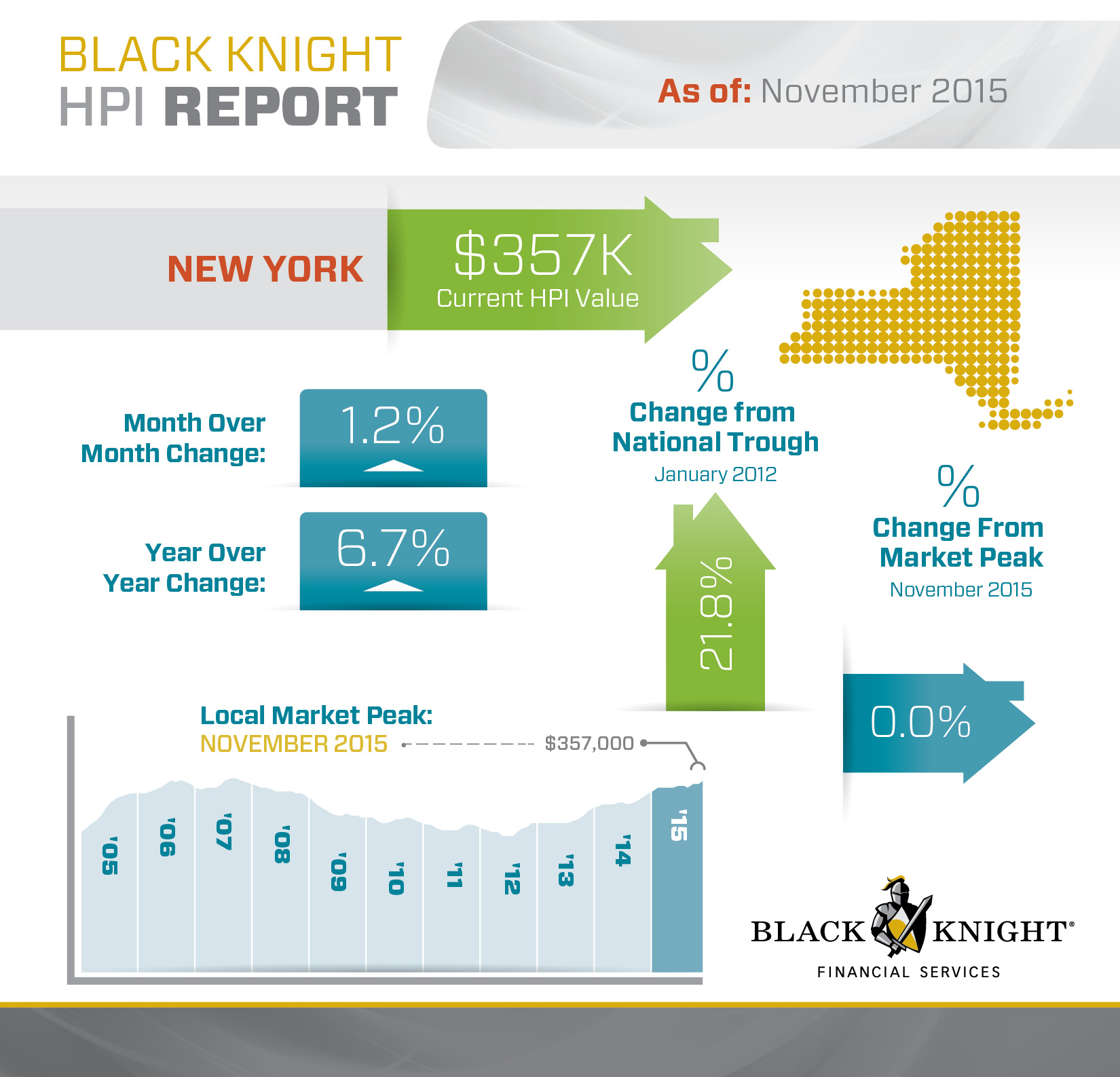

Notably, New York led gains among the states for the fifth straight month, seeing 1.2% month-over-month appreciation, the report said.

The state accounted for five of the top 10 best performing in November, with NYC leading at 1% month-over-month growth.

Here’s a breakdown of just New York.

Click to enlarge

(Source: Black Knight)

Along with New York, Tennessee and Texas also hit new peaks in November:

- New York ($357K)

- Tennessee ($179K)

- Texas ($216K)

And at the metro level, of the nation’s 40 largest metros, seven hit new peaks:

- Austin, Texas ($286K)

- Dallas, Texas ($221K)

- Denver, Colorado ($329K)

- Houston, Texas ($220K)

- Nashville, Tennessee ($222K)

- Portland, Oregon ($324K)

- San Antonio, Texas ($195K)