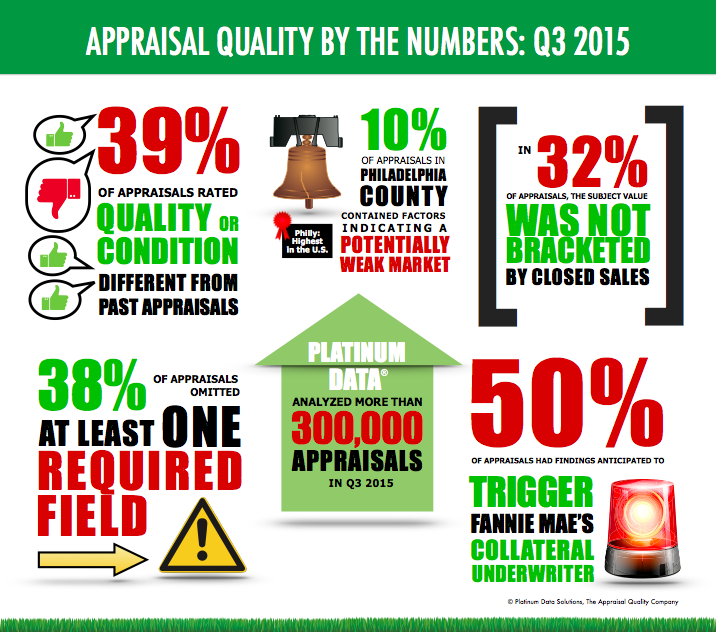

39% of appraisals contained property quality or condition ratings that conflicted with previous ratings on the same property in the third quarter of 2015, according to a report from Platinum Data Solutions.

For the report, the company analyzed its database of over 300,000 appraisals that were evaluated by RealView, its appraisal quality technology, in Q3 2015.

This infographic shows what the company discovered.

Click to enlarge

(Source: Platinum Data Solutions)

“More than one in three appraisals contain inconsistencies in property ratings,” said Phil Huff, president and CEO of Platinum Data Solutions. “Causes aren’t easy to determine, so they need to be investigated. Doing this after Uniform Collateral Data Portal (UCDP) submission opens lenders up to numerous issues. Costly delays are just one of them.”

According Fannie Mae, Collateral Underwriter identifies rating inconsistencies on loans submitted through the UCDP by comparing the appraisal’s data with its own proprietary data, and flags the appraisal for comments or corrections.

Conflicting property condition and quality ratings can result from a number of factors, such as human error, appraiser subjectivity, actual changes in the property’s condition or quality, or even possible appraisal fraud, which has been cited by the GSEs as the top origination fraud scheme trend in 2014.

To combat this issue, Huff explained that appraisers need to be aware of what other appraisers are doing. They need to see that someone ranked things differently than them and be made aware of one another’s discussions upfront.