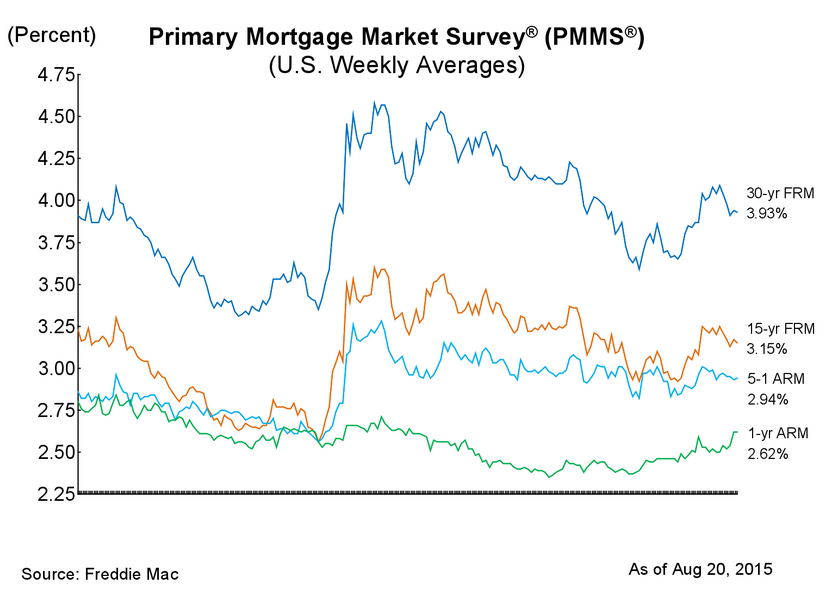

Mortgage rates barely moved from last week, with rates once again coming in below 4%, the latest Freddie Mac Primary Mortgage Market Survey found.

Click to enlarge

(Source: Freddie Mac)

The 30-year, fixed-rate mortgage averaged 3.93% for the week ended Aug. 20, down from 3.94% a week ago. Last year, it sat at 4.10%.

The 15-year, fixed-rate mortgage averaged 3.15%, down from 3.17% a week prior and 3.23% a year ago.

In addition, the 5-year, Treasury-indexed hybrid adjustable-rate mortgage inched up from 2.93% a week ago to 2.94%. A year ago, the 5-year ARM averaged 2.95%.

The 1-year Treasury-indexed ARM averaged 2.62%, unchanged from last week. In 2014, the 1-year ARM averaged 2.38%.

"There was little movement in financial markets this week as the 30-year fixed mortgage rate remained steady, dropping only 1 basis point to 3.93 percent,” said Sean Becketti, chief economist, Freddie Mac.

“Overall inflation grew an underwhelming 0.2 percent year-over-year in July, but core inflation remains steady at 1.8 percent keeping chances alive for a potential rate hike in September. Housing markets have responded positively to low mortgage rates — the 30-year fixed mortgage rate has been below four percent for five consecutive weeks,” he continued.

Bankrate reported that mortgage rates moved slightly higher, with the 30-year fixed increasing to 4.06%, up from 4.04%.

The 15-year, fixed jumped to 3.28%, up from 3.26% a week ago, while the 5/1 ARM hit 3.24%, up from 3.20% last week.