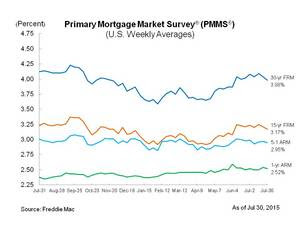

Mortgage rates moved lower once again, falling just enough to slip under 4%, the latest Primary Market Survey from Freddie Mac said.

The 30-year, fixed-rate mortgages averaged 3.98% for the week ended July 30, 2015, a drop from last week’s 4.04%. A year ago, it sat at 4.12%.

In addition, the 15-year, FRM averaged 3.17%, down from 3.21% a week ago and 3.23% a year ago.

The 5-year, Treasury-indexed hybrid adjustable-rate mortgage averaged 2.95% for the week, declining from 2.97% last week. In 2014, it averaged 3.01%.

The 1-year, Treasury-indeed ARM averaged 2.52%, down from 2.54% last week, but up compared to 2.38% a year ago.

Click to enlarge

(Source: Freddie Mac)

"Monday's 8% decline in Chinese stock prices triggered similar — though smaller — sell-offs in global equity markets. The associated flight to quality drove U.S. Treasury yields down nearly 5 basis points. Accordingly, 30-year fixed-rate mortgages fell 6 basis points to 3.98%,” said Sean Becketti, chief economist with Freddie Mac.

“The mortgage rate has bounced between 3.98% and 4.09% since the first full week of June, falling a bit when events overseas take a turn for the worse and rising when the clouds appear ready to part. With no clear direction coming from the Fed this afternoon, we expect more of the same in coming weeks,” he continued.

Bankrate posted similar findings, with its 30-year, FRM falling to 4.09% from 4.12% last weel.

The 15-year, FRM dipped to 3.27%, down from 3.30% last week, while the 5/1 ARM decreased to 3.22%, down from 3.24% last week.