On a gray and rainy day in April, dozens of senior executives from the nation's largest mortgage servicers are gathered in an upstairs conference room of one of their largest competitors, and all of them are holding their right hand in the air.

“Repeat after me,” they’re told.

“I am a good person,” they say in unison. “And I care about homeowners.”

“My company occasionally sends out really bad letters that confuse people,” they continue. “I will not beat myself up for my company’s issues, because homeowner communication needs work.”

The group laughs.

Providing the pledge’s source material is Katherine Porter, who previously served as California’s independent monitor in the nationwide $25 billion National Mortgage Settlement. Porter’s pledge and the subsequent act of self-deprecation breaks the ice in a room filled with executives from Bank of America, Bayview Loan Servicing, Citigroup, JPMorgan Chase, Nationstar Mortgage, Ocwen Financial, OneWest Bank, Quicken Loans, US Bank, and Wells Fargo.

The group has gathered at the Irving, Texas, offices of Nationstar for a meeting of Hope Now, the voluntary, private sector alliance of mortgage servicers, investors, mortgage insurers and nonprofit counselors.

On the agenda is improving borrower communication, much of which is still reliant on sending letters back and forth between borrowers and servicers, a process which Porter says can and needs to be greatly improved.

Having taken Porter’s lighthearted pledge, the group is laughing as Porter begins to discuss how difficult it is to create borrower communication that works effectively, meets all appropriate regulatory and compliance standards, and satisfies the servicers’ legal requirements as well.

With her two-plus years as California Mortgage Monitor complete, Porter has continued her career as a professor of law at the University of California at Irvine and she treats the room full of executives like a classroom full of first-year law students. Her energy and enthusiasm are infectious.

She moves in and out of the spaces between the tables in Nationstar’s Dallas conference room, asking probing questions she already knows the answers to.

“I am a Socratic method professor,” she tells the group. “I’ll go a little Elizabeth Warren on you. Not Elizabeth Warren on Tim Geithner, but Elizabeth Warren on a 1L (first-year law student). Only a few of you will cry,” she says with a laugh.

Later, Porter tells HousingWire that she knows Elizabeth Warren’s teaching style well, having studied under Warren at Harvard Law School, before Warren’s accession to the U.S. Senate.

“One of her big things was that you have this knowledge and expertise, put it to good use,” Porter says of Warren.

That’s why Porter travels and speaks at conferences and meetings like this Hope Now meeting. Because of her position as an academic, she says she’s able to “tell it like it really is.”

Back in the conference room, Porter is discussing how difficult it is to create effective communication when it has to serve so many masters.

“This is actually really hard,” Porter says. “I can show you. Writing these letters is really hard.”

The letters Porter is speaking about are letters sent from servicers to borrowers, and Porter begins by highlighting the process many servicers go through before a single letter is mailed out to a borrower.

“Right now, because of all the regulatory and legal standards, you have multiple hands in the pot, stirring in the kitchen at the same time,” Porter says. “You don’t get a good letter when you send it through seven different departments. It’s too many tweaks.

“I get that some of these letters have to be built on an assembly line,” she continues. “But this is really a process problem.”

With bad processes come bad letters, Porter says. And bad letters have serious consequences.

“Bad letters damage the brand,” Porter says. “There’s a contagion effect of this. I think bad letters are unjust.

They disproportionately harm the borrowers we need to help the most.”

The servicers agree on the harm these letters do, causing borrower confusion, increased stress on servicer employees, increased complaints and regulatory risks.

“Think about the literature of going to the doctor,” she says. “Once they tell you have cancer, you don’t hear anything else. Something similar has happened to all of us.”

Porter compares this to a borrower, especially a delinquent borrower, receiving a confusing or threatening letter from a mortgage servicer.

“If we have a bad letter, we’ve lost the opportunity to reinforce good communication,” Porter says, highlighting a disconnect between the verbal communication that takes place between a borrower and the servicer and the written communication that is sent to borrowers.

“I think having to send everything by mail dooms you to failure,” she tells the group. “These letters are being produced to meet regulatory requirements, but consumers don’t know that. They’re worried about losing their house. If consumers were in a less vulnerable place, they would realize these [letters and verbal communication] are just ships passing in the night.”

Porter speaks about the mountains of letters her office received when she was California Monitor.

“We’d get banker’s boxes full of letter from borrowers. They collected every piece of mail from servicers and sent it to us. And so many pieces of mail were unopened,” Porter says. “I hate to break it to you, but most homeowners don’t open or read these letters.”

Porter asks the room how often they check their own mail. Several in the room say they check their mail once a day, while others say they check it once a week.

“I check it when my mailman knocks on the door and says ‘Can you take this pile?’” Porter says. “There’s nothing in there that I want.”

Porter says that one of the significant issues with the deluge of letters that servicers send to borrowers is delayed response, and when it comes to a borrower potentially paying a mortgage late, a delayed response is a serious problem.

“You want a response via email?” Porter asks rhetorically. “Send them an email. I’m a big proponent of email and I want to work with regulators on that. Moving to electronic communication would help alleviate many of these concerns. This a great opportunity to partner with the CFPB. Go and talk to them about this.”

Porter lists three principles that are the main tenets of her presentation, the three points she wants all of the servicers to take to heart.

Principle #1

Good communication places the burden on the more sophisticated party.

- Give borrowers a head start by prepopulating the known information already.

- “If you know something, tell them. Don’t make them fill out the information you already know.”

- Use actionable items in letters instead of large blocks of text.

- “You tell borrowers that they have items that are either missing, incomplete or illegible, but you don’t tell them which one. Are there missing documents or are there incomplete documents? Or are the documents illegible? If I don’t know which one of those it is, I don’t know what to do. This does not produce action from consumers.”

- Servicers need to have robust web portals as soon as possible.

- “Your web portals need to be more like Turbo Tax. Give borrowers more opportunities to engage.”

Principle #2

Good communication is timely and strategically timed to encourage action.

- Change the method of communication.

“How do you like to receive information from a homeowner?” Porter asks the room.

“By fax,” one of the executives answers, drawing nods of agreement from much of the room.

“Guess what?” Porter says. “No one has a fax machine in their house anymore. Fax is expensive. These borrowers have to go somewhere and pay per page to fax these documents.”

- Adapt to changing demographics.

“Putting everything in Spanish should be on your list. Do it all the time. I’ve said this before, and the response I always get from servicers is, ‘If you make us put in Spanish, you are going to make me do it in Burmese too.’ You know what, don’t be such a lawyer!”

- Change the timing of servicer communications, especially with borrowers who are either on the verge of default or are already in default.

“This idea that we’re going to cure everything through preventative action, it’s like people who expect us to brush our teeth three times a day and floss twice a day. It’s not going to happen,” Porter says.

“So send your modification letter with the notice of sale on a judicial foreclosure. It’s hard to get them to get help early. It’s hard to help someone who’s had a heart attack, it’s easier to tell them to cut back on the Cheetos. Consumers have terminal euphoria.”

Principle #3

Reforming borrower communication requires top talent.

- Write these letters by committee as opposed to cycling it through department after department.

- “These letter-writing exercises become very unfun, but you can make them better. Make them a contest. Do something to get your best people working at their best."

- Make these communications more readable.

The slide behind Porter changes. On the screen now is language taken directly from the Making Home Affordable handbook. The Department of the Treasury included this sample language for servicers to use when telling borrowers when they were denied a loan modification under the government’s Home Affordable Modification Program.

Porter says that servicers often copy this language into their own denial letters, using it for both HAMP denials but also for their own proprietary loan modification programs.

The language reads:

We are unable to offer you a HAMP Modification because, in performing our underwriting of a potential modification, we determined that the proposed modified monthly payment which we could offer you, which includes a modified monthly principal and interest payment on your first lien mortgage loan plus property taxes, hazard insurance premiums, and homeowners dues (if any) was outside the of the range of [insert as appropriate:] [10% – 55%] OR [insert Servicer’s DTI Range] of your monthly gross income (your income before taxes and other deductions which we verified as $________. Your modified monthly housing expense must be within this range in order for you to be eligible for HAMP. If you believe the verified income figure we have is incorrect, please contact us at the number provided below.

“With all due respect,” Porter says, “this blows.”

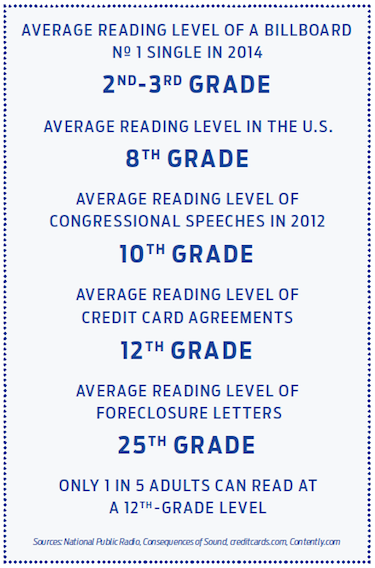

“This is at a 25th-grade reading level,” Porter says. “You know what the average reading level in the U.S. is? 8th grade.”

Porter also discusses the government’s language in a report she authored as California Monitor.

“The denial language Treasury provides here is troubling for many reasons. A homeowner will likely read this several times and still not understand the reason for denial from the program because the explanation is convoluted and contains technical terms like ‘underwriting,’” Porter says in the report.

“And, the explanation is far too wordy,” Porter’s report continues. “The first sentence alone contains 80 words and three clauses.”

“How many of you use a readability index?” Porter asks the group. “A readability index tells you the grade level of any block of text. You need to be using one on every letter. There’s one available in Word. It’s not great but it’s in there.”

In Porter’s report, she lists an alternative version of the same HAMP denial language – one that’s shorter, easier to read and doesn’t contain any errors:

In Porter’s report, she lists an alternative version of the same HAMP denial language – one that’s shorter, easier to read and doesn’t contain any errors:

“We are unable to offer you a HAMP modification because your new monthly payment would be more than [X percentage] of your gross monthly income (your income before taxes and other deductions). This monthly payment is larger than the program guidelines allow. We determined your gross monthly income to be $ ______ . If you believe this income number is incorrect, please contact us at the number provided below.”

That passage contains 67 words instead of the 125-127 words in the government’s language, reads at a 10th-grade level and contains zero typos.

Another area Porter would like to change is the use of governmental acronyms.

“You don’t have to take the crap acronym the government gives you,” Porter says. “I mean, HAMP Tier 2, who came up with that? Who even knows what it means? Try capturing some other words and actually telling them what it is. You never tell them what it is. You tell them what it does, but you don’t tell them what it is.”

While Porter is talking to HousingWire, the servicers have broken up into small groups and are tackling some of the issues that Porter laid out for them.

“It’s time for the industry to take some of its learning about consumers and go back to government and say the rules that we made in crisis can be improved,” Porter says.

“We ended up designing a process that is way too complicated,” she continues. “Those problems affect the industry and the people as well. Every time you make them go back and forth, you run the risk of having a miscommunication. We need to be thinking about a simpler process that is designed to be consumer driven.”

Later, Erik Selk, the executive director of Hope Now and the organizer of the day’s events, tells HousingWire that he feels the day’s discussions went well.

“I think there’s an appetite for things to improve,” Selk says. “Honest discussions are happening right now. I think real change can come out of this.”

After the meeting, Hope Now will organize the servicers’ thoughts into action items and begin to work towards proposals for change that can be presented to regulators, Selk said.

“I think there are some ways to bring technology into the conversation. We need to meet customers where they are. We’re so far beyond getting a letter in the mail and sending a check,” he says.

“Why can’t we be like Amazon or iTunes? We can make it simpler. There has to be a way to make it simpler. It can only get better.”

As Porter noted, she can talk freely now that she is again a professor, not serving as the California Monitor. Here are some of her other thoughts on servicing, which she shared at the conference.

“The rules of the National Mortgage Settlement came out of a time of crisis. Some of those rules were good and some were not so good. Why would you think the rule of the NMS are the be-all, end-all? People just wanted those negotiations to be over. The CFPB just took the NMS’ rules and made them national. Then the states went out and created their own wacky rules. Servicing rules are hard. Servicing is hard.”

Porter also calls herself one of the “rare people” who want HAMP to end.

“I think left to your own devices, with your own expertise, you could do better than HAMP. Tacking on to HAMP is like lipstick on a pig.”

Porter suggests that any potential GSE reform should include servicing rules changes.

“Servicing has been the step-child. We can use GSE reform as another vehicle on how to revolutionize servicing going forward. One of the big unsolved things in servicing is that we still haven’t figured out how to balance investor needs with the servicers and the borrowers as well.”

“We need to do some work on the modification programs that investors and Fannie and Freddie build into their pooling agreements. There is an amount and type of modification that produces the best/worst outcome. Somebody needs to figure out what it is and build it into the servicing contracts in the future. I think we need to do more work on educating investors and the options they permit servicers to offer and that will help to standardize things to the borrowers.”

Porter says that now is the time to bring private capital back into the market, and if we succeed in doing that, then everyone will benefit.

“Investors are not aligned with borrowers, servicers and the government,” she says. “They need to be brought to the table. And I think it’s the government’s job to facilitate those conversations or force them through regulations. But this is going to be a tough row to hoe.”

Porter tells HousingWire that she saw great improvement in servicing during her time as California Monitor. “It needed improvement!” she said. “I think we’re now at the point where we need to figure out when the next improvement is.” Porter said that she thinks now is the right time for servicers to try to affect real change.

“What’s gotten lost in all the litigation and regulation is a look at the industry-driven innovation that has come out of the financial crisis. The industry has done some learning. Now is the right time to build on how we communicate with customers. I hope they’re trying to reflect now on what we can do to help consumers.”