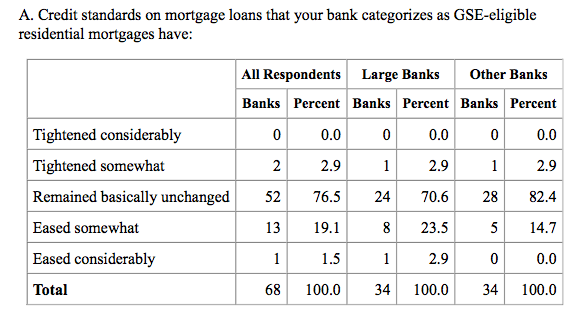

The housing market started off on solid footing this year as lenders experienced an increase in mortgage lending demand, while credit standards eased simultaneously. According to the April 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve, over the past three months, nearly 20% of banks said that credit standards for approving applications on GSE-eligible residential mortgages eased somewhat.

Click to enlarge

Source: Federal Reserve

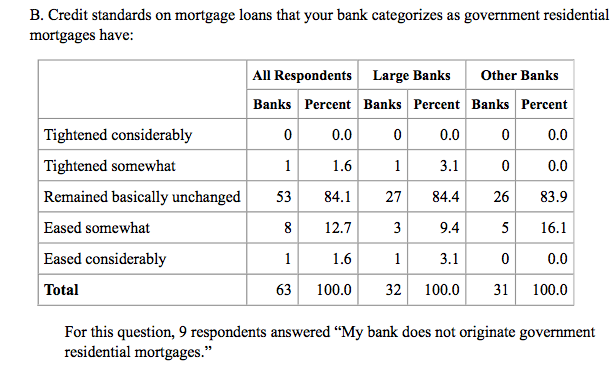

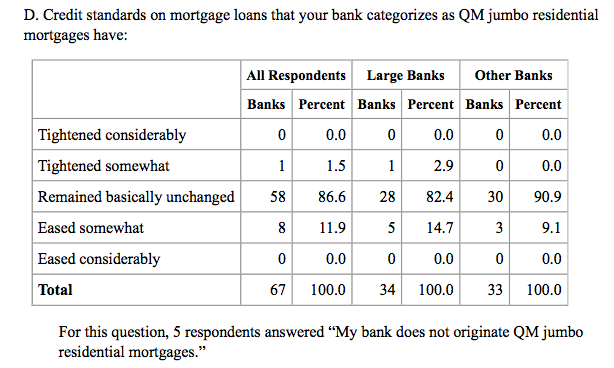

Other loan categories that also loosened were government residential mortgages and Qualified Mortgage jumbo residential mortgages.

Click to enlarge

Source: Federal Reserve

Click to enlarge

Source: Federal Reserve

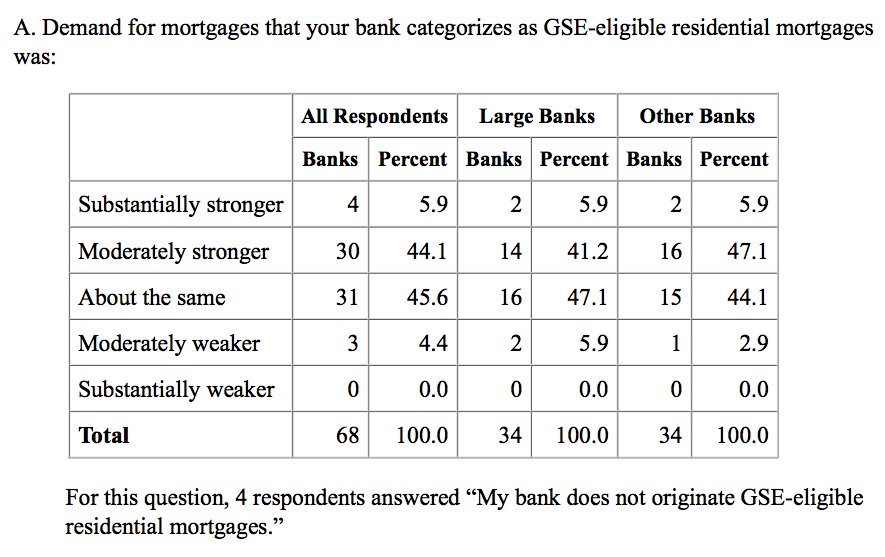

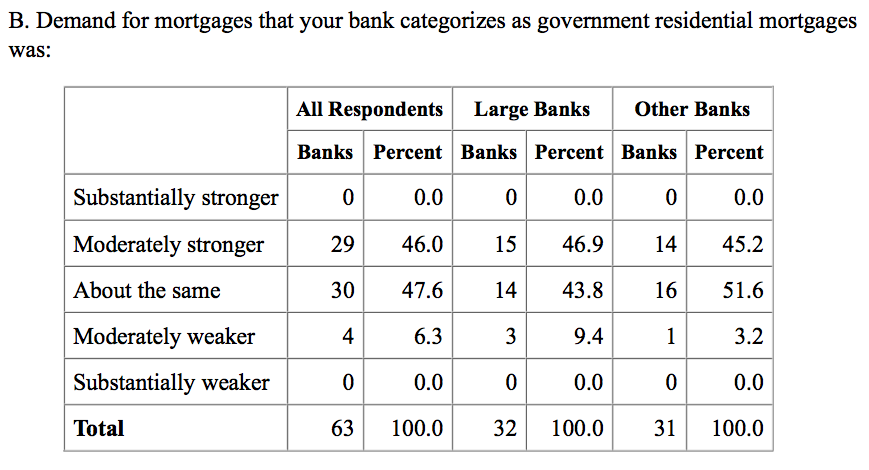

Then, when it came to consumer demand, it nearly increased across all types of mortgages.

The two most notable surges in demand came from GSE-eligible residential mortgages and government residential mortgages, with almost 50% of lenders saying they moderately stronger demand.

Click to enlarge

Source: Federal Reserve

Click to enlarge

Source: Federal Reserve