Overall mortgage origination projections for 2015 are hard to estimate due to rates remaining surprisingly low into 2015.

According to the latest Freddie Mac primary mortgage market survey, the 30-year, fixed-rate mortgage averaged 3.86% for the week ended March 12, up from last week’s 3.75%. Bankrate posted the 30-year fixed at 3.97%. A year ago, the 30-year averaged 4.37%.

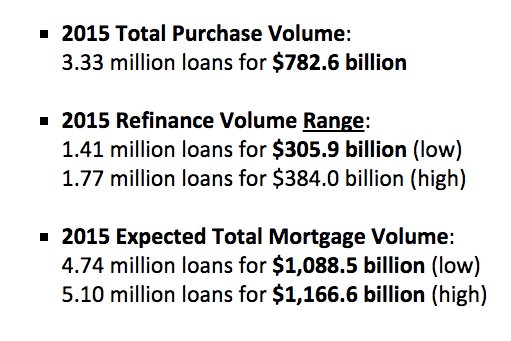

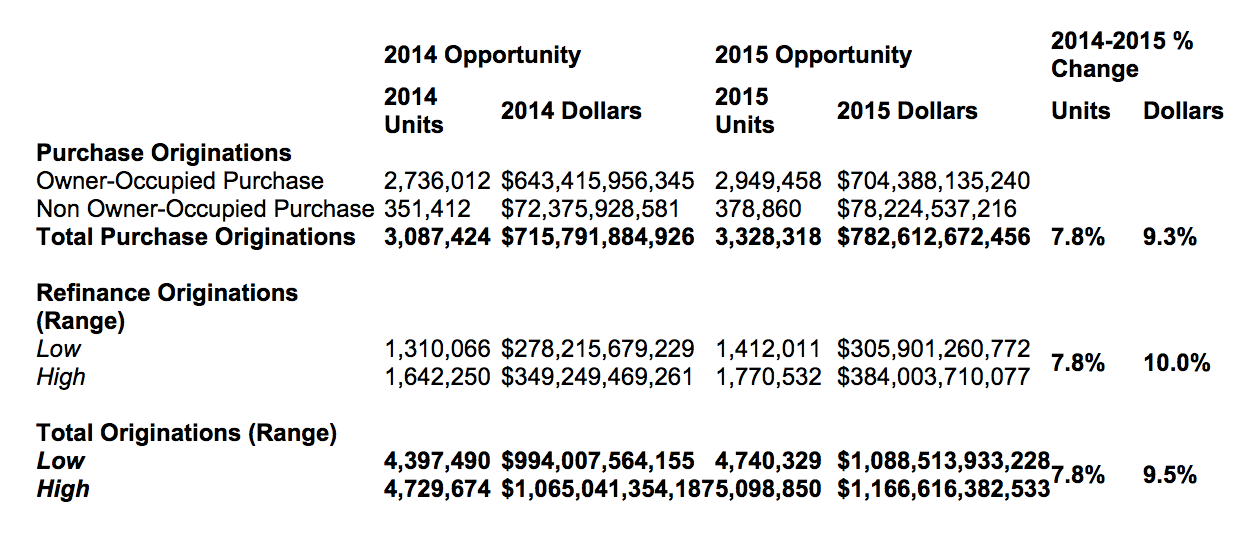

iEmergent, a forecasting and advisory services firm for financial services, issued its most recent 2015 to 2019 U.S. Total Mortgage Volume Forecast, projecting that 2015 purchase mortgage lending activity will rise modestly and the refinance range will continue to be weak and volatile.

But there are several variables making it difficult to predict the numbers for 2015, including interest rate increases, global economic uncertainty and credit availability, which still threaten to minimize the overall improvement in the housing market.

“Even though we are seeing some signs that housing is slowly recovering, there are still many factors and forces at work that could make for a very turbulent year," said Dennis Hedlund, founder of iEmergent.

Click to enlarge

Source: iEmergent

Click to enlarge

Source: iEmergent

At the end of 2013, HousingWire wrote that the lending market was moving back into a purchase-driven mortgage market.

"With the close of 2013 will also come a major transition in the housing finance industry," said Frank Nothaft, former Freddie Mac chief economist and vice president, at the time of the report. "For the first time since 2000, we're going to see the mortgage market dominated by purchase activity as the refinance share drops below 50%."

And this trend is expected to continue through 2015 and into 2016 with owner-occupied purchases representing 90% and non-owner-occupied purchases comprising 10% of all purchase volume, iEmergent’s data showed.

However, iEmergent separated its forcast into a high and low estimate, and even its projected high is lower than the Mortgage Bankers Association’s forecast of 2015. In October, the MBA forecasted a 7% increase in mortgage originations for 2015, to $1.19 trillion, with purchase originations rising 15% to $731 billion in 2015, and refinance originations decreasing 3% to $457 billion.