The U.S. Department of the Treasury’s latest Hardest Hit Fund program category, the Blight Elimination Program, is raising some concerns from the Special Inspector General for the Troubled Asset Relief Program due to the newness and lack of data for the program.

The Blight Elimination Program is the newest and sixth category in the HHF program and is defined as the demolition and greening of certain vacant and abandoned single-family and multi-family structures.

In SIGTARP’s latest quarterly report to Congress on the status of TARP, it noted:

“Given the nature of this TARP program, the limited performance history, and the very different set of risks involved in making large payments of taxpayer dollars to individual contractors and other parties not previously participating in a TARP program, Treasury cannot conduct the same type of oversight that it has used for programs that provide assistance to homeowners and mortgage servicers.”

As a result, the Treasury must develop and implement new and appropriate oversight tools to monitor its Blight Elimination Program, the report stated.

Also, it needs to identify, understand, and mitigate the new and different risks posed by using TARP taxpayer funds for the Blight Elimination Program, especially as this program may continue to represent a growing portion of HHF.

Originally, the treasury approved five categories of HHF assistance: principal reduction, second-lien reduction or payoff, reinstatement through payment of past due amounts, unemployment or underemployment assistance, and transition assistance such as a short sale, deed-in-lieu of foreclosure, or relocation assistance.

Since the sixth category’s approval in mid-2013, the Treasury has approved HHF blight elimination programs in six states, beginning with Michigan in June 2013, followed by Ohio, Indiana, Illinois, South Carolina, and Alabama.

The funds for the new program were reallocated from the states’ other HHF programs, with programs differing across states in terms of program eligibility, activities covered and per-property assistance amounts.

According to the report, this program marks a significant shift in the Treasury’s approach to the use of HHF funds.

Previously, Treasury used HHF to make payments to homeowners or to mortgage servicers to help keep homeowners in their homes. Now the Blight Elimination Program allows for substantial payments of TARP funds to land banks, non-profits, and other parties, in cash and mortgages that can be forgiven over time.

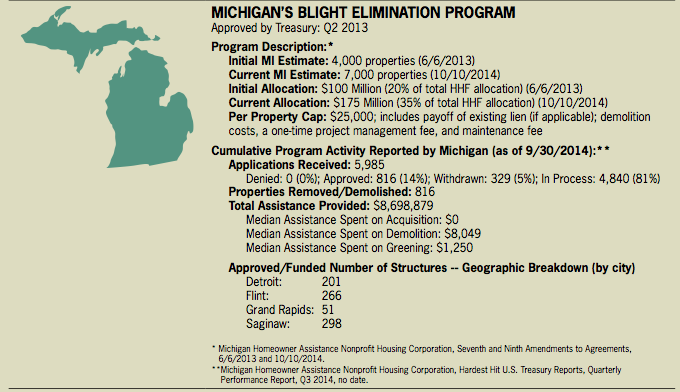

Through Sept. 30, 2014, Michigan was the only approved state that reported it had paid an average of almost $11,000 in HHF funds per property to remove 816 properties.

Ohio is the only other state to have reported removing any properties (144) under the HHF Blight Elimination Program.

The report did add that information currently available to the public through Treasury on the use of these funds is scarce. SIGTARP is publishing limited, basic information made available on HHF state websites (see below) on what the states reported to Treasury, which is one quarter behind.

Here are outlines of the two states that have used the program so far:

Click to enlarge

Source: SIGTARP

Click to enlarge

Source: SIGTARP