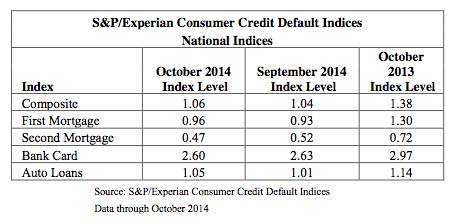

The first mortgage default rate marginally increased for the third consecutive month, rising to 0.96% in October, up from 0.93% in September and 1.38% a year ago, the S&P/Experian Consumer Credit Default Indices found.

However, the second mortgage default rate dropped from September’s rate of 0.52%, decreasing to 0.47% in October. This is significantly down from October 2013’s index level of 0.72%.

The overall national composite index ticked up slightly to 1.06%, compared to 1.04% in September and 1.38% the previous year.

(Source S&P/Experian; Click to enlarge)

“With the continued increase in the composite default rates, the overall movements have still been very small. The continued six month upward trend in auto loan default rates does coincide with strong automobile sales over the same period. Despite the small increases in default rates, bank card and second mortgage default rates are currently at historical lows,” said David Blitzer, managing director and chairman of the Index Committee for S&P Dow Jones Indices. “Even with the increases, default rates are still much lower from their October 2013 rates.”

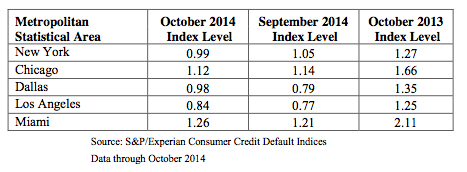

When looking at the top metropolitan statistical areas, Dallas, Los Angeles and Miami all posted rate increases. Dallas recorded a default rate of 0.98%: the highest it’s been since March 2014.

Miami saw its first default rate increase since December 2013, up 5 basis points from September 2014 to 1.26%, while Los Angeles continued its default rate increase for the third consecutive month, posting a rate of 0.84%,

New York posted the largest decline, dropping for the third straight month and posting a 6 basis point decrease to a historical low of 0.99%.

(Source S&P/Experian; Click to enlarge)