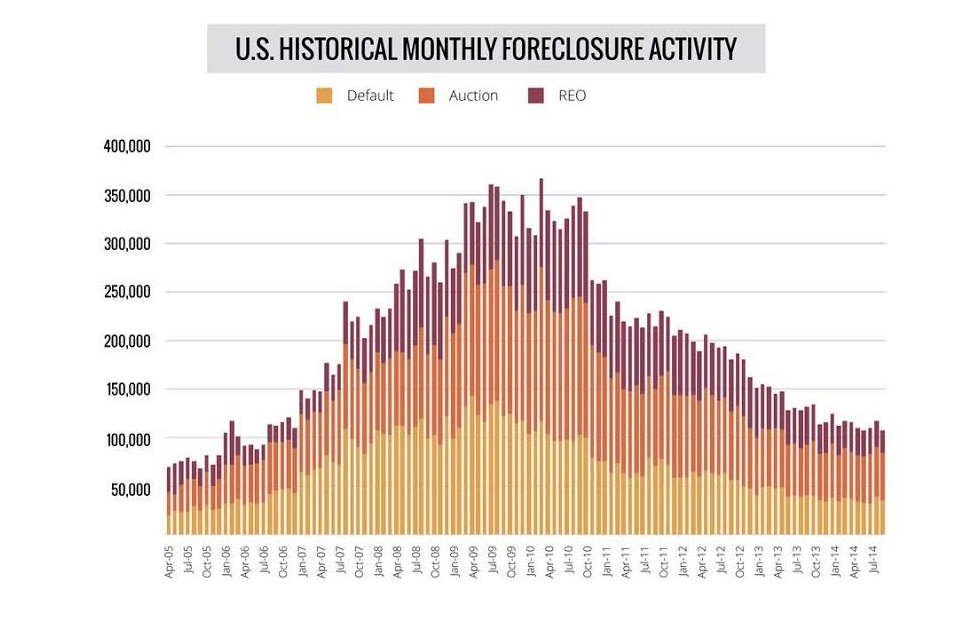

Foreclosure filings, including default notices, scheduled auctions and bank repossessions, were reported on 317,171 U.S. properties in the third quarter, marking the first quarterly increase since the third quarter of 2011, according to RealtyTrac’s latest September and third quarter Foreclosure Market Report.

However, it was just a meager 0.42% increase from the previous quarter and is still down 16% from a year ago.

The quarterly increase in overall foreclosure activity was driven by a 2% increase in default notices and a 7% quarterly increase in scheduled foreclosure auctions. In addition, bank repossessions decreased 12% from the previous quarter.

In September, a total of 106,866 U.S. properties had foreclosure filings, down 9% from the previous month and down 19% from a year ago to the lowest level since July 2006 — a 98-month low.

This also marks the 48th consecutive month where U.S. foreclosure activity decreased on a year-over-year basis.

“September foreclosure activity was back to pre-housing bubble levels nationwide, in large part thanks to a continued slide in bank repossessions,” said Daren Blomquist, vice president at RealtyTrac.

“However, a recent rise in scheduled foreclosure auctions in many markets across the country shows lenders are continuing to clean house of lingering delinquent loans. This rise in scheduled auctions foreshadows a corresponding rise in bank repossessions and auction sales to third party buyers in the coming months,” Blomquist added.

(Source RealtyTrac, click to enlarge)