Finance of America Mortgage Wholesale Division is a national lender offering two channels of business — wholesale and non-delegated correspondent, with a commitment to expand its menu of non-traditional loan products for the evolving American homeowner.

As brokers continue to gain a larger share of the mortgage origination market, the profile and needs of the American homeowner will continue to evolve. FAM works alongside its brokers and correspondents in serving those homeowners through its commitment to investing in customer-facing technology and expanding its menu of non-traditional loan products.

“Our brokers and correspondents know they can count on their FAM account executives for accurate information. Our account executives are knowledgeable and experienced, with well-established relationships with many of our brokers who count on them for candid communication,” said David Brown, director of third party originations at FAM.

The company also holds a high reputation for in-house underwriting, providing a seamless process and allowing FAM’s skilled account executives to help brokers and correspondents structure deals that will work.

FAM provides multiple monthly opportunities for brokers and correspondents to participate in FAM webinars on new products, tools and marketing strategies. The company also provides customizable marketing material that highlights its product offerings.

FAM’s variety of loan products helps brokers choose the best option for their borrower. The company’s Two-X loan products provide an array of non-traditional loan products for brokers to choose from. The products include the following:

Two-X Apex — Designed to accommodate high LTV financing. This product may be ideal for clients who are well-documented, have no derogatory credit and want to put less money down when purchasing their home.

Two-X Extend — A fixed-rate second mortgage solution.

Two-X Flex — A solution for borrowers looking for jumbo financing while utilizing one year of documentation. A great option for self-employed borrowers.

Two-X Flex: Bank Statements — This proprietary loan option is a solution for self-employed borrowers, with unique income requirements.

Two-X HBX — This mortgage solution is for high balance loan amounts in counties currently restricted to conforming or high cost limits.

“Our commitment to expanding our menu of non-traditional loan products sets us apart from other wholesale and correspondent lenders,” Brown said. “FAM’s commitment to investing in customer-facing technology and expansion of loan product options puts us in a position to work alongside our brokers and correspondents in serving homeowners.”

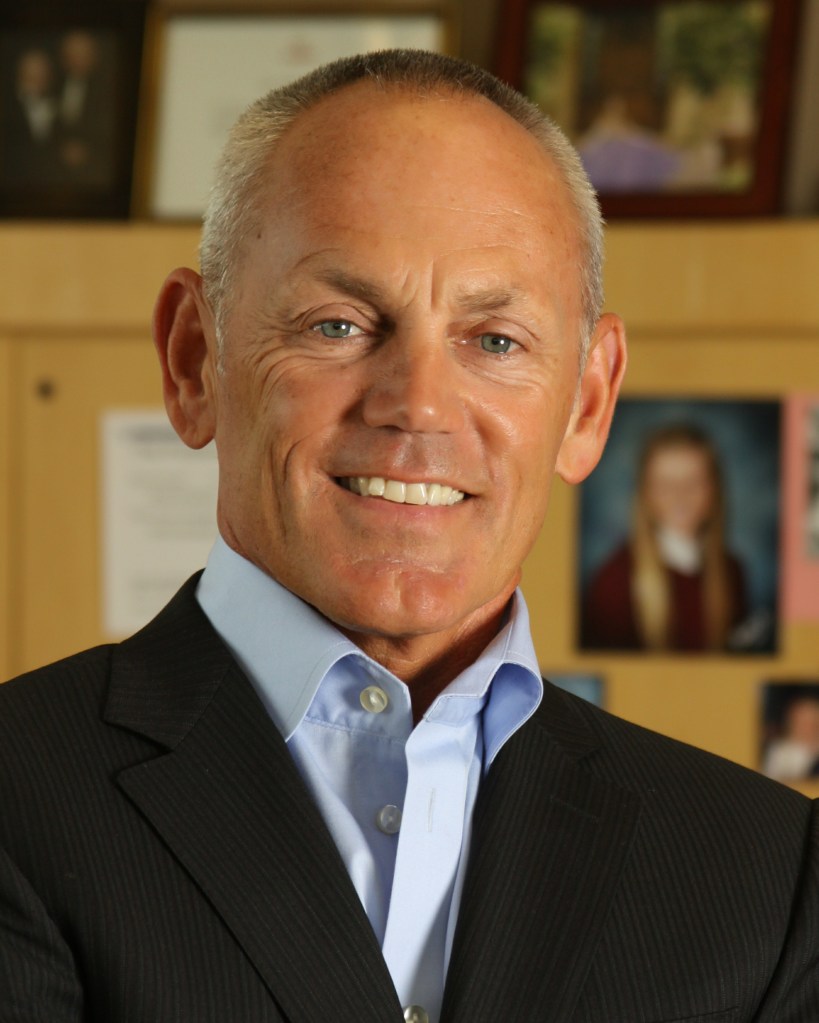

Bill Dallas, President and CEO

Bill Dallas is known for building two mortgage companies from the ground up: First Franklin and Ownit Mortgage Solutions. He purchased Skyline Homes in 2009 and eventually joined forces with Finance of America Mortgage in 2018. Today, Dallas leads the charge at Finance of America Mortgage. His previous experience includes founder of InterThinx, MindBox, two California banks and Cloudvirga.

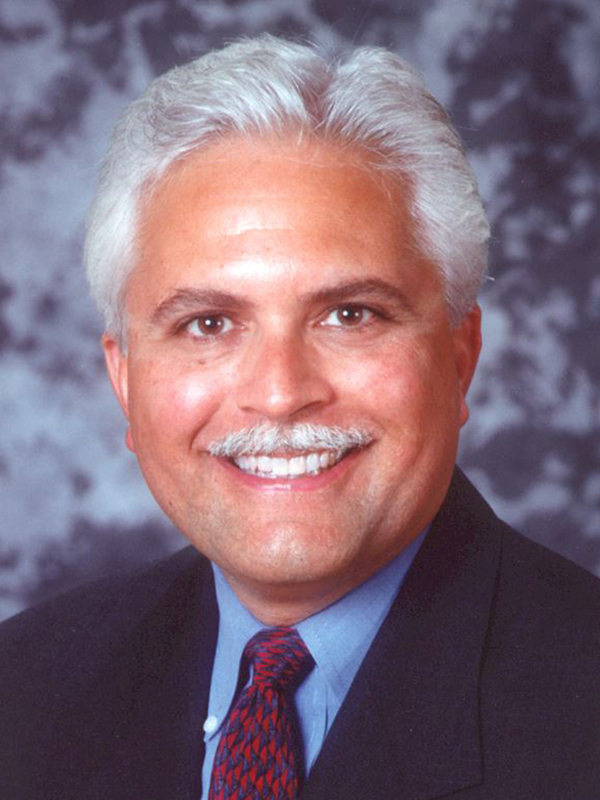

David Brown, Director of Third Party Originations

David Brown is currently the director of third party originations at Finance of America Mortgage with over 30 years of diverse industry experience. Prior to his current role, Brown served in various executive roles, including; executive vice president, COO of capital markets and retail sales for Skyline Financial Corporation, senior vice president of capital markets for Freedom Mortgage and both president and senior vice president for the Financial Services Group of national homebuilder Ryland.