Sue McCormick is doing her part to help solve the nation’s increasingly complex affordable housing puzzle.

In 2021, McCormick resold two renovated properties that she originally purchased at foreclosure sale on Auction.com in her hometown of Dayton, Ohio. Both properties sold to owner-occupant buyers for under $150,000 apiece.

“I grew up in an area that was predominantly Black, working class, suburb of Dayton,” said McCormick. “Some of the areas where I grew up have taken a big hit. … There are some areas that have been hard-hit by things like drugs and crime. Some of those areas I’m investing in, and they’re starting to turn again so that’s exciting to see.”

McCormick’s efforts are helping to improve neighborhoods and boost homeownership one house at a time in Dayton. Combined with thousands of other local community developers like her, McCormick’s efforts are moving the needle when it comes to quality, affordable housing for owner-occupants nationwide.

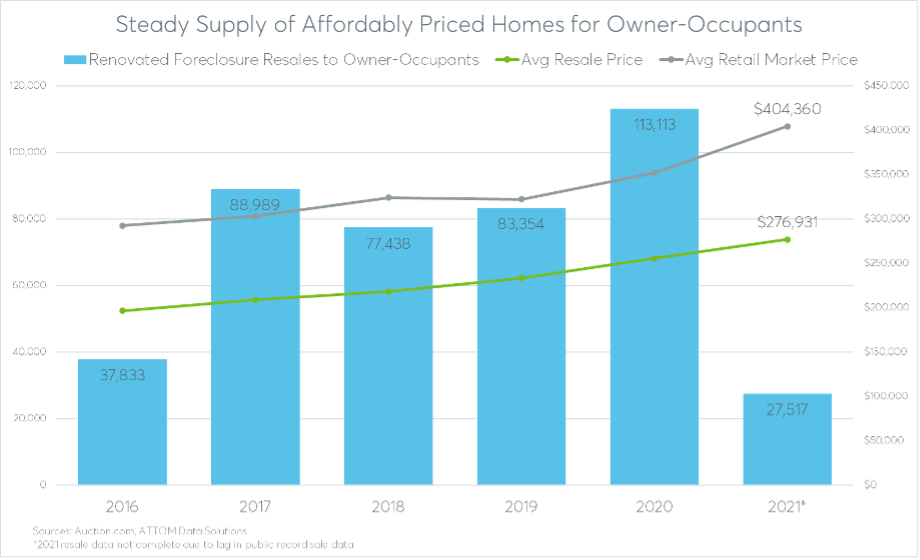

An estimated 140,000 renovated properties purchased at foreclosure auction or bank-owned auction were resold to owner-occupant buyers between January 2020 and December 2021, according to an analysis of foreclosure and bank-owned (REO) auction sales data from Auction.com along with public record data from ATTOM Data Solutions. The Auction.com data was extrapolated using the public record data to arrive at the total market estimate of 140,000 resales to owner-occupants. That total market estimate is likely conservative given that some resales occurring in the second half of 2021 have not yet been captured by public record data.

Local Community Developers

Most of the renovated foreclosure resales came from local community developers like McCormick who sell a handful of renovated foreclosures a year in communities they care about.

“I am very excited to enrich the communities that produced the person that produced me,” said McCormick’s daughter, Alexis Gaines, who has been helping her mother design the renovated homes. “My grandfather is also buried at the Veteran’s memorial [cemetery] down the street from this house. It’s awesome because every time we pass there I kind of feel like he is proud of us.”

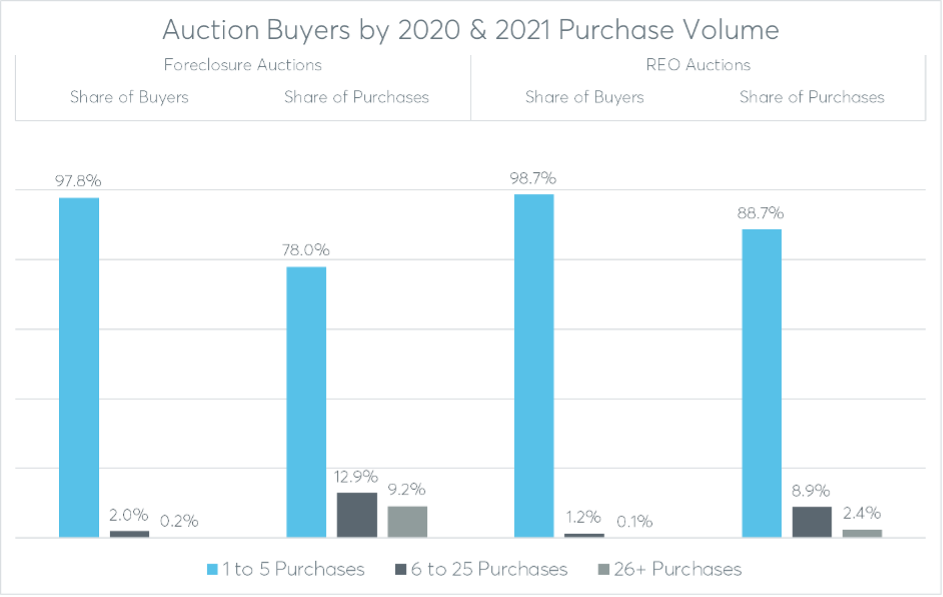

Ninety-eight percent of foreclosure auction buyers purchased five or fewer properties in 2020 and 2021 combined, and those small-volume buyers accounted for 78% of all foreclosure auction purchases nationwide. Similarly, 99% of REO auction buyers purchased five or fewer properties in 2020 and 2021 combined, and those small-volume buyers accounted for 89% of all REO auction purchases nationwide on Auction.com.

The median distance between Auction.com buyers and the homes they purchased was 15 miles for foreclosure auctions and 16 miles for REO auctions in 2020 and 2021 combined. Seventy-eight percent of foreclosure auction buyers lived within 75 miles, and 75% of REO auction buyers lived within 75 miles.

Affordably Priced Homes

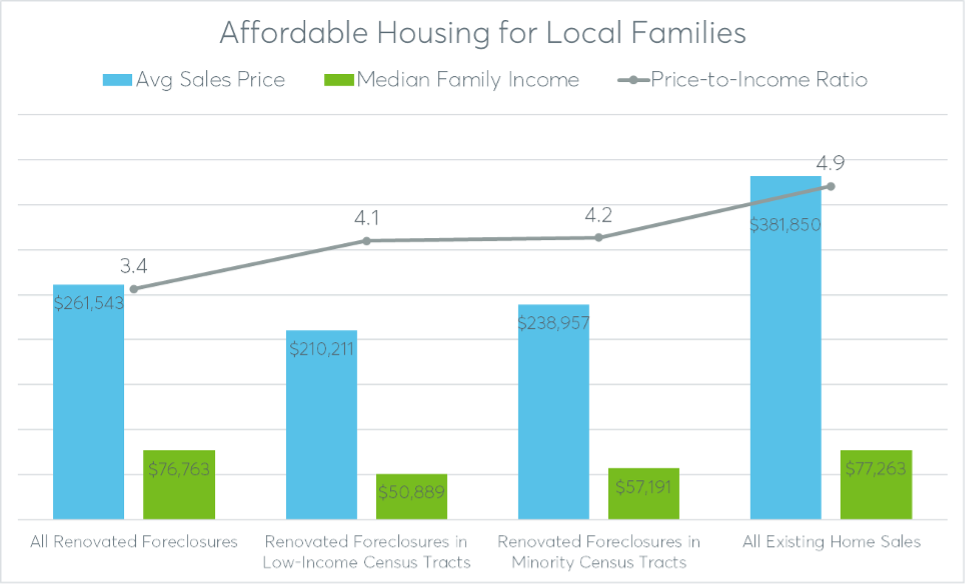

Owner-occupants purchased renovated foreclosures for an average price of $261,543 in 2020 and 2021 combined. That was 32% below the average sales price of $381,849 for all existing home sales during the same period. Nearly three-quarters of all renovated foreclosures purchased by owner-occupants (74%) sold for below $300,000, and nearly one-quarter (23%) sold for below $150,000.

States with the lowest average resale price for renovated foreclosures were Iowa ($144,916), Michigan ($161,750), Ohio ($163,495), Nebraska ($169,392) and Oklahoma ($170,047).

“The ideal property for me is one that I can retail for about $129,000,” said Steve Johnson, a Chattanooga, Tennessee-based Auction.com buyer who has purchased properties in Tennessee and across the state line in Georgia. “That’s typically the first-time homebuyer, low-income, maybe single parent who can’t afford a big house payment.”

The renovated foreclosures supplied by local community developers like McCormick and Johnson were not just low-priced relative to the overall housing market, they were affordable relative to the incomes in the neighborhoods where they sold.

The average sales price of all renovated foreclosures ($261,543) was 3.4 times the median family income on average across all the Census tracts with renovated foreclosure sales, according to Census-tract level data from the Federal Housing Finance Agency (FHFA). That compares to a price-to-income ratio of 4.9 for all existing homes sales in 2020 and 2021 — using the aforementioned average sales price of $381,849 and the median family income nationwide of $77,263, according to the latest estimates from the U.S. Census Bureau. The average resale price for renovated foreclosures was consistently about 4 times the median family income, even in low-income and minority Census tracts.

Historically the average U.S. sales price has run about five times the median household income, according to this Longtermtrends chart of home price data from the S&P/Case Shiller National Home Price Index and median household income data from the Census Bureau. The Longtermtrends chart shows the price-to-income ratio exceeding 7 in November 2005 and more recently in June 2021.

41,000 Sales to Owner-Occupants in Low-Income Neighborhoods

Overlaying the Census-tract level data from the FHFA, which includes a designation for low-income tracts, shows that more than 41,000 renovated foreclosures were resold to owner-occupants in low-income neighborhoods in 2020 and 2021 combined. The FHFA data defines low-income tracts as those where the median family income is at or below 80% of the surrounding metro area’s median family income.

The average sales price of renovated foreclosures sold to owner-occupants in low-income Census tracts was $210,211, 4.1 times the median family income of $50,889 on average in those same neighborhoods.

States with the most renovated foreclosure resales in low-income Census tracts were Florida, Illinois, New Jersey, Georgia, and Ohio.

Census tract data was available for two of the three renovated homes that Johnson — the Chattanooga, Tennessee-based Auction.com buyer — has resold to owner-occupants after purchasing at REO auction. Both of those renovated REOs sold for less than 2.5 times the neighborhood’s median family income. One was in a low-income Census tract with a median family income of $53,333.

46,000 Sales to Owner-Occupants in Minority Neighborhoods

More than 46,000 renovated foreclosures were resold to owner-occupant buyers in minority Census tracts in 2020 and 2021, according to the resale analysis overlaid with Census tract data from the FHFA.

The FHFA data defines a minority Census tract as one with a minority population of at least 30% and a median family income of less than 100% of the median family income in the surrounding metro area. Because many minority Census tracts are also low-income Census tracts, about 29,000 of the renovated resales to owner-occupants were included in both categories.

The average sales price of renovated foreclosures sold to owner-occupants in minority Census tracts was $238,957, 4.2 times the median family income of $57,191 on average in those same neighborhoods.

States with the most renovated foreclosure resales in minority Census tracts were Florida, Georgia, Illinois, New Jersey and California.

The two renovated foreclosures that McCormick sold to owner-occupants in 2021 were both in minority Census tracts in Dayton. Minorities accounted for close to 70% of the population in both neighborhoods, and both neighborhoods had a median family income below $40,000. One of McCormick’s renovated resales sold for 3.6 times the neighborhood’s median family income, and the other sold for 3.3 times the neighborhood’s median family income.

24,000 Foreclosure & Bank-Owned Homes Sold Directly to Owner-Occupants

In addition to the estimated 140,000 renovated foreclosures resold to owner-occupants by local community developers like McCormick and Johnson, nearly 24,000 properties were sold directly to owner-occupants at foreclosure auction or REO auction in 2020 and 2021 combined.

These direct-to-owner-occupant distressed sales were those with no subsequent resale in the public record data or MLS data but where the county assessor data identified the home as owner-occupied.

This data is supported by buyer questionnaire data for REO properties sold on Auction.com. In 2021, 13% of REO auction buyers identified themselves as owner-occupant buyers, up from 12% in the previous year and a low of 8% in 2017 to the highest level since 2012.