If avoiding REO holding risk and realizing better price execution aren’t reasons enough, selling at foreclosure auction or online auction also provides a third benefit that may surprise many mortgage servicers — more efficient neighborhood stabilization.

“The quicker that bank-owned (REO) homes — particularly those that are vacant — can get into the hands of a new owner, the more stabilizing effect it will have on the surrounding neighborhood,” said Jason Allnutt, CEO at Auction.com.

He added that nearly 60% of the 20,000 bank-owned properties sold via online auction on the Auction.com platform in 2019 were vacant at the time of sale. “Each of those vacant REOs also represents an opportunity to provide another family with shelter during difficult times like the pandemic we are now experiencing,” Allnutt said.

As of March 25, all buyers purchasing occupied REO homes through the Auction.com platform have been required to sign a Community Stabilization Pledge, which states that they will not commence eviction proceedings during the nationwide eviction moratorium.

“It doesn’t bother me about the evictions because I’m not going to evict anyone anyway. I don’t want to kick people out, I want to keep people in,” said one Auction.com buyer who offers distressed occupants of foreclosures that he buys the option to buy back the home with affordable owner-financing. “The good news is I bought the house, I am going to let you buy the house back, I am going to keep your mortgage less than rent.”

Most distressed property buyers employ a similar investing strategy, according to an Auction.com buyer survey conducted in April, after widespread eviction moratoriums had been implemented in the wake of the coronavirus crisis. Sixty percent of those surveyed said their preferred investing strategy is to resell to owner-occupants.

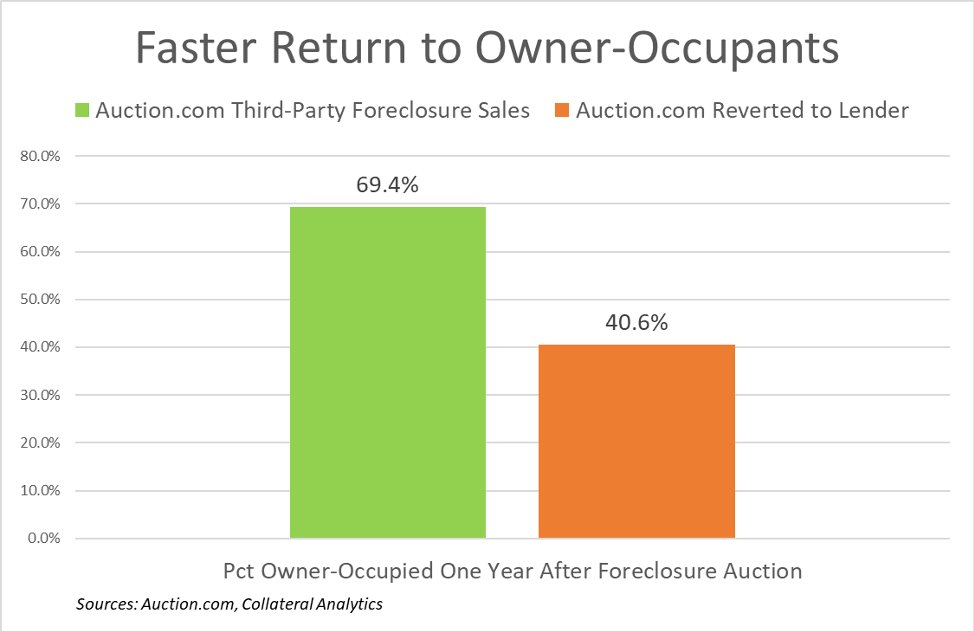

Faster return to owner-occupants

Even before the coronavirus crisis, most buyers using the Auction.com platform (58%) said rehabbing and reselling to owner-occupants was their preferred investing strategy for 2020, according to the Auction.com 2020 Buyer Survey conducted in February 2020.

Of those who picked rehabbing and reselling to owner-occupants as their top strategy, 95% expect their property purchases to increase (64%) or at least stay the same (31%) in 2020 compared to 2019.

But buyers aren’t just paying lip service to the idea of selling to owner-occupants. The analysis of 165,000 properties brought to foreclosure auction on the Auction.com platform in 2018 and 2019 shows that most properties that subsequently resold after being purchased by third-party buyers are ending up in the hands of owner-occupants.

The analysis specifically looked at nearly 20,000 properties that were purchased at foreclosure auction and then subsequently resold within a year. It also looked at more than 36,000 properties that reverted back to the lender (REO) and then subsequently resold during that same timeframe.

While 69% of the investor-resold homes were owner-occupied within a year of being sold at foreclosure auction, only 41% of the resold REOs were owner-occupied a year after the foreclosure auction.

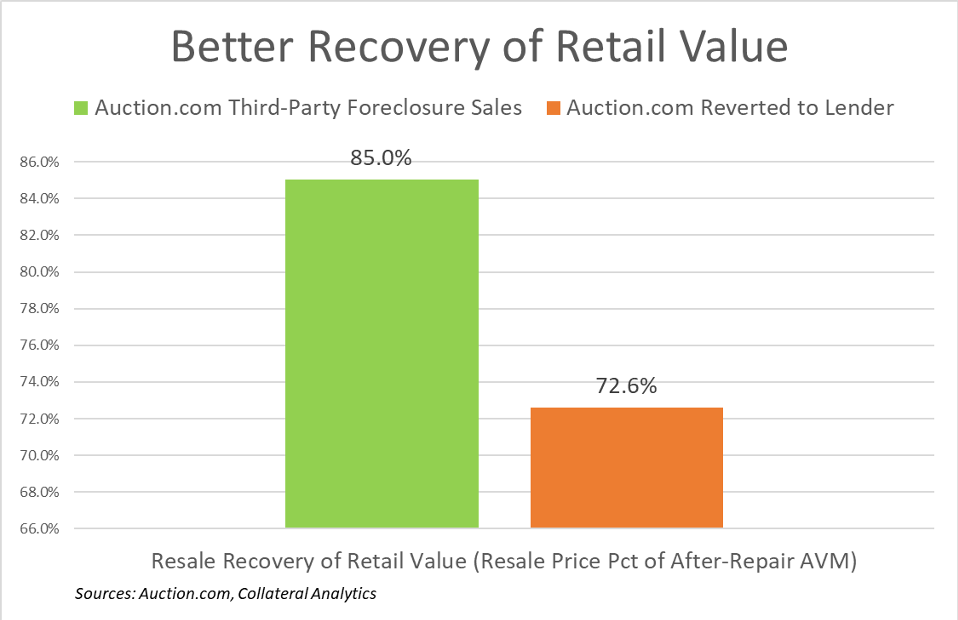

Better recovery of retail value with responsible rehab

The analysis also shows that the investor-resold homes recovered more of their full market retail value a year later than the resold REOs.

Properties purchased by third-party investors at the foreclosure auction were resold an average of 221 days later for 85.0% of their full after-repair market value. By comparison, the properties that reverted to REO were resold an average of 250 days later for just 72.6% of their full after-repair market value.

The full after-repair market value is based on an automated valuation model (AVM) that assumes the property has no deferred maintenance, little or no physical depreciation, and requires no repairs.

“Instead of having an REO property sold for pennies on the dollar, dragging down surrounding home values, you’re having a property sell closer to full retail value, which helps to lift all home value boats in the surrounding neighborhood,” said Jesse Roth, SVP of business development at Auction.com. “That’s helpful for neighbors trying to sell or refinance.”

The value investors add to foreclosure homes comes primarily through responsible rehab.

A real estate investor operating in rural Washington Parish, Louisiana, described one recent property that she and her husband purchased for $150,000. After rehab costs of $30,000 and holding costs for the 11 months it took to resell, the couple netted a $10,000 profit.

That deal — in which rehab costs amounted to 20% of the property’s purchase price — aligns with what many real estate investors using the Auction.com platform say they budget for rehab costs.

According to the Auction.com 2020 Buyer Survey, 44% of investors with a preferred investing strategy of rehabbing and reselling to owner-occupants said they budget more than 20% of the property’s purchase price toward rehab costs. Another 41% said they budget between 10-20%.

Alan Goodwin, a Houston-based real estate investor, closed on his second investment home in late March. He purchased the property for $108,000 and is budgeting $40,000 and four months for rehab. He was able to buy the Anchorage, Alaska-area property remotely using the Auction.com online platform, but he plans to oversee the rehab in person.

“I was able to do everything remotely: due diligence, bid, purchase and successful closing on the property following the easy-step process provided by Auction.com,” he said. “[But I am] definitely going to [Alaska] and overseeing the rehab. I must have eyes and hands on the project.”