The past couple years have been smooth sailing as delinquencies continue to fall, and, for the most part, Americans make their mortgage payments with ease.

Each month foreclosures and delinquencies decrease again, and are now at or above decade lows, according to data from Black Knight. Americans have enjoyed a period of economic prosperity and perfect housing conditions – a much-needed relief after the most recent recession that ended homeownership for so many.

The most recent report from Black Knight showed the number of loans in active foreclosure fell 24% annually, while the number of mortgage delinquencies dropped to a 12-year low. These improvements occurred even amid a continued struggle from hurricane-related delinquencies.

In fact, as mortgage originations decrease and lenders struggle with a decreased buyer interest and increased competition, servicing departments have kept lenders making a profit.

In fact, as mortgage originations decrease and lenders struggle with a decreased buyer interest and increased competition, servicing departments have kept lenders making a profit.

Lenders earned $480 per loan during the third quarter of 2018, down from $580 per loan in the second quarter of 2018, an even more significant drop from $929 in the third quarter of 2017, according to the latest Quarterly Mortgage Bankers Performance Report from the Mortgage Bankers Association. This was an all-new third quarter low for lender profits.

But despite this decrease, lender profits did not go negative like in the first quarter of 2018, when they reported a loss of $118 per loan because of the increase in competition and decrease in homebuyers. Lenders were able to remain in the black during the third quarter, and this was due, in part, to servicing revenues.

“Including all business lines, both production and servicing, 71% of the firms in the study posted a pre-tax net financial profit in the third quarter,” said Marina Walsh, MBA vice president of industry analysis. “Without servicing, that percentage would have dropped to 52%.”

Overall, mortgage servicers have had it easy the last few years. But that could be about to change due to rising interest rates, an increase in FHA loans and, of course, LIBOR.

Ri$ing intere$t rate$

Now, for the first time since the Great Recession, the housing market is facing a rising mortgage rate environment. Most experts are predicting the average 30-year fixed rate mortgage in 2019 will have an interest rate at or above 5%.

These rising rates could mean trouble for consumers who took out an adjustable-rate mortgage to keep their initial mortgage costs low. Now, as mortgage rates increase, those ARMs could hit unsuspecting borrowers with a huge jump in their mortgage payment.

A further rise in mortgage rates could reduce the number of loan modification options servicers have at their disposal, as borrower rate reductions and deferrals may no longer be feasible.

Principal deferments may be more practical solutions because they are non-interest-bearing and will not be affected by changing interest rates, servicers noted during a roundtable with Fitch Ratings.

Of course, due to regulations, such as the Know Before You Owe rule passed after the last recession, more consumers are aware of what is about to hit them, but that may not make mortgage payments any easier to meet for some.

Cue an increase in delinquencies and even foreclosures.

“Higher rates could also make borrowings more expensive for the servicers even as the value of their mortgage servicing rights increase,” Fitch Ratings explained. “The movement in interest rates has not had a dramatic impact on mortgage performance so far this year. This, however, could become more of an issue if interest rate increases take place quicker and become more sizable.”

FHA loan$

A recent survey from Altisource Portfolio Solutions, a provider of real estate and mortgage technology services, which surveyed more than 200 mortgage default servicing professionals, shows about 86% of servicers service FHA loans.

The 2018 State of the Servicer Industry report from Altisource shows that about 72% of servicers expect their FHA loan portfolio to increase over the next 12 to 24 months, and 77% of those surveyed expect the increase to be more than 25%.

FHA loan limits increased at the beginning of 2018 and again at the beginning of 2019, making them even more attractive to consumers, Altisource explained in its report. The loans have remained popular as they allow borrowers with lower credit scores to be eligible, and require lower down payments.

While FHA mortgage delinquencies remain low, they are still higher than conventional rates, and servicers must prepare for the expected increase.

“Based on the survey results, recent economic indicators suggest that the housing market is approaching an inflection point,” said Patrick McClain, Altisource senior vice president of Hubzu Auction Services and Equator.

“While delinquency and foreclosure rates remain low, home price appreciation is slowing and interest rates are rising,” McClain said. “With lower origination volumes and an expanding credit box, servicers expect to see growth and increased delinquencies in their FHA portfolios.”

LIBOR

But rising interest rates aren’t the only storm about to hit the servicing industry. Servicers are about to face a new struggle coming from the other side of the Atlantic – the end of LIBOR.

LIBOR, the London Interbank Offered Rate, dubbed the world’s most important number, is a scandal-plagued benchmark that undergirds about $350 trillion in loans, and it is about to be phased out. LIBOR is a common benchmark for determining short-term interest rates. ARMs, for example, are often linked to LIBOR.

When borrowers take out on ARM on their home, they lock in a lower interest rate for a set period of time, typically about five years. After that, the interest rate will fluctuate depending on an index like LIBOR.

“LIBOR is a benchmark interest rate for global financial markets and many adjustable-rate mortgages are linked to LIBOR so they will need to be linked to a new replacement interest rate once LIBOR is phased out at the end of 2021,” explained Roelof Slump, Fitch Ratings managing director in the company’s U.S. RMBS group.

LIBOR has a long, complicated history, but for years, traders at some of the largest banks in the world worked interest rates illegally in order to make a profit.

LIBOR is set to terminate at the end of 2021. Fitch Ratings noted that, with many ARMs linked to LIBOR, servicers say these mortgages will need to be linked to a new replacement benchmark once it is phased out. However, the industry has yet to establish a clear path for its replacement.

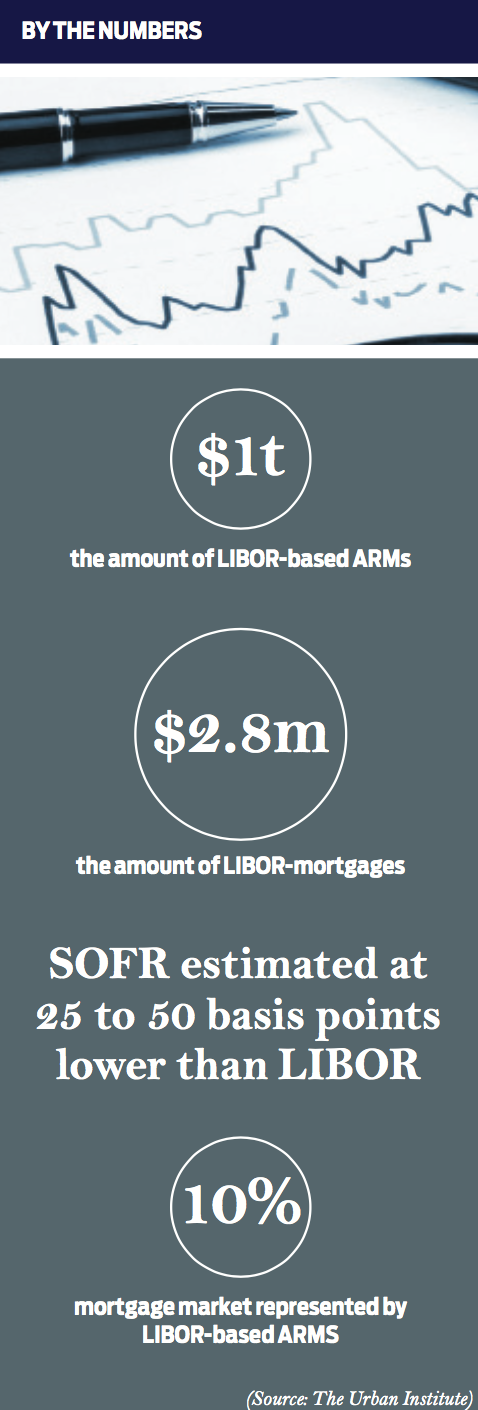

There are about $1 trillion in LIBOR-based adjustable-rate forward mortgages, or 2.8 million mortgages, which represent close to 10% of the outstanding mortgage market, according to the Urban Institute. The greatest concentration is in loans held in bank portfolios and in private-label securities.

In the U.S., the New York Federal Reserve announced the creation of SOFR, the Secured Overnight Financing Rate, that could take the place of LIBOR over the next several years – or so it hopes. This rate uses Treasury securities as collateral.

SOFR is a secured rate, making it historically lower than the unsecured LIBOR rate and less volatile. The Urban Institute estimates that the one-year SOFR rate will be 25 to 50 basis points lower than the one-year LIBOR. By switching to this rate, LIBOR-indexed ARMs could actually drop 25 to 50 basis points.

“If SOFR was substituted for LIBOR, we estimate that, over the entire $1 trillion forward ARM market, this differential would give borrowers a change in cumulative payments and investors an increased cost of $2.5 to $5 billion a year, or $15 to $30 billion on a present-value basis,” the Urban Institute stated.

While some have proposed adding on a certain number of basis points to make the rate more closely align with LIBOR, the Urban Institute explained why that could be problematic.

“Any add-on may work on average or ‘ex ante,’ but it is subject to dispute,” the institute stated. “Reasonable people may come up with different estimates of the add-on, and even one basis point on $1 trillion is $100 million a year.”

“We have seen litigation over smaller amounts,” it continued. “It may also be difficult for the mortgage market to use an add-on if the larger $200 trillion LIBOR market does not make this adjustment.”

But SOFR is just one option, and although the deadline is quickly approaching, there remains to be a clear consensus on what should replace LIBOR.

“Finding a suitable replacement for LIBOR is proving to be a somewhat contentious process thus far,” Slump told HousingWire. “And until a replacement rate for LIBOR has been determined, mortgage servicers are likely to hold off on developing formal implementation plans.”

The legal documents on most adjustable-rate mortgages allow for the substitution of a new index based on comparable information if the original index is no longer available, the Urban Institute explained. But contract language for most mortgages is largely silent on how to define a reasonable substitute and what it means for LIBOR to be unavailable.

As they do move forward, servicers will likely look for guidance from entities such as U.S. Department of the Treasury, the Federal Housing Finance Agency and the government-sponsored enterprises – Fannie Mae and Freddie Mac.

In fact, the FHFA revealed that one of the targets for the GSEs in 2019 will be to find a replacement for LIBOR as its end nears. The FHFA released the information in the GSEs’ Scorecards for 2019. These Scorecards tell Fannie and Freddie what the FHFA expects of them each year, and what they will be graded on.

Many of the 2019 Scorecard’s initiatives are carried over from previous years, and instruct the GSEs to “continue” in their current efforts, such as supporting access to single-family mortgage credit for creditworthy borrowers.

However, there were also new items on the list, such as preparing for the end of LIBOR, assessing its impact and performing industry outreach to inform policy and implementation plans.

The problem, however, is that as the deadline approaches, servicers need to begin implementation of a new benchmark now.

When asked when the servicing industry should start phasing in a replacement for LIBOR, Slump said, “The short answer is ‘now.’ Among servicers’ primary focuses and challenges will be to effectively communicate the transition away from LIBOR to borrowers, many of whom are not anticipating an index change and are not aware of its potential impact.”

When asked when the servicing industry should start phasing in a replacement for LIBOR, Slump said, “The short answer is ‘now.’ Among servicers’ primary focuses and challenges will be to effectively communicate the transition away from LIBOR to borrowers, many of whom are not anticipating an index change and are not aware of its potential impact.”

Not only is the deadline for LIBOR to expire quickly approaching, but the Urban Institute warns that there is also the possibility that the LIBOR will become increasingly unreliable before it expires. As banks begin to pull back from providing information, they may create what has been nicknamed a “Zombie LIBOR,” which would be an unreliable LIBOR index and a real risk.

When a new replacement for LIBOR is decided, it could significantly impact mortgage payments, a shift that borrowers may not be prepared for.

“Monthly mortgage payment amounts could change. Comprehensive communication to mortgage borrowers far in advance of these changes is imperative so they are not broad-sided with a substantially higher monthly mortgage payment,” Slump said.

“A LIBOR replacement could also affect company financing tools like credit lines, repurchase agreements and warehouse lines so mortgage servicers may have to change their advancing strategy if a new benchmark has a material impact on their borrowing costs used to fund the advances,” he said.

How to weather the storm

But even as conditions worsen, there is still hope for mortgage servicers to be able to weather the upcoming storm that rising interest rates, the end of LIBOR and other costs and burdens the market will soon bring.

“Now is the time for servicers to review their internal capabilities and ensure they are partnered with the best vendors to effectively manage their FHA delinquent loans to avoid unnecessary cost, increased risk and to maximize returns,” McClain said.

“Now is the time for servicers to review their internal capabilities and ensure they are partnered with the best vendors to effectively manage their FHA delinquent loans to avoid unnecessary cost, increased risk and to maximize returns,” McClain said.

Servicers at Fitch’s roundtable noted that increased emphasis has been placed on technology in an effort to counteract the impact of higher funding rates and other costs including regulatory compliance. More than 50% of the servicers expect to make material changes to their systems within the next five years, while some are considering using blockchain technology to help reduce costs. Some participants noted that servicers may be forced to adopt blockchain technology to align with the origination market over time.

“U.S. RMBS servicers operate in a competitive environment and are eagerly looking for opportunities to demonstrate superior performance against their industry peers in the face of economic pressures,” Slump said. “This is leading some servicing entities to be more proactive in early stage collections and other default management processes on loans in non-prime/non-qualified mortgage transactions, especially where issuers are still cultivating investor confidence in the product.”

Many servicers are also considering moving some of their key operations off-shore, replacing some domestic operations. More than half of Fitch’s roundtable participants said they planned to expand some parts of their operations to off-shore services in the next five years, but these functions would be primarily non-customer facing.

Fitch explained that while the majority of U.S. servicers primarily utilize on-shore staff and vendors for customer-facing positions, many offshore for back-office functions. As such, servicers can face risks from events outside the U.S. that may affect the domestic servicing landscape.

Servicers would prefer all servicing functions to be brought on shore. However, as costs mount, moving some operations offshore may be one of the few remaining options left to them as they seek to reduce costs and stay afloat admists challenging market conditions.