A more dovish tone at the Federal Reserve helped to hold interest rates steady after they fell to their lowest level in nine months.

“Weaker manufacturing data and a more dovish tone from the Federal Reserve left mortgage rates unchanged relative to last week,” Freddie Mac Chief Economist Sam Khater said.

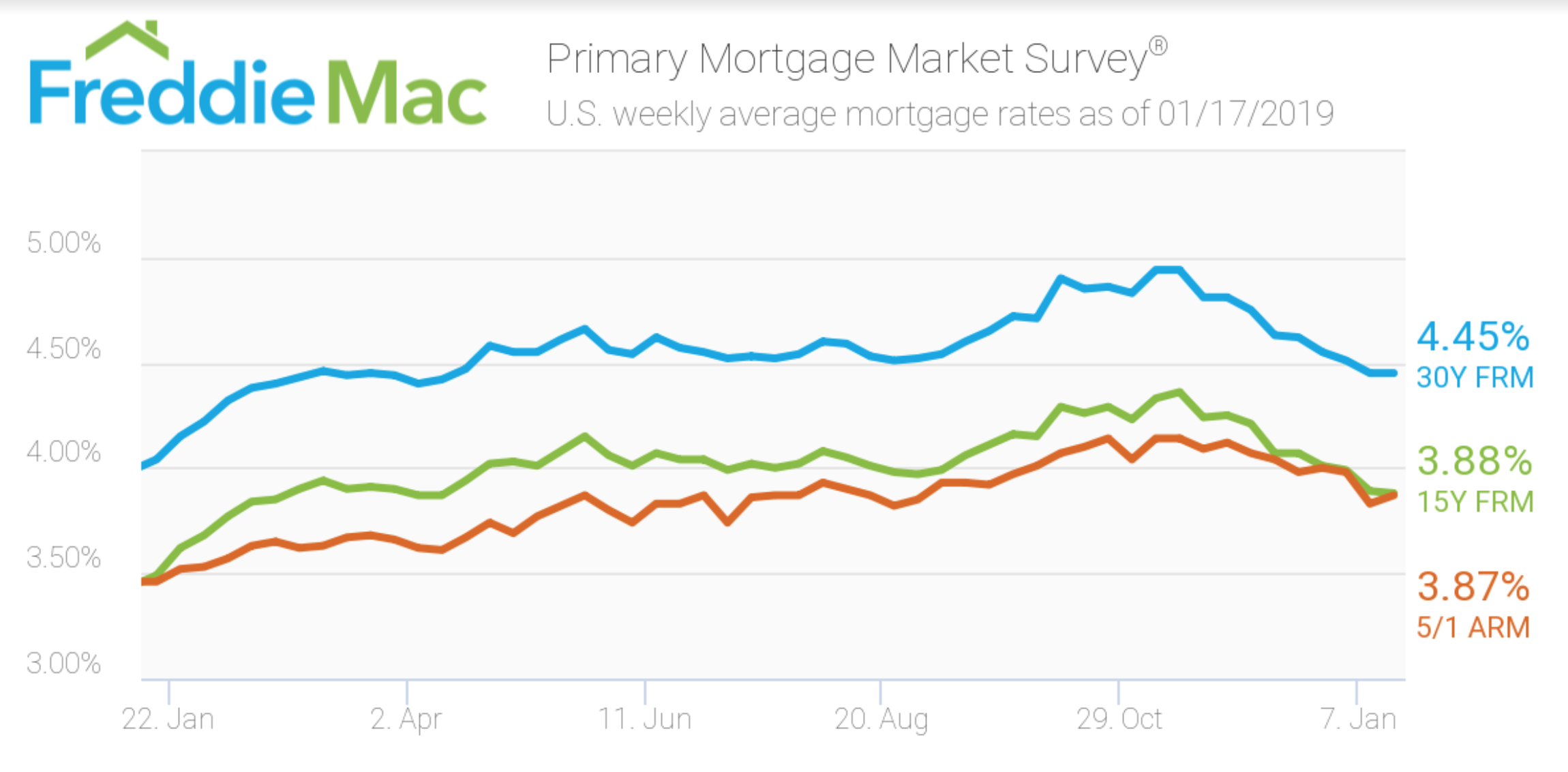

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage remained unchanged from last week at 4.45% for the week ending Jan. 17, 2019, according to Freddie Mac’s weekly Primary Mortgage Market Survey. This is up from last year, when the rate sat at 4.04%.

The 15-year FRM fell just slightly, slipping to 3.88%. This is down from 3.89% last week but up from 3.49% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.87% this week, up from 3.83% last week and from 3.46% last year.

“Interest rate-sensitive sectors of the economy – such as consumer mortgage demand and homebuilder construction sentiment – are on the mend, which indicates that lower interest rates are beginning to have a positive impact on some segments of the economy,” Khater said.