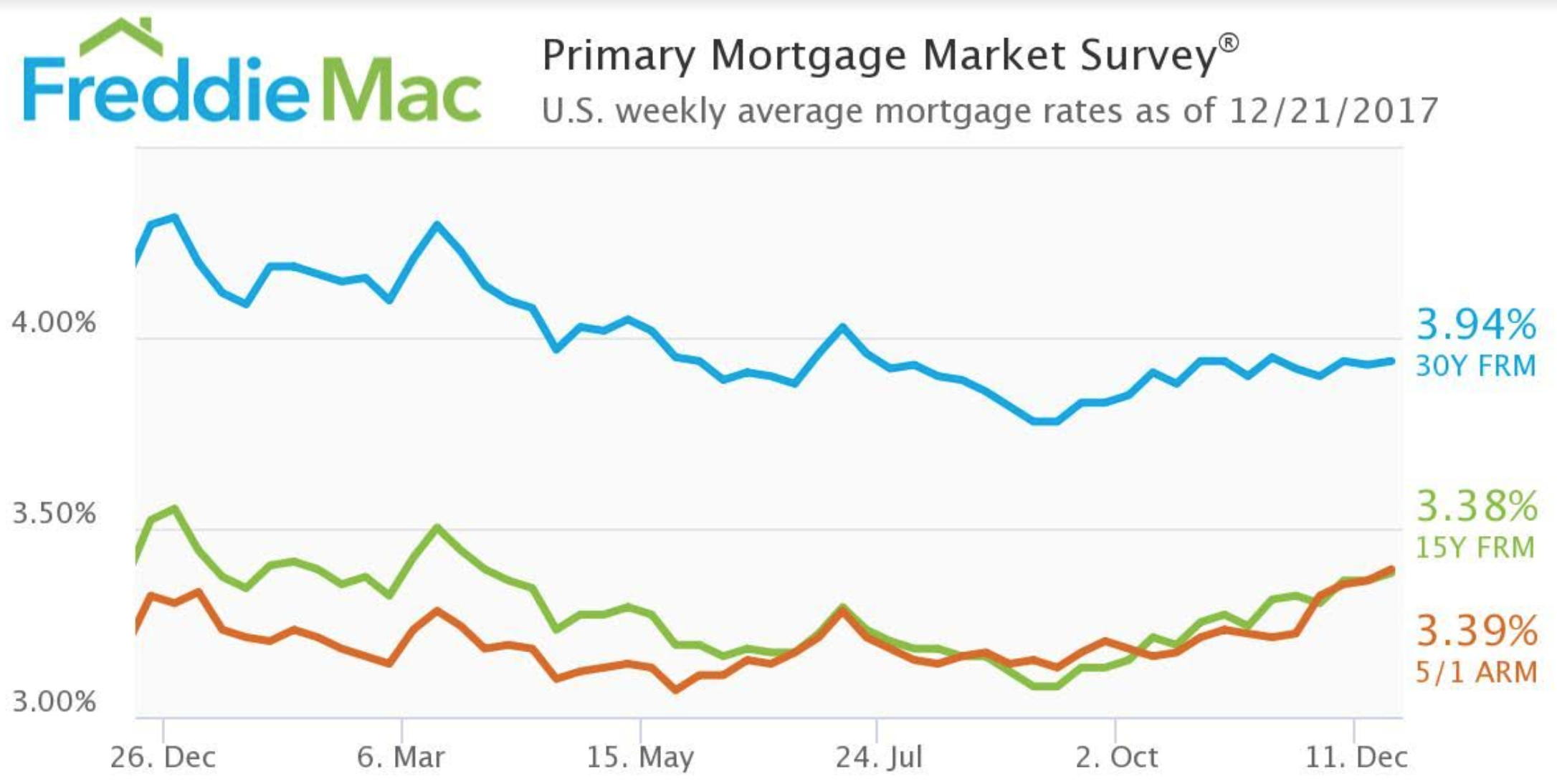

Mortgage rates increased just slightly this week, but they could be on the verge of further increases, according to Freddie Mac’s Primary Mortgage Market Survey.

“30-year fixed mortgage rates have been bouncing around in a narrow 10 basis points range since October,” said Len Kiefer, Freddie Mac deputy chief economist. “The U.S. average 30-year fixed mortgage rate increased one basis point to 3.94% in this week’s survey.”

“The majority of our survey was completed prior to the surge in long-term interest rates that followed the passage of the tax bill,” Kiefer said. “If those rate increases stick, we’ll likely see higher mortgage rates in next week’s survey.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 3.94% for the week ending December 21, 2017. This is up from last week’s 3.93% but down from 4.3% last year.

The 15-year FRM also increased slightly, rising from last week’s 3.36% to 3.38% this week. However, this is also down from last year’s 3.52%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.39%, up from 3.36% last week and from 3.32% last year.

“But even with yesterday’s increase, the 10-year Treasury yield is down from a year ago, and 30-year fixed mortgage rates are 36 basis points below the level we saw in our survey last year at this time,” Kiefer said. “Mortgage rates are low.”