Multi-borrower SFR securitizations have huge volume potential. When Invitation Homes launched its first securitization backed by a portfolio of 3,200 single-family homes, no one knew if this asset class even had the staying power to be around for the long haul.

Access to the capital markets then was the domain of financial services giants with deep pockets. Fast forward to October 2015 and along with the 23 single-borrower securitizations that have come to market are three deals with multiple borrowers. That’s still just a drop in the bucket of the potential volume this asset class may grow to, market players say. That’s because the multi-borrower structure, not dissimilar to commercial mortgage backed conduits, is still in its infancy.

“The market is now in a consolidation phase with a couple of larger folks merging; you now have seven or eight large operators and a couple of multi-borrower deals,” said Ryan Stark, a managing director at Deutsche Bank speaking at an SFR conference sponsored by the CRE Finance Council (CREFC) on Oct. 21. Stark has been with Structured Credit Group at Deutsche Bank for 17 years and has worked on several of the deals to be issued over the last three years.

On the multi-borrower side, the potential for volume is massively larger than on the single-family side, but the challenge until now has always been on how to scale this side of the business.

The latest multi-borrower structure comes by way of Colony American Finance. On Oct. 7 the sponsor launched $252 million worth in bonds under Colony American Finance 2015-1. The transaction included 69 fixed-rate loans secured by first priority mortgages on 4,140 rental units in 3,488 income-producing single-family, two-to-four family, and multifamily properties. The loans have principal balances ranging from $200,000 to $20.4 million for the largest loan in the pool.

First Key Lending’s inaugural deal issued in early April is collateralized by 16 loans secured by mortgages on 3,628 single-family, two-to-four, and multifamily rental properties and carries a total aggregate principal balance of $240.8 million.

On March 27, B2R Finance, a lender for single-family residential rental property investors that recently rebranded as Lending.com, announced the first multi-borrower SFR securitization transaction in the industry. B2R Mortgage Trust 2015-1 offered $230 million aggregate principal balance pass-through certificates rated by at least two rating agencies and backed by 144 mortgage loans.

The collateral pool backing CAF 2015-1 is more granular than the FirstKey securitization. The five and 10 largest loan exposures for FirstKey were 64.2% and 88.3%, respectively, while the largest loan comprised 21.3% of the pool. However, the subject transaction is less granular than B2R, which was collateralized by 144 loans, with the largest loan representing 9.6% of the pool, and top-five and top-10 loan concentrations of 27.6% and 37.1%, respectively.

The deals reflect what is considered the mid-tier portion of single-family rentals. For example, the two biggest loans in the Colony deal are sponsored by Huber Funding. The firm is responsible for constructing more than 10,000 single-family homes and in excess of 2,200 multifamily units in Huber Heights, Ohio, from inception in 1956 through 1992. Despite this, Huber and other large sponsors in multi-borrower SFR transactions generally lack the size and scale of the institutions that have participated in single-borrower securitizations to date such as Invitation Homes, Colony American Homes and American Homes 4 Rent.

LET'S LOOK AT TIERING

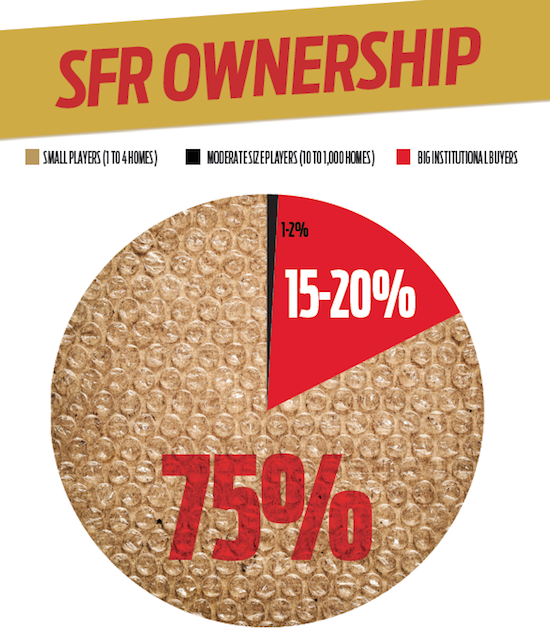

Big institutional buyers make up only 1% to 2% of single-family rentals; 15% to 20% are the moderate-size players currently tapping the securitization funding via the multi-borrower conduits set up by the likes of Colony Finance, Lending.com and First Key. These players tend to own anywhere from 10 to 1,000 or more homes. These two segments really only cover the top quartile of the market; another 75% of SFR owners hold portfolios ranging from one to four homes.

It’s the one-to-four segment that has really been challenged to find funding for growth because those owners can’t access funding via traditional lines of financing. “Fannie [Mae] and Freddie [Mac] may underwrite a loan for an investment property but it is going to be based on the income of the borrower, not the income of the property, so it is just like getting a second mortgage on a vacation home,” said Stark. “You are limited on how much you can borrow.”

Lending to these investors based on the income of the property can theoretically allow them to tap financing several times.

Capturing the one-to-four SFR portfolio investor is a feature of the recently rebranded Lending.com platform, says Jason Hogg, CEO at the company.

Lending.com’s platform consists of five core modules: origination, underwriting, servicing, a balance sheet system and capital markets access. Over the course of 2015 about $1 billion has been originated through the platform, of which the lender securitized $230 million under the former B2R brand.

The acquisition of Dwell Finance last May means the lender can now access borrowers looking to secure financing on individual single-family rentals (Lending.com essentially is the parent entity of B2R Finance and Dwell).

The plan, says Hogg, is to expand the B2R Finance suite of products with a one-home, one-loan product available through B2R’s Dwell Finance division. The product, called the Foundation Loan, ranges from $60,000 to $750,000 and can be used to purchase or refinance individual properties. Hogg said it had been in beta testing since the summer, but is now widely available.

“Through the Lending.com platform, we have the technology to create high quality loans at economies of scale that work down to that one property,” said Hogg. “The Dwell Finance Investor Office allows the borrower to get unlimited property quotes, automated pre-qualification, upload documentation and have that feed into the system to create a unified record for that borrower. It allows us to operate efficiently down to one property in the SFR space.”

Hogg said that since securitization is one of the core strategies of liquidity for B2R Finance, Foundation Loans may eventually make it into future securitizations.

What’s the volume potential of single loans, single homes?

Around 14 billion borrowers fall into the single-home tier of the market compared to 500,000 borrowers that fall into the enterprise level or the investor professional side of the market. But lending at all levels is based on debt service coverage ratio (DSCR) and the loan to value and not the borrowers’ personal income history, as is the case for a RMBS loan. DSCR is the relationship of a property’s annual net operating income to its annual mortgage debt service. For example, if a property has $125,000 in NOI and $100,000 in annual mortgage debt service, the DSCR is 1.25.

Morningstar’s Brian Grow, who spoke at the CREFC SFR event, said that the rating agency has conducted “a lot of research on the historical performance of investor properties and basically what we have tried to do is isolate homes where rent or net cash flows really covers the mortgage on the property from the ones that aren’t being covered.” What analysts have found is that is that personal income doesn’t act as a good indicator as to whether the loan will default; instead a DSCR that covers is indicative of a loan that will prepay versus a DSCR that doesn’t cover, and is more likely to default. “There does seem to be support for the concept that this is a business loan and even on a single property loan, you can look at it as a business loan and the income on property is predictive of default rather than the income of the borrower,” said Grow.

SINGLE-BORROWER SECURITIZATION THINNING OUT?

Total issuance of SFR bonds to date is about $13 billion representing well over 100,000 properties, according to figures reported by Morningstar. Issuance in the single-borrower space has tapered off since the market’s 2013 start. IH was out in front with aggregating collateral early on; the sponsor issued $6.5 billion in all 2014 and $5.5 billion in the first half of 2015, but only $700 million in the second half of 2015.

Issuance has slowed down pretty dramatically across large operators. Part of the slowdown can be put down to the more expensive securitization market that has seen pricing widen across all asset classes. When Invitation Homes completed its first deal, the triple-A rated bond priced under 100 basis points; today the triple-A bonds are pricing in the 160 basis points range.

“If we have the luxury of waiting we will, but we have a huge inventory of unlevered product that doesn’t have term leverage that we will be bringing to market at some point,” said Christopher Hoeffel, chief financial officer at Colony American Finance, on the CREFC conference call. “Although we have a bit of time to see where spreads go, even with the wide spreads we still feel it as an attractive way to finance a portfolio relative to other methods.”

Hoeffel suspects that for other large SFR operators, even if the acquisition pace of single-family homes has slowed, they may still have a lot left to securitize in portfolios.

Most of the large players have multiple-year warehouse lines. Many will have some sort of seasoning limitation or pricing step-up, but the combination of having that capacity and a slowing buying pace means there is going to be a bit of a slowing to get to the capital markets. Issuance has also been slowed down by mergers and the acquisition of large pools.

THE RENTAL HEDGE

Another phenomenon that the space may see more of is homebuilders using the rental market as a hedge against a slowdown in home buying. Hoeffel said that Texas-based merchant builder sold 800 homes to Colony, that are currently being rented. “The builder saw what was going on and continued to build and now has a massive portfolio of homes that they are renting. And they are maintaining homes in portfolio and we provide the financing.”

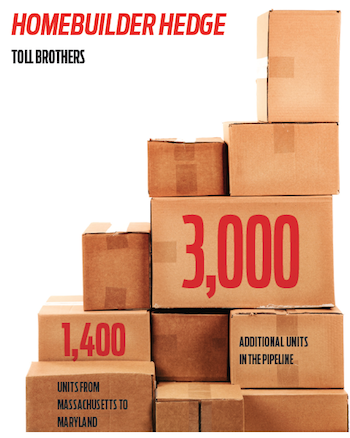

Toll Brothers, which built its first apartments for rent in Virginia and New Jersey in the late 1990s, began projects in suburban New Jersey, Washington, D.C., and Philadelphia in 2010. The merchant builder said in its 3Q 2015 earnings report that it currently has in construction four other rental communities totaling over 1,400 units stretching from Massachusetts to Maryland and has nearly 3,000 additional units in its pipeline. Toll expects to expand this business nationally.

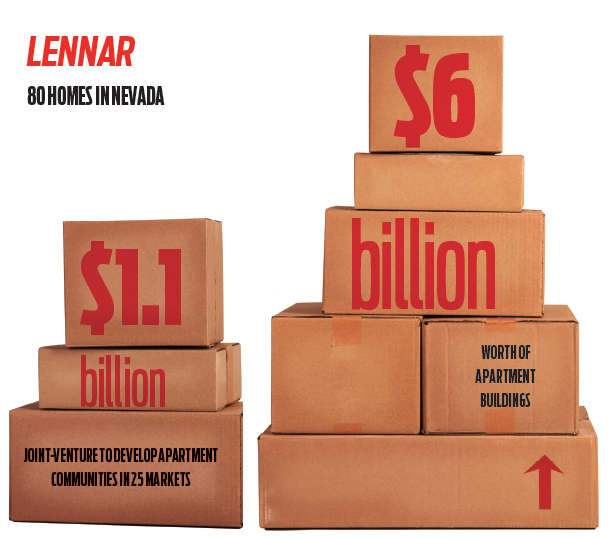

Miami-based public builder Lennar announced in March plans to rent a community of 80 freshly built, two-bedroom, detached houses in Sparks, Nevada, and is building or planning to build $6 billion worth of apartment buildings. In July Lennar formed a $1.1 billion joint venture to develop apartment communities in 25 metropolitan markets.

SFR CREATES A FLOOR

Theoretically, the institutional proliferation in the space has created a floor, or at least a higher floor for HPIs than previously existed during the housing crisis. At the depths of the crisis in 2010, investors were buying homes that peaked at $200,000 for just $40,000. “The rental demand was created immediately because the person who was foreclosed on still needed a place to rent, still had the same job, same income but they didn’t want to keep making payments on a loan that wasn’t affordable and that had depreciated,” said Carl Bell, managing director and co-head of investments at Invictus Capital Partners. Bell moderated the CREFC call.

Bell believes that without the institutional buyers stepping into the rental space, house prices would have certainly depreciated a lot more than they did. “Today we have much more of an institutional market that is better set up and therefore a better shock absorber than we had going into 2010,” he said.

Grow says that as the SFR market evolves so does its impact on providing stability for HPI. The asset is evaluated based on either cap rate or HPI, whichever is higher, said Grow. “When HPI declined so much during the crisis, that is when the market evolved — investors stepped in, did the cap rate valuation on the asset and when the HPI value was so low the higher cap rate became the floor,” said Grow. “Now that the investor valuation is there and prevalent in a lot of markets, we think it will continue to be the floor.”

The risk that a large institutional buyer could default and unload a large volume of homes is also pretty modest. Simply put, a large volume of homes in a concentrated market could drive home values down, but it is likely that SFR buyers would see that as an opportunity to snap up homes.

On Oct. 8, Moody’s Investors Service published a report looking at the systemic risk of an institutional buyer putting a large number of homes onto the market at the same time. The rating agency concluded that this would have little risk of significantly weakening home prices in the markets with the highest numbers of SFR properties because the numbers of securitized properties in those markets, as a percentage of the markets’ annual home sales, are still modest.

“Concentrations will grow if operators securitize more of the properties in their portfolios, but even if they securitize all of them, most markets’ concentrations will remain modest,” analysts reported. Atlanta and Charlotte, North Carolina, have the greatest potential for fairly high concentrations of securitized SFR properties; operators with securitizations own properties equal to about 22% and 19%, respectively, of those markets’ annual sold homes, though their properties in securitizations equal only about 11% in each market. Yet even in these markets the concentrations are not large enough to influence home prices.

“Theoretically yes, you could have the large landlords all selling homes in a market all at once, but that would still be a minority of the home sales in the area and if you believe in supply demand, it means that broader house prices are going to drop,” said Stark. “As long as there are still people there and they are willing to rent, you’ll get back to the place were the cap rates are so attractive that other operators not in distress are going to step in and start buying.”

In September, two of the nation’s largest owners of single-family rental homes announced a merger, stating that their combined businesses are an indication of the strength and stability of the single-family rental business.

In a joint announcement Sept. 21, Starwood Waypoint Residential Trust, which was spun off of Starwood Property Trust in Jan. 2014, announced that it would be merging with Colony American Homes. The transaction is expected to close in January 2016.

According to the companies’ announcement, the merger will be a stock-for-stock transaction. Upon completion of the merger, the combined company will own and manage more than 30,000 single-family homes.

The companies’ announcement also stated that the combined company will have an aggregate asset value of $7.7 billion, and the merger is expected to achieve an estimated annualized “cost synergies” of $40 million-$50 million.

Under the terms of the agreement, Colony American’s shareholders will receive an aggregate of 64,869,583 Starwood Waypoint shares in exchange for all shares of Colony American.

Upon completion of the transaction, existing Starwood Waypoint shareholders will own approximately 41% of the combined company’s shares, while former Colony American shareholders will own approximately 59% of the combined company’s shares.

Barry Sternlicht, CEO and chairman of Starwood Capital Group, and Thomas Barrack, executive chairman of Colony Capital, will serve as non-executive co-chairmen of the combined company’s Board of Trustees.

Fred Tuomi, president and chief operating officer of Colony American, will serve as CEO of the combined company. Doug Brien, CEO of Starwood Waypoint, will serve as president and COO. Arik Prawer, chief financial officer of Colony American, will serve as CFO.

“This merger is a transformative event for SWAY and for our industry,” stated Sternlicht at the time. “Combining two best-in-class teams, with a superior portfolio of homes in carefully selected geographic markets, positions us to deliver long-term capital appreciation for our shareholders while earning compelling current yields at or above those currently achievable in other major real estate asset classes.”

Barrack said that the merger “demonstrates the power of scale and consolidation and really crystallizes the long-term durability” of the single-family rental industry.

“This combination of Colony American and Starwood Waypoint truly redefines this asset class, and the opportunity in front of us is immense,” Barrack added.

In August, Altisource Residential announced its intentions to purchase a massive portfolio of rental homes in the Atlanta area from Invitation Homes.

Altisource announced the deal as part of its second-quarter earnings presentation. According to the company, Altisource will purchase 1,325 single-family rental homes from Invitation Homes for $112.6 million.

If the deal is completed as expected, Altisource will increase its portfolio of rented single-family rental homes from 777 at the end of June to an expected total of 2,282 — a nearly threefold increase.

According to Altisource, this purchase marks the company’s first bulk purchase of single-family rental homes.

“In the second quarter of 2015, we took crucial steps to diversify Residential’s acquisition strategies to anticipate and respond to changing market conditions and grow our single-family rental portfolio,” Altisource CEO George Ellison said as part of the company’s second quarter earnings release.

“I believe these critical achievements position Residential to be one of the preeminent single-family rental players in the industry,” Ellison continued.

According to Altisource’s investor presentation, the average market value for the subject properties is $85,000 and 100% of the homes are located in Atlanta. The average monthly rent for the properties is $848 and the average size of the properties is 1,575 square feet.

Altisource also detailed its plans for the properties once the deal is completed. “We are also undertaking grassroot efforts to offer quality, affordable rental homes to working-class families while offering incentives and beneficial programs for our renters to improve their credit ratings and provide with them opportunities to improve their living situation,” Ellison said.

To that end, Altisource said that it plans to offer “family-flexible leases.” An example of a “family-flexible lease” cited by Ellison in a call with investors is that Altisource plans to put 25% of the Atlanta homes into a rent-to-own program.

Additionally, families will be free to move within Altisource’s network of homes after 12 months of timely payments, Ellison said. He also said that all homes in the Atlanta portfolio will be “Internet-friendly.”

Altisource will also arrange for Department of Housing and Urban Development-certified pre-purchase homebuyer counseling to all customers in its Atlanta homes.

“Altisource Residential aspires to be the best provider of quality, affordable housing for working-class families,” the company said in its earnings presentation. “Part of the success in this effort requires commitment and involvement in each neighborhood’s issues.”