Do you remember the last time you received a letter in the mail, in an envelope, that was hand-addressed to you? People remember snail mail simply because we don’t receive much of it. Emails are easily forgotten, end up in the spam folder, or are never opened at all — but a letter in the mail ensures you occupy your audience’s mindshare for much longer.

Direct mail is a memorable way to stand out among cold callers and social media influencers. It’s an effective strategy to add to (and amplify) your other prospecting activities. Check out these nine downloadable real estate prospecting letter templates to help you make an impression in your neighborhood or zip code.

Summary

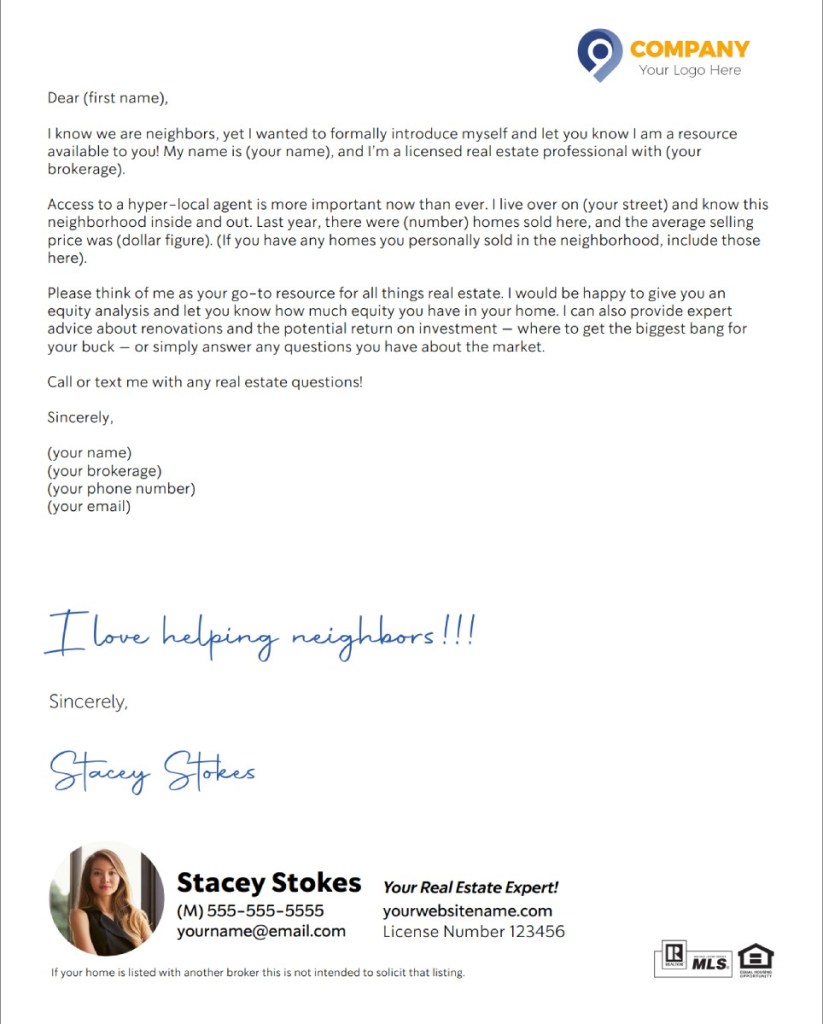

The hyper-local agent letter

Audience: Your own neighborhood

Format: Typed letter in an envelope or handwritten note

Send this letter to your neighbors — letting them know they have a knowledgeable agent living right in their own neighborhood. This is especially effective if you’re newly licensed, just moved to a new area, or simply as an introduction if you’ve haven’t previously told your neighbors that you’re in the real estate industry.

If you opt for the handwritten note option, I’d shorten this by removing the last paragraph and jumping straight from the data to the closing sentence.

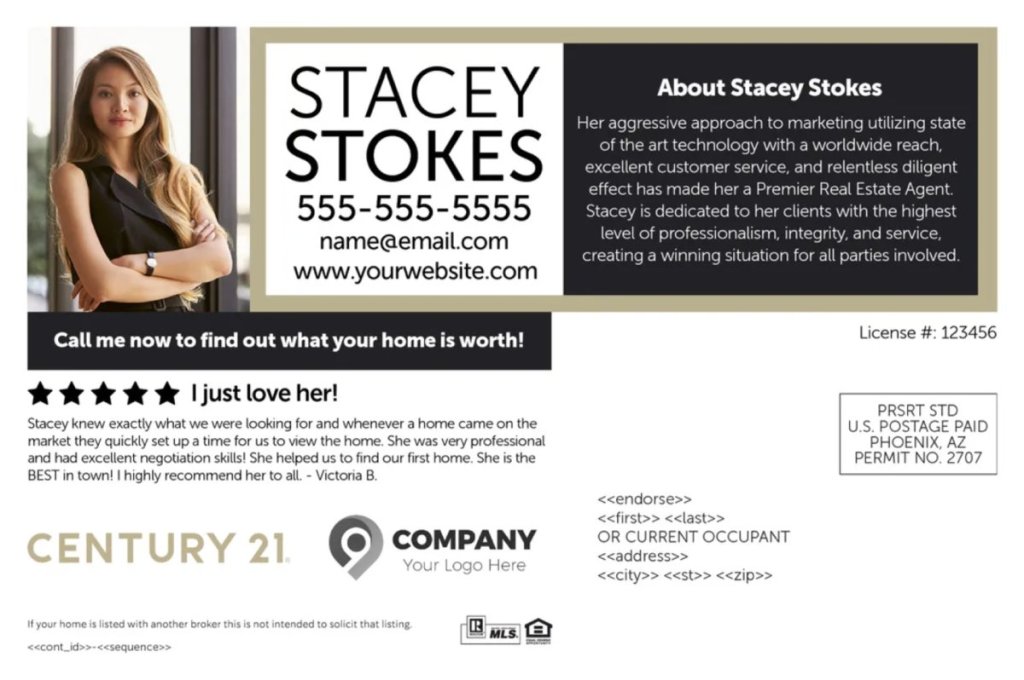

The just sold letter

Audience: Homeowners around a property you recently sold

Format: Postcard or typed letter in an envelope

The “just sold letter” is a spin on the traditional “just sold” postcard, which is a format I still suggest. I’d suggest A/B testing both formats and tracking which one yields more responses. With Wise Pelican, you can try both — it’s a fantastic resource for beautifully designed postcards and letters. All postcards are high-gloss and printed in full-color on both sides on oversized (6-inch x 9-inch) heavy card stock.

Wise Pelican pricing varies by quantity, but 500 printed postcards shipped to you will cost 46 cents each. The same quantity of printed, inserted, stamped and mailed letters are $1.38 each.

Typically, you’d mail the just sold letter to homeowners who live around a property you just helped your client to sell. However, you can get creative with these. You can absolutely send this type of mailer to homeowners around a recently sold property that someone else sold — but make sure you adjust the language and ensure it’s clear you were not the listing agent. Better yet, get permission from the listing agent to do a mailer around their sold listing, if possible.

For postcards, use the best exterior photo of the property if you were the listing agent or take your own photo of the property from the street if you were not the agent. You’ll want to include the list price, sale price, and days on market. If there were multiple offers, you may also want to include how many were received. Always include your contact information and a call to action, such as an offer for a free home valuation.

For letters, use the template below:

The just listed letter

Audience: Homeowners around a property you recently listed

Format: Postcard or typed letter in an envelope

Like the “just sold” mailers, “just listed” letters or postcards are sent to homeowners around a recently listed property. The goal of this type of letter is to promote a new listing in the neighborhood, to position yourself as the expert by providing information about the listing, and to find more business. Homeowners may know someone who could be a buyer, or they could be impressed with your proactive marketing approach and decide to talk to you about listing their home.

You can use other agents’ listings here, but be careful not to imply that you’re the agent. I recommend getting permission from the listing agent first.

A postcard works fine here, yet a letter in an envelope is more impactful. Wise Pelican can help with postcards and letters for these mailers, too.

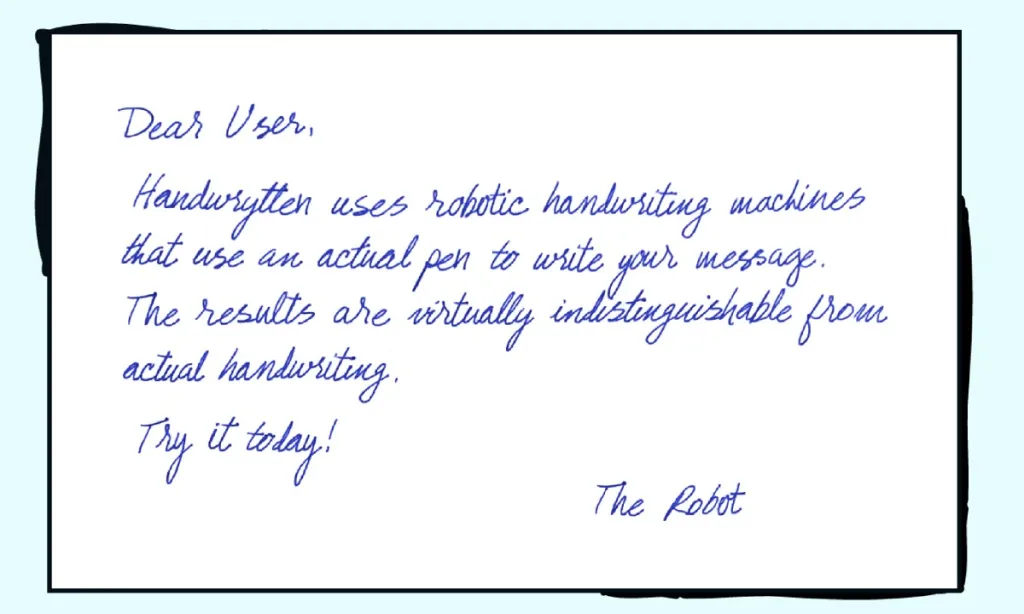

The golden letter

Audience: Homeowners in the neighborhoods your buyers are interested in

Format: Typed or handwritten letter in an envelope, handwritten address, short and sweet

A golden letter is a helpful tool when searching for an off-market property for your buyers. Many of us are in sellers’ markets with very low inventory. Buyer’s agents who can find their clients a home that’s not even on the market are instant heroes. What a great way to receive referrals for life!

While some agents choose to handwrite these, it can be time-consuming. We love Handwrytten as a service that convincingly mimics handwritten letters. I’d highly recommend leveraging Handwrytten to write your golden letters for you! It even integrates with commonly used tools like Salesforce, Follow Up Boss and Hubspot so you can easily target your existing contact lists.

Cards from Handwrytten start at $3.25 and most are available for $3.75 plus postage. You can save a bundle by signing up for a monthly subscription. They even provide 25 Real Estate Handwritten Notes Samples on their blog, plus an AI Copy Writing Assistant to

You will also hear agents say you can send these to any neighborhood, regardless of whether you have an actual buyer. While that’s technically true, I think it’s much easier and more natural to focus on targeting areas where your buyers are actively looking. If you don’t have active buyers, ask around the office. I’m sure someone in your office has a buyer struggling to find the right property.

The ‘for sale by owner’ or FSBO letter

Audience: For sale by owners

Format: Typed letter in an envelope, handwritten address

For sale by owner sellers are typically very cautious around real estate agents. They believe they can sell their own property without any help, yet the vast majority end up hiring a listing agent. The goal in prospecting FSBO sellers is to be that agent.

How? Provide a ton of value upfront, let them dictate the time frame, and stay in touch. That way, when the time is right for them to hire a real estate agent, you’re their first choice.

This letter template is full of value, specifically targeted toward for-sale-by-owners (FSBOs). Of course, you can edit the list of services offered as needed to make it your own. Bonus: If you have testimonials from past clients who started as FSBOs, those would make a good insert to include in the envelope.

The expired listing letter

Audience: Expired sellers

Format: Handwritten note on a folded notecard, in an envelope, handwritten address

For each newly expired listing, tens (if not hundreds) of agents are calling the homeowner, and most say the exact same thing. Why not stand out by sending a handwritten note on nice stationery? For an even bigger impact, drive over to the home, knock on the door, and leave the note at their door if they’re not home. This one’s short and sweet to give you enough room in the card.

Definitely include a business card in the envelope, as your information won’t be printed on the letter itself.

The tenant or renter letter

Audience: Renters

Format: Typed letter in an envelope, handwritten address

Educating renters about the benefits of homeownership and busting myths is a proven strategy for converting tenants into buyers. Send this letter to apartment complexes and past rental clients you’ve worked with.

If you want to think outside the box, consider partnering with an ambitious insurance agent who offers both rent and homeowners insurance. They’ll have a database of renters you can mail to, and you’ll likely be able to split the cost of the mailing!

The investor letter

Audience: Real estate investors

Format: Typed letter in an envelope, handwritten address

While the average homeowner moves once every seven years, investors buy and sell much more frequently — sometimes buying multiple properties each year. Targeting investors and tailoring your real estate prospecting letters to their needs and is very smart. They could be looking to acquire more properties, do a 1031 exchange, or sell everything and retire. You’ll never know unless you ask.

Edit this as needed, so it accurately reflects your own areas of service. If you have them, I would also include an insert with any testimonials you have from investor clients.

The open house neighbor preview letter

Audience: Neighbors of an upcoming open house

Format: Postcard or typed letter in an envelope, handwritten address

The delivery of this letter will need to be timed appropriately since you’ll want to make sure the letters arrive a few days before the open house happens. Hosting an exclusive neighbor preview the hour before your public open house accomplishes a few things: it makes the neighbors feel special, gives them permission to be nosy, and allows you more face time with future potential sellers while demonstrating to them that you go above and beyond for your seller clients.

Adding teaser photos of the home’s interior can help to pique neighbors’ interested. We are all a bit nosey by nature so a postcard or letter than includes images can help boost attendance. You can order preview postcards, letters and a more broad open house invitation postcard to send to your sphere of influence at Wise Pelican.

When you’re developing your prospecting plan, incorporate some of these real estate prospecting letter templates to round out your strategy. They’ll help you capture and sustain mind-share, reach new potential clients, and increase your local presence.

Do you have a tried-and-true real prospecting letter template, copy or provider that has worked for you or a tip about timing, delivery or style? Please share it in the comments!