Vetted by HousingWire | Our editors independently review the products we recommend. When you buy through our links, we may earn a commission.

While the real estate industry is forever in flux, one constant is that it’s a relationship business. One of the biggest challenges for agents is finding new clients and staying top-of-mind until they are ready to buy or sell. To build and maintain lifelong client relationships, a software solution like Top Producer can help you save time, stay organized, and stay connected to your clients and leads in a way that feels genuine — using meaningful, impactful touchpoints.

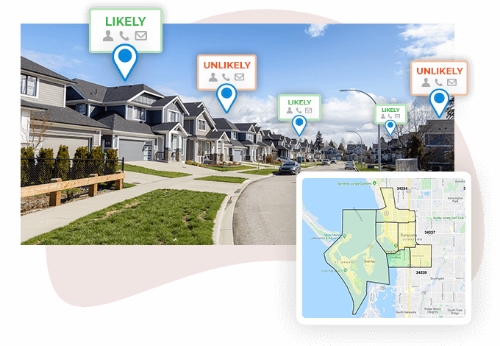

An industry favorite for its popular CRM, Top Producer can help you keep in touch with all your prospects with timely text messages, emails, and market reports delivered to their inbox. In addition to lead nurturing, Top Producer can also help you farm your favorite zip code or neighborhoods using AI-driven predictive analytics (or Smart Targeting), pinpointing which homeowners are most likely to list their property in the coming months. It’s Social Connect feature will load your CRM with affordable leads using their done-for-you social media ads.

These are just a few of the key features of Top Producer. In this article, we’ll review Top Producer’s comprehensive suite of solutions and the benefits of each tool in the Top Producer arsenal.

In this article

Top Producer key specs

- Pricing: Pro Plan starts at $109 per user/ per month

- Smart Targeting: Farm your target market use a predictive analytics tool that analyzes hundreds of data points to generate a list of homeowners who are most likely to sell.

- Social Connect: Done-for-you social media ads help load your Top Producer CRM with low-cost, qualified leads

- Automated marketing: Once your Top Producer CRM is populated with high-quality leads, its automated email, text and lead nurturing tools kick in.

- Exclusive leads: No

- Trial period: No

- Contract requirements: One year contract required

Top Producer alternatives (compared)

| Top Producer | Market Leader | SmartZip | |

|---|---|---|---|

| Exclusivity | No | Yes | No |

| Contract requirements | One-year contract | Six-month minimum | One-year contract |

| Customer support | Articles and videos, webinars, email, and live chat | Email, phone, live chat, and knowledgebase | Text, email, phone, and live chat |

| Free trial period | No free trial | Undisclosed | Undisclosed |

| Starting price | $129 | $139 | $500 |

Top Producer at-a-glance

Since 1982, Top Producer has been a leading provider of real estate software tools. Today, It is an all-in-one platform designed to help real estate agents manage many aspects of their business, including building meaningful relationships to grow repeat and referral business with clients.

Wondering how? Top Producer offers an innovative customer relationship manager (CRM) tool that lets you store all your contacts and client communications, with text and email capabilities from within the platform. Automated lead nurturing helps you consistently follow up with every client.

Top Producer also offers mobile-friendly websites that you can create using their intuitive website builder to capture leads, showcase your listings, and build your brand. Top Producer can also help you automate your marketing with branded MLS reports. With a customized market report, you can send your client list real-time information on just listed properties and price reduction alerts. You can keep your clients informed of market changes by answering the common questions “How is the market?” before they even ask — and easily track client engagement.

Top Producer Features

- Lead Response is an automated tool with up-to-the-minute automation for text, email, and Market Snapshot reports.

- Transaction Management tools built into the new Top Producer CRM, agents and teams can start a new transaction by following prompts, selecting a contact’s Property Insight, or importing an active MLS listing.

- Dynamic Workflows and Tasks let you launch drip campaigns based on hundreds of insights, such as contact type, last touch, email clicks, Property Insights, and Social Insights.

- Social Insights thoroughly searches the internet and social media platforms like Twitter, LinkedIn, and Pinterest to help you learn more about your leads, providing you with locations, photos, jobs, interests, and other client details.

- Property Insights help you save, note, and assign MLS property listings of interest to your clients within Top Producer’s CRM. The MLS integration then updates the status and relevant information of listings attached to each of your clients.

- Market Snapshot reports on new listings, for-sale properties, price changes, and neighborhood trends. You get automated market and listing reports with solid data to help position you as a market expert with your clients.

- Email Marketing is available via the CRM and directly syncs with commonly used email platforms like AOL Mail, Gmail, Outlook.com, Yahoo! Mail, and Microsoft Exchange.

- Lead Management and Routing is available via FiveStreet, lead management software that works with your existing lead sources to automatically deliver personalized auto-responses to new leads in less than a minute; broadcast leads to your team, and easily track who is working with a lead.

- Integration for 150+ Lead Providers. Top Producer’s CRM integrates with over 150 online lead providers at no added cost. And all your Facebook leads can be imported using Zapier.

Top Producer’s Key Components

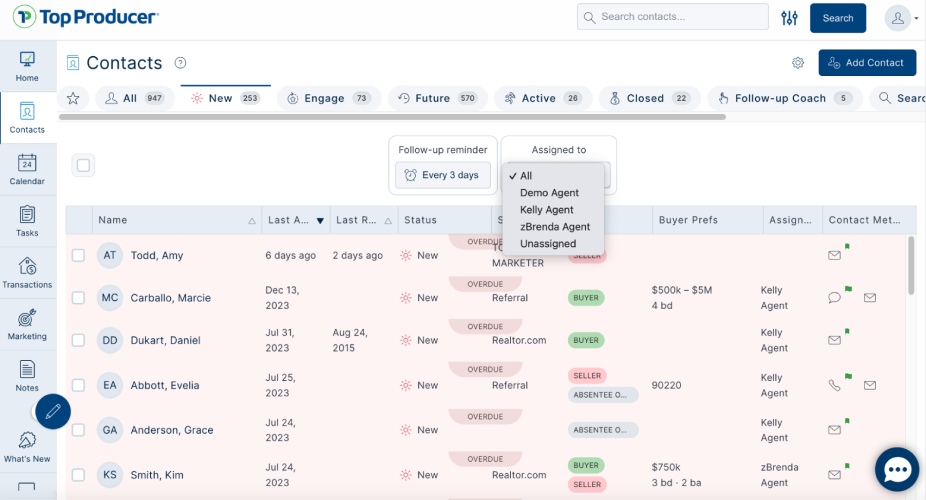

Top Producer’s CRM: In Top Producer’s CRM, you can track transactions by pairing MLS data with your unique workflow. Personalize client interactions by text and email directly through the platform and track every touchpoint and conversation with your clients. You can also store important dates like birthdays, anniversaries, names of their family members, and property interests. Customize messages or build upon provided templates to save time. You can gain insights into who’s opening, reading, or unsubscribing to or from your emails.

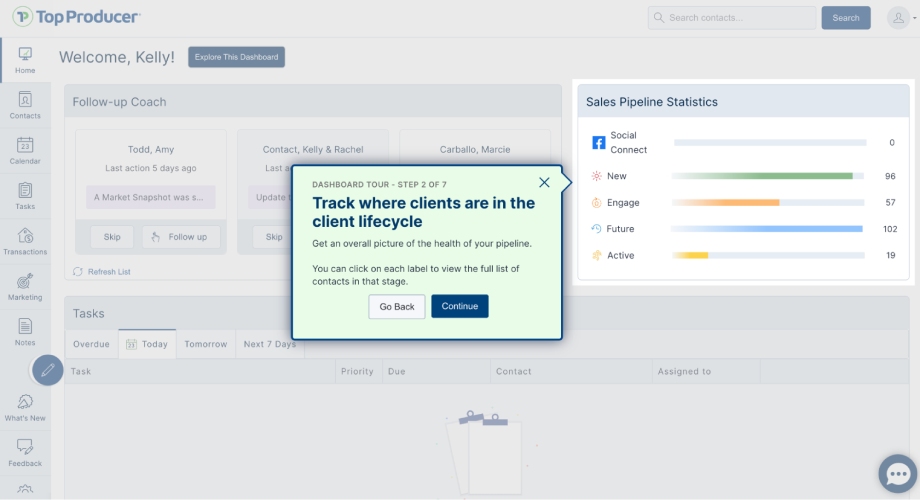

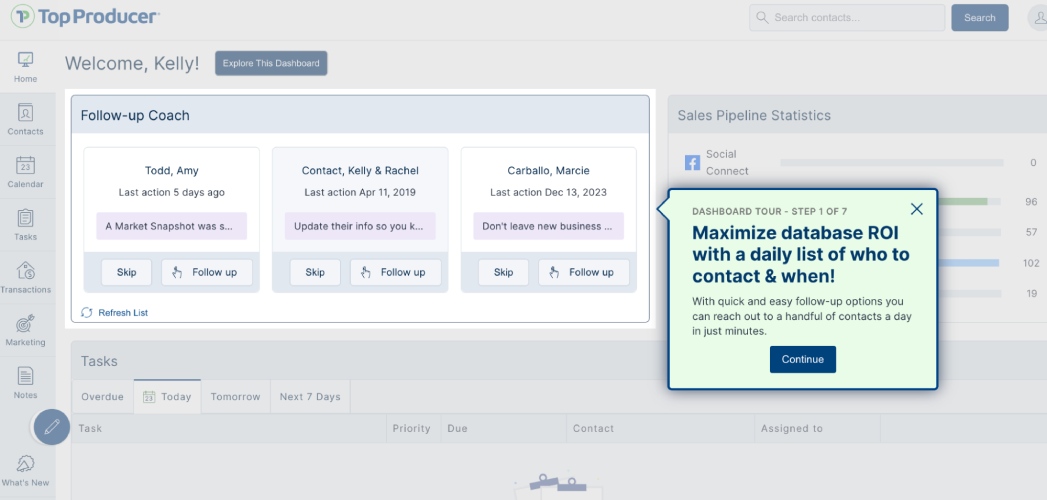

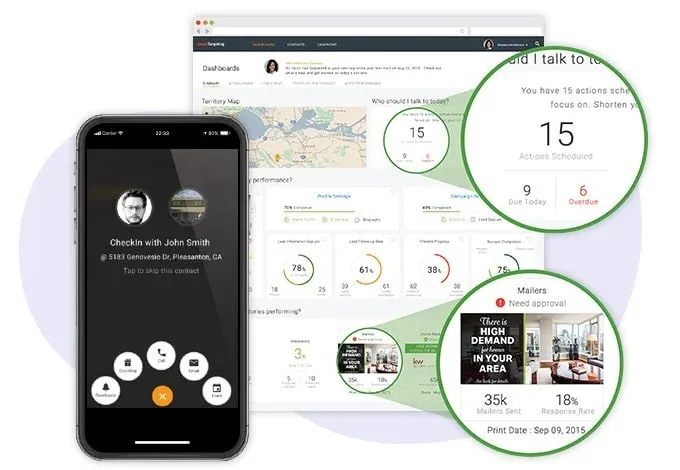

Check-in feature lets you stay organized and on track by alerting you of new leads and enabling you to schedule and automate your follow-ups on the go. Track your results and measure your successes with the dashboard, which lets you keep tabs on lead conversion, marketing impressions, prediction results, and more.

Follow-up system: The personal Follow-Up Coach can help you stay on track to make five meaningful connections daily (or over 1,000 annually) and turn prospects into commissions paid by following the system-suggested touch points.

360° Contact View: 360° saves all your contacts’ information in one central place, helping you stay organized and preventing leads from being lost.

Market Snapshots: You can also send your clients branded MLS market snapshot that work for all stages of the client lifecycle and real-time alerts for new listings, price changes, and sold properties.

Social Connect: Top Producer’s online advertising with automated lead nurture provides a steady stream of leads from social media. After you set your target city and budget, Top Producer experts create active and sold listing ads for you and launch your campaign within hours. Top Producer then displays ads to leads who intend to buy and automatically nurtures those leads with a mix of texts and emails to increase your connection rate. Leads are automatically sent to your CRM, so you can step in with more personalized communication once a lead is engaged to carry them across the finish line.

Smart Targeting: Smart Targeting is a predictive analytics tool that uses big data, as well as local market trends, on all homes in your farming area, generating a select list of homeowners most likely to sell in the next 12 months. You can define your farm area by zip code or by drawing a polygon or circle on a map.

Top Producer’s automated marketing campaigns then kick in, keeping you in front of the top 20% of households most likely to sell. All the marketing is done for you, including online ads, email marketing, postcards, and handwritten letters to the homeowners in your targeted area.

Once leads respond to your initial automated marketing, they’ll be directed to your Top Producer landing page, where they will submit their contact information and receive a comparative market analysis (CMA) and monthly market trend reports to move them through your sales pipeline.

FiveStreet: Gone are the days when you could get back to a buyer inquiring about a property in a day or two. Today, buyers expect an immediate response to their inquiries. We found that with FiveStreet, you can deliver personalized, automatic email and/or text message replies to prospective buyers.

If you’re a managing broker or team leaders looking to filter buyer leads to agents across your team, you can use FiveStreet to automatically broadcast a new lead to your entire team or redirect the lead to a specific team or team member. You can also view which agent claims the lead and the lead’s current status.

FiveStreet also helps you keep your team in the loop with shared access to contacts, communications, and a calendar of key dates. It also helps to review prospect and property details before calling a lead.

Agent Website: We checked out Top Producer’s website builder and found their templates and web design offerings clean, straightforward, and engaging. You can choose from 12 real estate designs, customize your website with high-resolution images and real estate news, and showcase your listings with lead-generating landing pages. While Top Producer’s agent websites are compatible with most third-party IDX providers and MLS boards, they do not include an IDX feed.

It’s easy to import your profile from Realtor.com or add a photo, description, and reviews. When building your site, you can also connect your MLS to import your listings, as well as connect your Top Producer® CRM and Market Snapshot® accounts. Top Producer website subscribers are eligible for discount pricing on IDX solutions from iHomeFinder and IDX Broker.

Top Producer pricing & monthly plans

Top Producer offers seven plans, with pricing starting at $109 for the Pro Plan which includes use of Top Producer’s CRM and market snapshots. Individual users can upgrade Pro + Leads plan to benefit from completely done-for-you social media ads, or the Pro + Farming plan to benefit from Top Producer’s predictive analytics to find likely sellers in your area.

All the packages listed can be customized. Contact Top Producer directly for custom quotes, current pricing, discounts, and terms.

| Plan | Price/month | # of Users | Includes |

|---|---|---|---|

| Pro Plan | $129 | 1 | CRM + Market Snapshot |

| Pro + Leads | $379 | 1 | CRM + Market Snapshot + Social Connect |

| Pro + Farming | $399 | 1 | CRM + Market Snapshot + Smart Targeting |

| Pro Teams 5 | $299 | 5 | CRM + Market Snapshot + Team Sharing |

| Pro Teams 10 | $499 | 10 | CRM + Market Snapshot + Team Sharing |

| Pro Teams 15 | $699 | 15 | CRM + Market Snapshot + Team Sharing |

| Pro Teams 25 | $999 | 25 | CRM + Market Snapshot + Team Sharing |