The fate of Freddie Mac and Fannie Mae will be center stage in January when the Obama administration makes its required Congressional recommendations about what to do about the two companies. The stakes for homeowners and the economy couldn’t be higher as the next Congressional session will determine if the U.S. has a private mortgage market or if, by controlling housing finance, government bureaucrats will be able to direct where Americans live and how much they pay for housing. While the administration is trying to figure out how much is too much government intervention in the housing finance markets, it doesn’t seem to be concerned with the underlying problems that shut down virtually all new issue volume in the private mortgage securities markets. As a result, administration proposals are doomed to fail until it acknowledges that radical mortgage finance reform is a prerequisite for the U.S. to break its dependency on Freddie Mac and Fannie Mae. Reform is needed to induce investors to buy newly issued non-government guaranteed mortgage backed securities.

Wall Street’s fatal defect

Most Popular Articles

Latest Articles

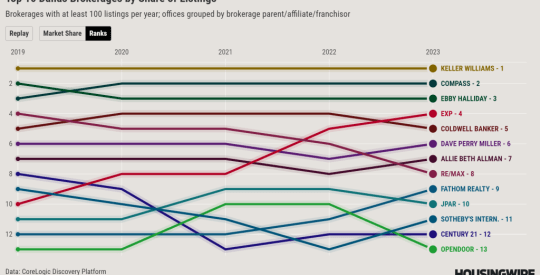

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders