You don’t have to look far to find articles on changing attitudes toward homeownership. Whether it’s the latest sound bite on Millennial shopping habits or the coming age wave of Boomers looking to downsize, there’s no shortage of stories that suggest that attitudes toward the American Dream of owning a home are changing.

If you look beyond the anecdotal, though, you’ll find data and demographics that tell a much different story—one that reaffirms that the dream of homeownership is alive and well, but could be made a little easier to attain. Supporting this dream takes the work of multiple sectors, like lenders, mortgage insurers, real estate agents, public policymakers, builders and financial technology companies, to name a few.

Of those sectors, the housing finance industry plays a unique and powerful role—and as the world around us continues to evolve, we should work together as an industry and as part of the greater housing sector, to protect and advance the dream of homeownership for more people.

Is the dream still alive?

Say what you will about the boomerang generation. The U.S. is clearly on a path for growth in family households, which should drive homeownership.

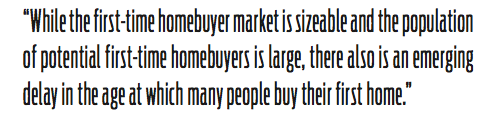

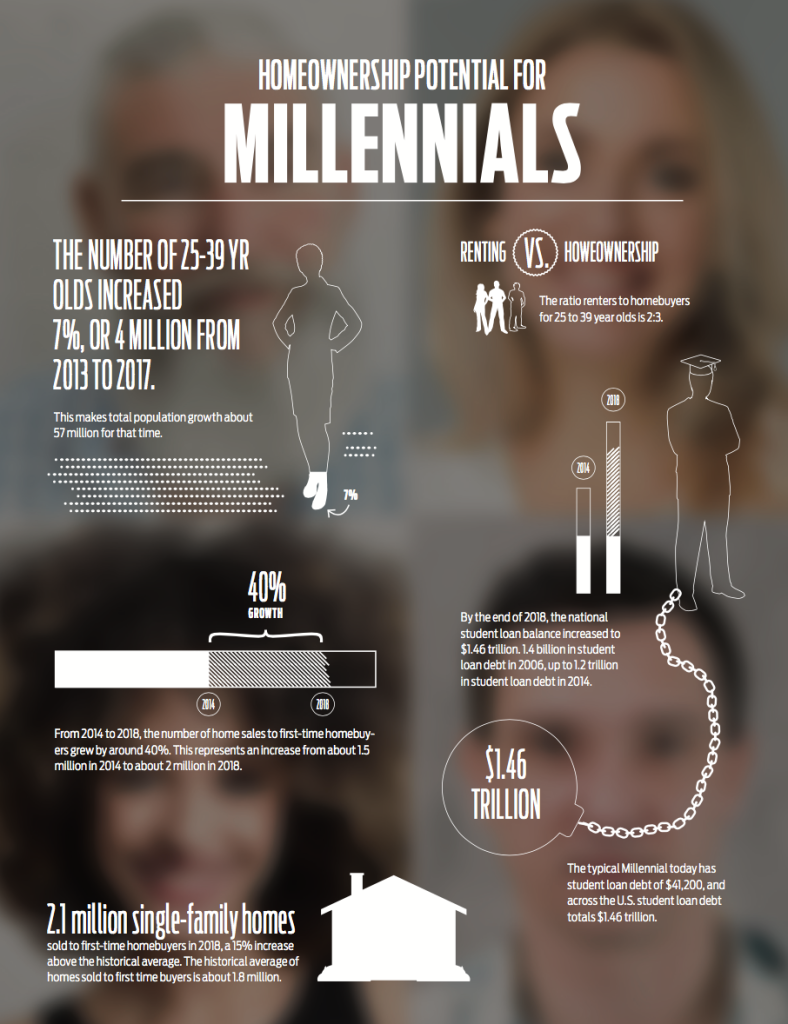

When you look at the demographics, the fastest growing age group after Baby Boomers is 25 to 39, growing by 7% between 2013 and 2017, according to the 2018 Census Bureau Population Estimates. That translates to population growth of 4 million and 8 million each during that period, while populations decreased during the same period in other age groups. This is significant because the most important age groups to watch for homeownership trends over the next five years will be 25 to 39 and 40 to 45. Historically-speaking, it’s at this point in the average lifecycle when people get married and have children, which typically also means moving out of rental housing and buying homes. Despite the pervasive narratives, the data on homeownership rates bears this out.

While the split between renting and owning for the under 35 age group is 2:1, 35% homeownership rate, that ratio nearly inverts to 2:3 (60% homeownership rate) in the neighboring demographic of 35 and 44 as noted in the 2019 Census Bureau Housing Vacancy Survey. Said another way, one of the only two growing age groups in the population is at a turning point in their lives and moving rapidly into homeownership.

Beyond population shifts and homeownership rates, we also see additional evidence that the dream of homeownership is still alive in the growth and resiliency of the first-time homebuyer market. Between 2014 and 2018, the number of home sales to first-time homebuyers grew by around 40% and accounted for most of the growth in sales in the entire housing market. In fact, the current housing cycle is largely defined by the surge in first-time homebuyers with 2.1 million single-family homes going to first-time homebuyers in 2018, a 15% increase above the historical average.

Why the doubts?

The numbers tell us that the dream of homeownership is very much alive and well, but today’s prospective homebuyers do face challenges unique to our place in history.

While the first-time homebuyer market is sizeable and the population of potential first-time homebuyers is large, there also is an emerging delay in the age at which many people buy their first home. The percent of households with homeowners under the age of 45 is 10 points lower compared to the 1999 to 2001 period. So, while the narrative that Millennials are not interested in homeownership is not supported by data, it appears to contain a grain of truth that a noticeable proportion are not able to attain homeownership or are delaying the decision to buy a home.

A popular culprit in this avoidance or delay is high levels of student debt. In the early 2000s, the national student loan balance was relatively low at just $250 billion. By the end of 2018, when the last of the Millennials entered college, the national student loan balance had increased to $1.46 trillion, meaning that Millennials—and a core part of that growing homebuying population—are carrying most of the student loans in the economy today. According to the 2017 Student Loan Debt and Housing Report, the typical Millennial today has student loan debt of $41,200. Even if they can reconcile the idea of taking on even more debt with good financial planning, it may be difficult to even qualify for a mortgage. The same report has estimated that student debt has delayed homeownership by between three and seven years.

Another factor driving that delay—and one that causes ripples through the process—may be a lack of supply, especially for the moderately priced homes that are most attractive to first-time homebuyers. The number of new homes sold at a price below $300,000, a price point considered affordable to many first-time homebuyers, is essentially unchanged at 265,000 units a year between 2013 and 2018. In that same time, demand from potential first-time homebuyers has grown by 44%, meaning that the housing market must absorb more than 630,000 first-time homebuyers annually.

This lack of supply has resulted in home price growth that far exceeds income growth.

Accordng to the Federal Housing Finance Agency, home values have grown by close to 50% since the end of 2011. Over the same period, private sector hourly wages have grown by less than 20%. So, a larger proportion of a homebuyer’s income would go toward their mortgage payment, creating an even more intimidating investment that leaves less discretionary income available.

How the housing industry can help

The desire to pursue homeownership is there, but so are the challenges. The good news is that the challenges are far from insurmountable. As noted earlier, it will take all industry sectors working together to address factors like the lack of available housing below $300k and student debt levels, but the housing finance industry has a pivotal role to play. Between educating, advocating, and facilitating, there are several responsible ways that our industry can help turn a dream into a reality for more potential homebuyers.

• Don’t believe the hype. The misconception that a borrower must have a 20% down payment in order to purchase a home persists. Mortgages with less than 20% down financed close to 2.5 million home purchases in 2018 and accounted for 80% of all home sales to first-time homebuyers. Despite statistics like that, 68% of renters cited saving for a down payment as an obstacle to homeownership in a 2017 survey by the Urban Institute. Additionally, 39% of renters believe that more than 20% is needed for a down payment, and many renters are unaware of low-down payment programs. As hard as the housing finance industry works to remove barriers to homeownership by enabling low down payment mortgages, we also should work to ensure that more potential homeowners know that those options exist.

• Knowing is half the battle. If we can overcome the down payment knowledge gap, the housing finance industry already has at the ready homebuyer education programs that inform the spectrum of considerations from “Am I ready to buy a home?” to “What’s the best type of mortgage for me?” to “How do I properly maintain my new home?” Where we can do better is to find ways to bring these types of programs out ahead of the traditional purchase process. A few of these programs currently exist outside of the purchase process, but the majority are offered by mortgage insurers, lenders and Housing Finance Agencies. While these providers offer their programs at no charge, they also require a borrower to a) commit to the purchase process, and b) provide personal information in order to link their completion of the course to their loan. To help broaden access to homeownership, the housing industry should find ways to give more potential homebuyers access to these programs before they commit to the purchase process. This less committed experience could reach a broader audience of potential buyers that might be curious, but not curious enough to engage a lender or provide their personal information.

• Keep up with the times. After the housing crisis, underwriting standards were understandably tightened. While relaxing those standards may not be the right answer, our industry should take care to account for the changes in employment models that have emerged with the gig economy. Traditional credit underwriting guidelines and verification sources work well for borrowers who hold your standard W-2 jobs, but they don’t work well for those who may supplement those jobs with earnings from non W-2 jobs such as TaskRabbit, Uber or Upwork. Whether it’s the gig economy or whatever the next income or savings trend may be, we have a responsibility to account for these trends in our standard underwrite and ensure the same opportunities that exist for traditional borrowers, also exist for those who put together the same home investment capacity through different avenues.

• Serve traditionally underserved communities. Black and Hispanic homeownership rates continue to decline post-crisis. To put that in perspective, the gap between black and white homeownership rates is currently wider than it was in 1968, when the Fair Housing Act was passed. We must dig deep to understand the root causes of this alarming trend and work together to make sure that we truly do serve all home ready borrowers. For example, black families rent at a higher rate than white families—and there’s good evidence to show that rental pay history is a strong indicator for whether a borrower will pay back a mortgage. Even though it has the potential to benefit all parties involved, it’s rarely considered as part of the underwriting process.

• Use the tools we have. Keeping the dream of homeownership alive for more people means taking on more risk. It’s simple math, more loans=more risk, even if you take quality out of the equation. Lenders have options to help balance that risk, but within those options, there are clear choices that favor broader access to homeownership. Low down payment options abound between FHA and VA loans, as well as GSE lending programs like Fannie Mae’s HomeReady and Freddie Mac’s HomePossible, which are designed to help more underserved populations get into homes. Private mortgage insurance is another option to broaden access while limiting risk. Available for conventional mortgages, private MI provides access and flexibility for borrowers in the form of free education programs, an array of premium options, loss mitigation programs, and, perhaps most importantly to affordability, the ability of the borrower to request cancellation of MI coverage once the loan balance reaches 80% of its original value. It seems our industry is acknowledging these benefits as the use of private mortgage insurance outpaced FHA loans for the first time in 2018 and has continued in the lead position since. It also should be noted that using private capital to support the housing finance system helps to protect taxpayers in a down cycle. Win-win.

• Keep our own house in order. Post-crisis safeguards like the Dodd-Frank Wall Street Reform and Consumer Protection Act got it right by outlawing predatory lending practices and requiring that mortgage lenders assess a borrower’s ability to repay their loan. With the QM Patch now set to expire in early 2021, our industry needs to ensure that the regulations continue to balance the need for borrowers to have access to credit and strong consumer protections with strong assurances that buyers are truly positioned to invest in a home. While there’s room to debate the role of debt-to-income ratios in determining borrower eligibility, we need to ensure that we maintain our focus on broadening access to homeownership in a future-focused and responsible manner.

To sum things up

While the dream of homeownership is very much alive in today’s world, it is not without its challenges. Broadening access responsibly requires products that meet borrowers’ needs, advocacy to make sure borrowers are aware of the options available to them, sufficient supply, homebuyer education, and legislative and regulatory policy—and the housing finance community certainly can’t solve all of those issues on our own. We’re not powerless, though. Better yet, many of the tools we need to help more families realize the dream of homeownership are already in place and just need to be applied more intentionally.