Single-family rent prices increased 3% in November 2019 over the same time period in the previous year, according to CoreLogic’s Single-Family Rent Index,

In October, low-end rent prices went up 3.6%, while high-end price gains rose 2.9%.

Overall, year-over-year rent price increases have slowed down since February 2016. During this time, they peaked at 4.2%, and stabilized at around 3% since early last year.

November 2019 was the 67th month in a row that low-end rentals propped up national rent growth, the report said.

Low-end rental prices increased 3.6% year over year in November 2019, down slightly from November 2018’s rent gain of 3.8%.

High-end rentals increased 2.7% in November 2019, and the report says this remains unchanged from the previous year.

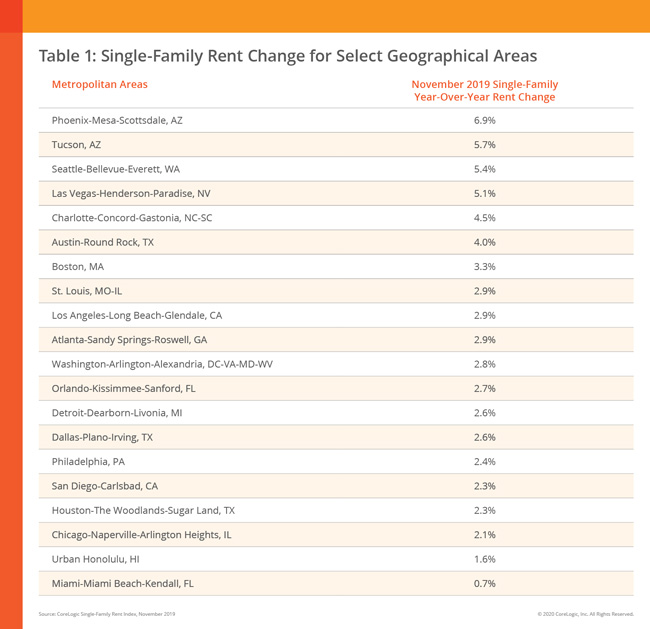

For the 12th month in a row, Phoenix has the highest year over year increase in single-family rent prices in November, at 6.9%. Neighboring town Tucson had the second-highest rent price growth, with gains of 5.7%.

Miami had the lowest rent increase in November, at 0.7%. Miami had the lowest amount of rent increase in October as well, at 1%, the same amount of increase it saw in September.

For October, Phoenix was the market that saw the highest uptick in rent, with the highest year over year increase in single-family rents at 6.8%, according to CoreLogic.

“Strong rent growth in the Southwest reflects strong population growth in this part of the U.S.,” said Molly Boesel, principal economist at CoreLogic. “Arizona ranked third for population growth in 2019 by both number and percentage increase, according to the U.S. Census Bureau. In contrast, Illinois and Hawaii both had a decrease in population in 2019, which could account for the slower rent growth in these regions.”

Interested in exclusive real estate news and commentary? Join HW’s free twice-weekly newsletter OpenHouse to stay informed. Sign up here!