For the first time in its history, Rocket Mortgage has revealed the amount of business it does in the broker space.

The disclosure comes just days after United Wholesale Mortgage issued an ultimatum to mortgage brokers, telling them that they could not partner with Rocket or Fairway Independent Mortgage Corp. and continue to do business with UWM.

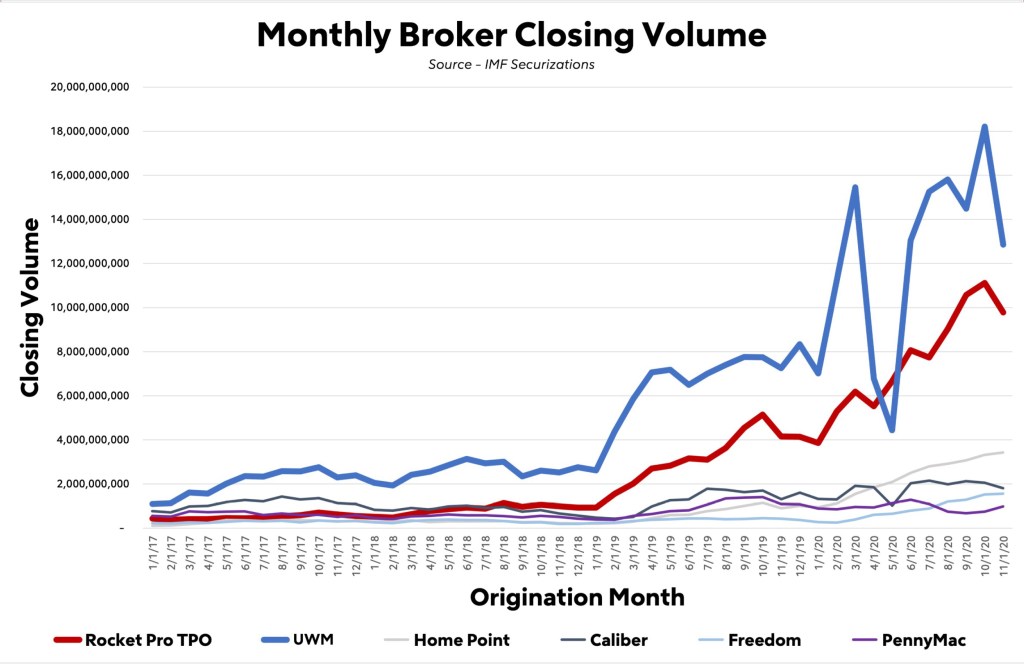

The figures provided by Rocket — which are based on Inside Mortgage Finance securitization data — show that the Detroit-based lender closed roughly $97 billion in mortgages through its broker partners in 2020.

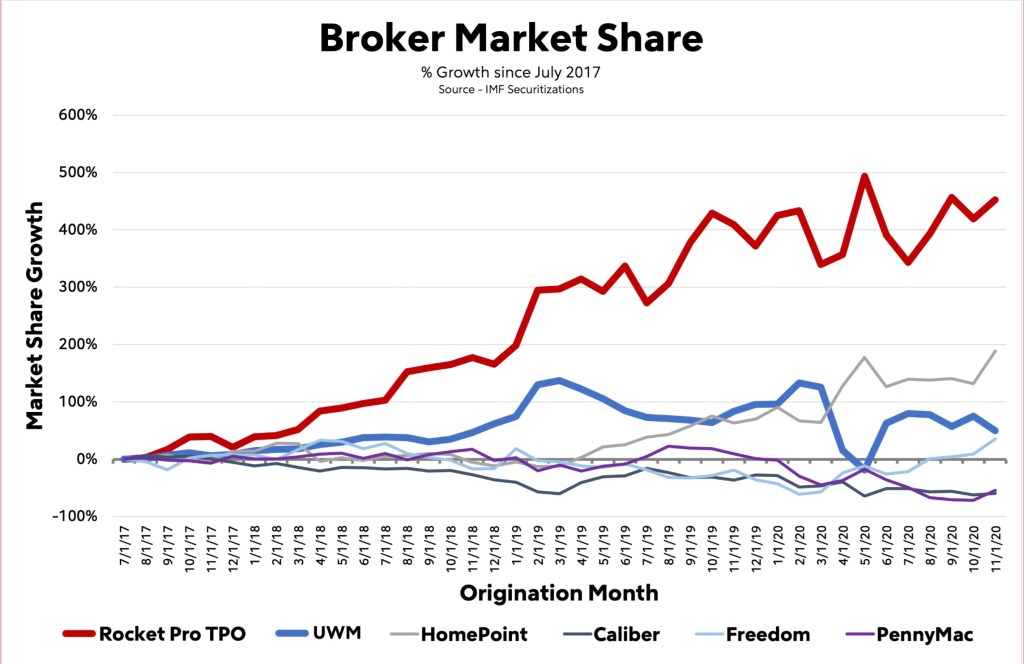

That’s good enough to make Rocket the second-largest wholesale lender in the country. It’s still far behind UWM — Mat Ishbia’s firm originated over $182 billion in mortgages in 2020, and is easily the largest player in wholesale — but Rocket Pro TPO is rapidly gaining market share, the released figures show.

(Rocket declined to provide details on gain-on-sale margins or net income for its broker operations, which are just one part of its partner channel; the other being a referral business with Charles Schwab, State Farm, Morgan Stanley and others.)

“We’ve had brokers call in left and right, clearly upset about this mandate from UWM,” Austin Niemiec, vice president of Rocket Pro TPO, told HousingWire in an interview Sunday night.

“One of the big questions the broker community is asking is, why are they forcing brokers to make a choice? It’s not because of morals, in my opinion, it’s not because of a principled stance like they’re claiming. It’s because of fear. The numbers we put out show that. It’s to show why UWM is reacting so desperately. They don’t want to compete head-to-head.”

After his announcement on Thursday, Ishbia told the crowd at HousingWire’s Spring Summit that the ultimatum was issued to protect brokers. Ishbia said the decision was a response to Rocket and Fairway soliciting loan officers away from brokers and working directly with real estate agents to cut brokers out of the entire process.

In a subsequent interview with HousingWire, Niemiec dismissed the accusations. According to Niemiec, Rocket Pro Insight, a new program that gives real estate agents greater visibility into the loan process, allows for real estate agents who are licensed loan originators to originate loans. But that’s nothing nefarious, underhanded or unique, he said.

“We do not and never have paid for a real estate agent referral, period,” said Niemiec. “That narrative is reckless and it’s false…There’s close to 2 million real estate agents in the U.S. and for decades agents have been able to originate mortgages. Like most mortgage companies, Rocket gives agents the ability to do that. There’s less than 90 real estate agents that have been able to do that for Rocket. So you’re talking a fraction of a fraction of a percent.”

“We have to compete”

Niemiec again reiterated Rocket’s position that UWM’s move is anti-consumer and philosophically in opposition to the broker ethos.

“If you look at the mortgage broker community over the last five years, it has grown tremendously. And I believe competition is the reason why. We’ve had a lot of great lenders competing for brokers’ business, which is the beauty of competition. Every day we have to show up and get better. Whether that means rates, turn times, new technology, programs – we have to compete for brokers business. And if we don’t provide them value, and trust, they’re going to send their loan somewhere else.

“As you can see by the numbers, we’re providing brokers value. They’re trusting us with their business, and we couldn’t be more proud. And we believe that’s why the huge reason why it’s been such an amazing five years for the broker community – it’s been an awesome competition. It’s sad now that one lender just wants to stop competing. That will harm brokers, it will harm their clients and ultimately stifle innovation. It’s sad,” Niemiec said.

Rocket Pro TPO declined to specify how many brokers have told them they’re booting them in favor of UWM or sticking with Rocket.

“I haven’t spoken to a single broker who is partnered with both of us that isn’t upset and offended at the choice they have to make,” Niemiec said. “A theme I’m hearing when I’m speaking to brokers is this is an extremely slippery slope. And when you start to give up freedom, it becomes a dangerous descent down a slippery slope.

“Today it’s Rocket and Fairway, tomorrow, who knows, it’s Caliber and Freedom. Then it becomes, ‘Hey if you don’t give me a certain percent of wallet share, you’re not part of the team.’ If you’re forced into not working with the second-largest wholesale lender by far in America, that is an incredible choice to the entire broker community, everything else is on the table.”

He continued: “We’ve had an incredible amount of support over the last three days. We have thousands of folks that have already made the decision to work with us. We’re confident many more thousands will do the same.”

“Lifetime value”

Rocket, which made over $9.5 billion in profits in 2020, has gone big on the broker channel in recent months. Beyond paying millions to broadcast a Super Bowl commercial that promotes the broker space, Rocket Pro TPO last week announced a new jumbo mortgage product to draw in self-employed borrowers who have been frustrated by a lack of options outside the conventional space. The company claims it will spend $100 million on the broker space in 2021.

Analysts who follow Rocket have questioned executives about their outlook for gain-on-sale margins in the upcoming year, especially since interest rates are ticking up, margins are already shrinking, and Rocket is a refi-heavy company.

On the earnings call in late February, executives said the company’s size and investment in technology would allow it to thrive even in a very different rate environment, especially when others retreat.

“We have the luxury of being a 35-year-old company,” Bob Walters, president and COO of Rocket said on the call. “If you look back decades, you will see a very consistent track record of gain on sale and it’s really one of the, I think, one of the hallmarks of the company and there’s a number of reasons for that. Jay [Farner] also talked a lot about lifetime value. You mentioned the service clients, over $400 billion of service clients. So in a rising rate environment, that becomes incredibly valuable and let alone all the other things that we talked about, the other businesses and markets that we are in. So quarter-to-quarter, we don’t spend a lot of time thinking about, it’s just gaining share and gaining lifetime value.”

Rocket also announced during the call that it struck potentially lucrative corporate partnerships with Morgan Stanley and E-Trade, who would refer clients seeking non-jumbo products to Rocket.