Rental prices for one-bedroom and two-bedroom units fell in March, sliding by 0.4% and 0.3%, respectively, according to Zumper.

It now costs the average renter a median of $1,219 and $1,463 to rent the average one-bedroom and two-bedroom units. This equates to an annual increase of 0.2% and 0.6%, respectively.

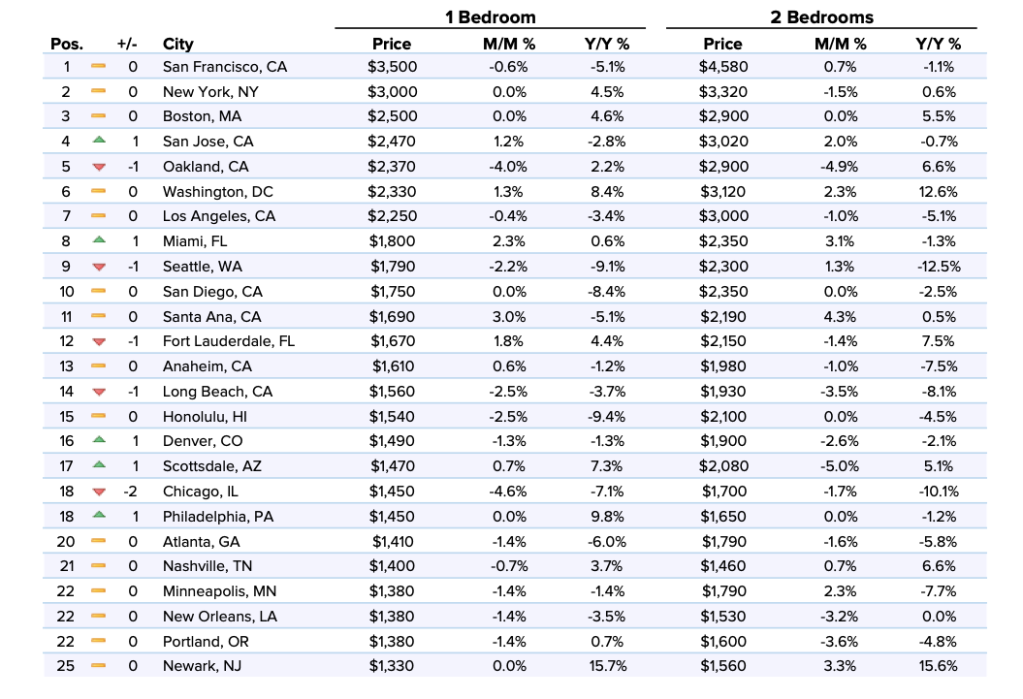

Despite this growth, Zumper notes the nation’s top three rental markets including San Francisco, New York, and Boston, all experienced lackluster demand in March.

In San Francisco, renters saw their one-bedroom rental prices drop by 0.6% to $3,500, while two-bedroom rents grew 0.7% to $4,580.

New York renters also experienced some relief this month, as prices for one-bedrooms held steady at $3,320. Meanwhile, two bedrooms fell 1.5% to $3,320.

Rent for one-bedroom units in Boston remained stagnant at $3,000, although prices for two-bedroom units declined by 1.5% to $3,320.

“In the top 10 rental markets, while the three priciest cities experienced flat months, there was a battle of the Bay Area cities right underneath as San Jose pushed past Oakland to reclaim its position as the 4th most expensive,” Zumper writes. “Miami barely inched past Seattle, with a $10 difference in one-bedroom rent, to move up 1 spot to become 8th.”

When it comes to the remainder of the nation’s rental markets, Zumper says Des Moines, Iowa had the fastest growth rate for one-bedroom units as rent increased by 4.9% to $860, ranking the city as the 70th priciest rental market in the nation.

In terms of year-over-year changes, Zumper says Washington, D.C. was the only city to have a double-digit year-over-year rental growth rate, with two bedrooms up 12.6%.

On the opposite end of the spectrum, Seattle was the only city in the top 10 to experience double-digit price drops, with two-bedroom rent declining 12.5% since this time last year, according to Zumper.

The chart below displays the 25 most expensive rental markets and how they moved in March, according to Zumper.