The market for investments in catastrophe insurance-related bonds looks ready to swell in 2010, with news this week of the first such issuance under a new program. Bonding the risk of damage to homes in relation to natural disasters is becoming increasingly relevant as the rehab of affected houses becomes more expensive in areas hard-hit by disasters like Hurricane Katrina. Swiss Reinsurance Co. is preparing to issue the first in a series of notes under the principal at-risk variable-rate note program, Successor X. The notes are linked to the risk of Californian earthquakes and North Atlantic hurricanes between November 2009 and November 2010 in selected states including Puerto Rico, according to a report by credit-rating agency Standard & Poor’s. Catastrophe bonds — or cat bonds — are a way for an insurer to boost liquidity and remain solvent. The issuer pays a larger return to investors during years without catastrophes like hurricanes and earthquakes. In years of catastrophe, the insurer uses funds to pay claims on insured on affected properties, and the investors receive lesser payouts. Successor X provides cover to Swiss Re, S&P said, against losses incurred from November 2009 to November 2010. Swiss Re will have the option to extend the transaction beyond the scheduled redemption date in increments of three months. It may extend the transaction up to six months for the earthquake risk and up to two years for the hurricane peril, to allow for loss calculation. The transaction is expected to close in November 2009, but the collateral value was not disclosed at the time this story was published. Write to Diana Golobay.

Swiss Re Prepares to Issue Cat Bond: S&P

Most Popular Articles

Latest Articles

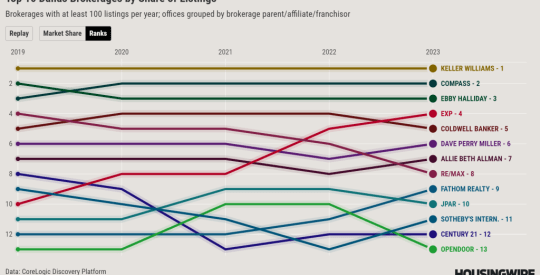

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders