Pending home sales rose 2% in December from the prior month for the fifth gain in six months but remain below the year-ago period, according to the National Association of Realtors. Despite the modest gains in sales, at least one research firm predicts the housing market has a long road to recovery that will take as long as six years. NAR said its pending home sales index, which is based on contracts signed, increased to 93.7 last month up from a downwardly revised 91.9 for November and down from 97.8 for December 2009. NAR Chief Economist Lawrence Yun said good affordability conditions and economic improvement led to the monthly increase. “Modest gains in the labor market and the improving economy are creating a more favorable backdrop for buyers, allowing them to take advantage of excellent housing affordability conditions,” Yun said. “Mortgage rates should rise only modestly in the months ahead, so we’ll continue to see a favorable environment for buyers with good credit.” Not everyone shares Yun’s view. TrimTabs Investment Research said Thursday that its analysts are forecasting the U.S. housing market won’t recover for five to six years. And the housing “depression” will continue to be a drag on the economy, despite the gains seen in domestic stock markets of late. The Dow Jones Industrial Average has climbed steadily since July and passed 12,000 Wednesday before closing at 11,985.44. Madeline Schnapp, director of economic research at TrimTabs, said the firm estimates upward of 20% of GDP growth and 40% of employment growth between 2002 and 2007 was in some way related to housing. But the sector has collapsed in on itself and “will serve as a drag for years to come.” “Sloppy paperwork and government policies that allow banks to postpone losses are only delaying the necessary adjustment in the housing market,” Schnapp said. “The sooner house prices are allowed to find a market-clearing level on their own, the sooner the housing sector can contribute to economic growth.” TrimTabs said nearly 11 million homeowners owe more than the house is worth, and some 7 million mortgages are delinquent with 250,000 new notices of default every quarter. “Loan-to-value ratios need to come down significantly, especially in states like Florida and Nevada,” according to Schnapp. “Meanwhile, a painfully slow foreclosure process and house prices that are still too high are making it virtually impossible for the market to normalize.” NAR said its pending home sales index was mixed in different parts of the country with increases in three regions and a decline in the West. The group said the index rose 1.8% in the Northeast in December, with a 8% gain in the Midwest and a 11.5% rise in the South. Meanwhile the index fell 13.2% in the West. Write to Jason Philyaw.

NAR pending home sales rise 2%; TrimTabs expects slow recovery

Most Popular Articles

Latest Articles

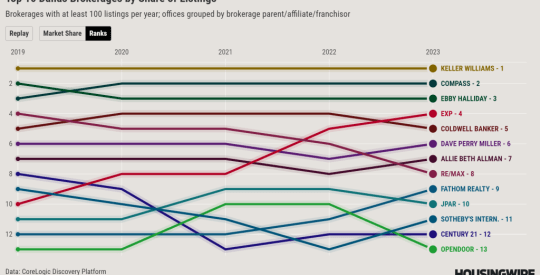

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders