California governor Arnold Schwarzenegger vetoed a bill Thursday that had proposed instituting stricter regulations on state-licensed mortgage brokers, in an attempt to protect borrowers from irresponsible lending. In the wake of sky-high residential foreclosures, the wide-reaching bill was one of more than a dozen mortgage-related bills introduced by California lawmakers in January. Schwarzenegger signed 10 of those bills, which the governor’s office said “will aim to increase accountability in the real estate market, improve transparency standards in order to prevent abusive lending practices and help Californians maintain homeownership in the aftermath of the foreclosure crisis.” California has consistently been one of the hardest-hit states throughout the nation’s housing mess. Despite the passage of the other measures, bill AB 1830, proposed by state Assembyman Ted Lieu (D-Torrance) was blocked, leaving consumer groups dissatisfied and angry. The bill was the centerpeice of an effort by consumer groups to rein in mortgage brokers that many say helped fuel the mortgage crisis. The bill would have established a “fiduciary duty” for mortgage brokers to consumers, prohibited steering borrowers into higher-cost loans, banned option ARMs, and signficantly limited the use of yield spread premiums as a form of broker compensation. “California is experiencing 1,300 foreclosures every single day,” as a result of loose lending practices, said Paul Leonard, director of the California office of the Center for Responsible Lending. “We should not allow the narrow interests of the mortgage brokers who got us into this mess dictate how we get out … yet Schwarzenegger just did.” The bill passed with a 6-4 vote in the Senate. But Schwarzenegger said that while the bill had laudable intentions, it “overreaches and may have unintended consequences,” according to the Sacramento Bee Thursday. Among them were putting California mortgage brokers at a competitive disadvantage. The California Association of Realtors, however, praised Scwarzenegger’s decision for blocking a bill they said would have failed to apply to conventional lenders and created a new, unnecessary right of enforcement by private parties. “AB 1830 is a feel-good measure that would have unequally burdened different sectors of the mortgage industry, but would not have addressed lender misconduct that inspired the legislation in the first place,” said CAR president William Brown, in a press statement. “We don’t need more laws— we need more enforcement.” Among the mortgage legislation signed by Schwarzenegger was: SB 1461, which requires real estate agents to disclose their license number on all first-point-of-contact marketing materials; SB 1737, which authorizes the state’s real estate licensing authority to suspend or bar a person who has committed a violation of real estate law; AB 69, which mandates that all mortgage loan servicers report detailed data to their licensing agency in regards to loan modifications; AB 180, which provides a registration and bonding process for foreclosure consultants; and SB 870, which allows the California Housing Finance Agency to more quickly establish a mortgage refinance program. “I am pleased to sign legislation that protects consumers and creates a responsible and accountable lending environment that will encourage homeownership in out state,” Schwarzenegger said.

Most Popular Articles

Latest Articles

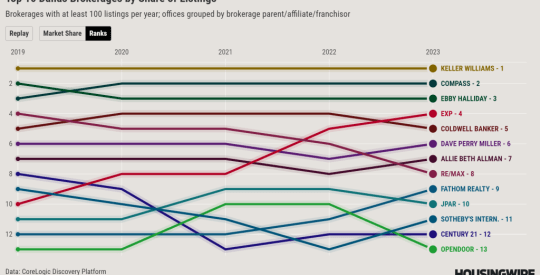

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders