All kinds of new rules have been developed to deal with the past and the implementation of those rules will consume considerable bandwidth for years to come. While this is all relevant and interesting, the proportion of eyes focused forward, through the windshield ahead, needs to increase dramatically.

Lately, it seems all eyes are fixed firmly on the rearview mirror as we analyze what went wrong during the growth of the housing price bubble and the resulting housing market crash. All kinds of new rules have been developed to deal with the past and the implementation of those rules will consume considerable bandwidth for years to come. While this is all relevant and interesting, the proportion of eyes focused forward, through the windshield ahead, needs to increase dramatically.

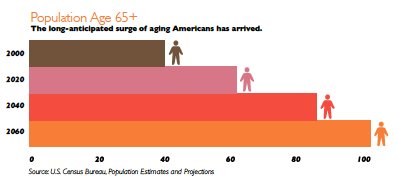

The long-anticipated surge of aging Americans has arrived.

A huge player in the American housing story over the coming decade will be the homeownership needs of older households. Eighty-six percent of all household growth will be attributed to those headed by persons age 65 and older, which amounts to more than 10.5 million new households. These are stunning statistics! By 2040, the U.S. Census Bureau estimates the number of persons 65-plus will be approximately 80 million, nearly double the population in the year 2012; 1 in 5 people in the U.S. will be 65 or older.

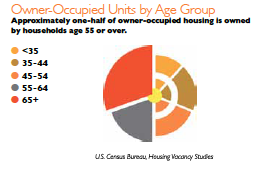

All of this has profound implications for America’s housing markets, local communities and the housing finance system. Older households have the highest homeownership rate of all age groups. Last year, the homeownership rate for older households was 81 percent. This compares with a 60 percent homeownership rate for households under the age of 65. Further, the homeownership rate of this group is forecast to remain steady for the next 20 years, while the rates of homeownership for all other age groups are projected to decline. Currently, more than 1 out of 4 homeowners (28 percent) is older than 65. The proportion is rising and it is certain to soar in coming years.

In other words, the determinants of housing demand and housing policy have shifted. And, this reconfiguration will continue for years to come. Housing policy makers need an increasingly open and consumer-driven approach to meet the actual needs of these future housing markets. The baby boomers that determined the past housing market wave have moved on to create the next wave.

Most stay at home within their present communities.

There is ample data finding that the overwhelming majority (approximately 78 percent) of older homeowners wish to age in place. As the number of these households increase, their housing stock will require routine maintenance and renovations, as well as retrofitting to accommodate aging in place. The costs of homeownership will continue to march upward.

At the same time, the majority of people now expect to reach retirement with mortgage debt. A recent survey by Securian Financial Group found that 59 percent of retirees entered retirement with mortgage debt and two-thirds of pre-retirees now expect to enter retirement with a mortgage. The University of Michigan Retirement Research Center reports that the amount of mortgage debt among pre-retirees tripled between 1992 and 2008. The diversion of retirement cash flows to debt service threatens a homeowner’s ability to meet the other housing obligations that facilitate aging in place. A reverse mortgage represents an opportunity to “reset” household finances and improve monthly cash flows so that it can be allocated to living expenses.

Forward thinking is required to ensure that the appropriate financial products and resources are available to facilitate and fund these considerable requirements. The enormity of the challenge requires both public and private involvement. This capability is not only essential to the occupants of the home, but important to the health of communities at large. With every third house becoming occupied by older homeowners, deferred maintenance, substandard living situations or mass selling will materially and adversely impact entire communities. The tenuous financial outlook of aging baby boomers is a crucial factor when considering the implications of this massive demographic change. A HECM that is aligned with the realities and needs of the consumers in this segment is an essential element of addressing this new wave through the housing sector.

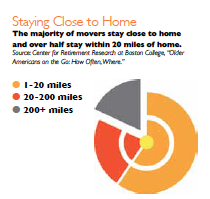

Others move, but most still stay close to home.

While a large majority of homeowners indicate a desire to age in place, almost 25 percent say they expect to move. Boston College estimates the two-year move rate among older households to be approximately 10 percent. Further, as boomers move along the aging continuum into their late 70s and early 80s, the number choosing to move to more accommodative housing is likely to increase. In 2014, 1.5 million older households will move and that figure is expected to rise rapidly.

A strong and viable reverse mortgage program tailored to meet the needs of older homebuyers is essential to a healthy housing finance system. Otherwise, the group is likely to become a significant component of the next housing finance bust. Conventional housing finance terms, in particular a mandatory monthly payment, present asymmetric risks to people of retirement age, especially the middle class and those below who have few financial reserves. While traditional mortgages require monthly payments in constant and consistent amounts, the monthly income of older Americans over the long term is neither constant nor consistent. The 2013 Department of Health and Human Services’ “Profile of Older Americans” reported 86 percent of older Americans represented Social Security as a “major” source of income. For couples, Social Security is not a constant or consistent source of income. Death of a spouse, an inevitability in the age group, reduces the amount of household Social Security income. The same goes for many among the shrinking group who report private pensions. For the increasing portion of society relying upon income from assets, much depends on markets and timing.

Compounding income stability risks, a second inherent characteristic of the constituency, is the expense risk associated with health care costs. One certainty of this unknown variable is that it will change, and it is very unlikely to go down. The upward risk is large.

The existing HECM for Purchase product addresses a portion of this growing market segment. However, the product contains rules that often deviate from accepted real estate market practices in local markets and it is only a rough fit with newly constructed homes. Product modifications are required to improve the suitability of the product for the rapidly growing housing market need.

How does a strong purchase money reverse mortgage help sustain housing markets and local communities? After all, the stereotype of older movers is that they pick up stakes and flock to newly built retirement communities in the “sand states” (Arizona, California, Florida, Nevada, etc.). Although a compelling image, it is not true. The Boston College Center for Retirement Research reviewed the moving patterns of the aging and found the vast majority of older households choose to move within 20 miles of their present home. Four-fifths stay within 200 miles. The connections at home matter.

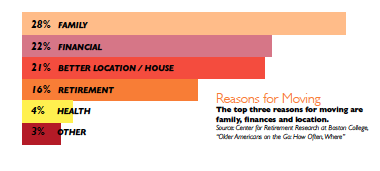

The actual reasons for moving are fairly intuitive. The top three reasons are:

ONE // Family

TWO // Finances

THREE // Location

The No. 1 reason, family, includes the death of a spouse and the related implications of finance and housing choice.

Now is the time to be proactive: Anticipate and steer around the next housing crisis.

Now is the time to be proactive: Anticipate and steer around the next housing crisis.

Now is the time to ensure that our housing finance products and delivery systems are in alignment with our aging population. Otherwise, future generations will be doing what preoccupies us now: looking out the rearview mirror, analyzing and reacting to a problem that was largely foreseeable. The housing financing needs of older Americans are unique and increasing rapidly.

There are two groups—those who stay at home and those who move—and although they have different immediate financing needs, they have similar long-term circumstances and challenges. Most Americans are no longer entering retirement free of mortgage debt. Traditional pension systems are disappearing. Housing wealth is the largest asset for most. The reverse mortgage program and other private sector equity release products are essential to providing stability to housing markets as they undergo unprecedented demographic shifts over the next several decades. In terms of household growth, this demographic far overshadows all other segments. As referenced earlier, 86 percent of all household growth over the coming decade will be attributed to households that are age 65 and over.

Today, the HECM is the only viable product in the marketplace. As such, it performs an essential role as the pilot program in providing stability to housing finance for older homeowners. It also performs a substantial role in seeding and reinvigorating the private sector for equity release products. Its popularity grew steadily for a decade following its conversion to a permanent FHA program in 1998, but has declined in the aftermath of the housing crisis, a time when demographics suggest it should be increasing. It is unrealistic to assume product design and structure play no role in this counterintuitive result.

It is time for policymakers to carefully examine the product to identify areas where there is an opportunity to better align with the needs and circumstances of actual consumers. Since 2009, the industry has been consumed with the past, installing new constraints and limitations to address the perceived failures that occurred largely in the traditional mortgage delivery system. Far less attention, if any, has been focused forward on meeting the actual needs of current and future consumers.

The HECM for Purchase program is an excellent place to start. It constitutes approximately 3 percent of all HECM volume, comprising 2,100 loans in 2013. Considering that 1.5 million age-eligible households will change houses this year, it is a ripe opportunity to start examining whether the existing program rules facilitate consumer use and conform to market norms. If the program does not line up to these requirements, the impact will be to force older homebuyers into alternative products that present substantial future default risks and contribute to the next market crisis.