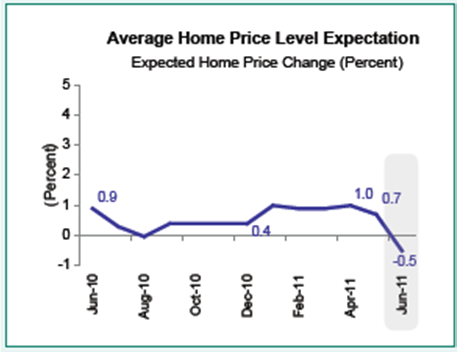

Americans adults surveyed in Fannie Mae's Monthly National Housing Survey now expect home prices to decline in the next 12 months.

The survey of 1,000 adults found an expectation that home values will decline by 0.5% in the coming year. This marks the first negative reading in the survey in the past year.

The number of respondents who felt that home prices would rise fell by 6 percentage points from May to 22%. Those feeling that home prices will decline rose by the same 6 percent to 25%, with 49% expecting home values to remain stagnant.

Correspondingly, a large majority at 69% believe it is a good time to buy a home, while only 11% think it is a good time to sell a home. In terms of interest rates, respondents who feel that interest rates will rise in the coming year fell by 9 percent from 47% to 38%, compared to an increase in those who expect them to remain the same from 40% to 48%.

"Our survey data on key aspects of the housing environment and Americans' household financial situations offer a comprehensive view of the marketplace that hasn't existed previously," said Doug Duncan, Vice President and Chief Economist of Fannie Mae. "The data have only a very short lag from collection to delivery and at present show how sensitive consumers are to contemporaneous events. We see a continued lack of confidence among consumers on home prices, the ability to sell their homes, and the state of their personal finances – all of which point to housing as a continued downside risk to economic growth going forward."

The survey, conducted between June 1 and June 28, 2011 polled 1,000 adults aged 18 an older. It is designed to track consumer attitudes in regarding home ownership and rentals.