In a time of consistent change, challenge and exits, the reverse mortgage struggles for some clear signs of positive momentum and sustainable growth. As year-over-year production has maintained a positive growth rate of 3.1%, other challenges remain.

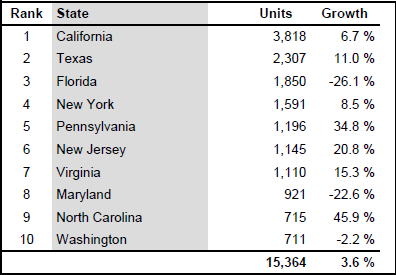

The latest Industry Trends Report from Reverse Market Insight (RMI)highlights that 7 out of the top ten states for production for 2011 have positive growth for the year. Texas has solidified their hold on the number 2 spot with 11% growth, and California is by far the number one, sustaining 6.7% growth. Two states, however, are shining above the crowed with growth rates well ahead of any other states in the top 10, North Carolina at 45.9% and Pennsylvania at 34.8 percent.

However, when you drill down beyond the state level to the county, city and zip code level, it reveals that the state growth is not coming from the typical areas. None of the top 10 areas at any of these levels are in positive territory for 2010. It raises several questions about the changing dynamics of the industry's production. The first suggests that the reach of the market is beginning to expand beyond the traditional areas. This can be considered a key element of product evolution. However, on the other side, one has to consider potential market saturation and whether the traditionally larger producing areas are reaching a natural market penetration ceiling and the market is forced into other areas to maintain the production.

A key element in the changing dynamic can be the exit of the large lenders Financial Freedom, Bank of America and Wells Fargo. Since many players in the industry are unable to match the reach of the larger lenders the question about production as they wind down will be how much will be absorption of their business and how much will be replacement. Of course, this will be very difficult to define unless suppositions are made based upon geographic considerations of their previous production and growth of other lenders in the wake of their exits. It may be far more difficult to determine the impact of Financial Freedom's exit as their decline had been occurring over a long period of time prior to their exit. However, the other two abrupt exits may reveal themselves in a more obvious fashion.

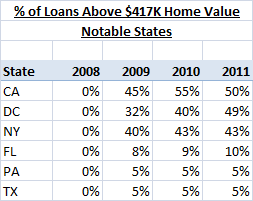

Another factor that will impact the industry this year is the pending expiration of the temporary national HECM lending limit of $625,500. With the limit set to expire on October 1st, many expect that Congress will allow the limit to fall back to the previous national limit of $417,000. Surprisingly, some of the key states for production have large percentages of their loans coming from homes with values above the $417,000 level. California leads this list with 50% of the loans produced coming from homes that exceed this value.

Change is constant it seems and the rest of this year will be no different. Of course in every market challenge, there is opportunity to be unfolded. It may be difficult to uncover where the opportunity lies at times, but interesting doors may be opening for the nimble and fleet of foot.