At the end of its December meeting Wednesday, the Federal Reserve announced 2017’s third and final rate hike as well as its forecast for 2018.

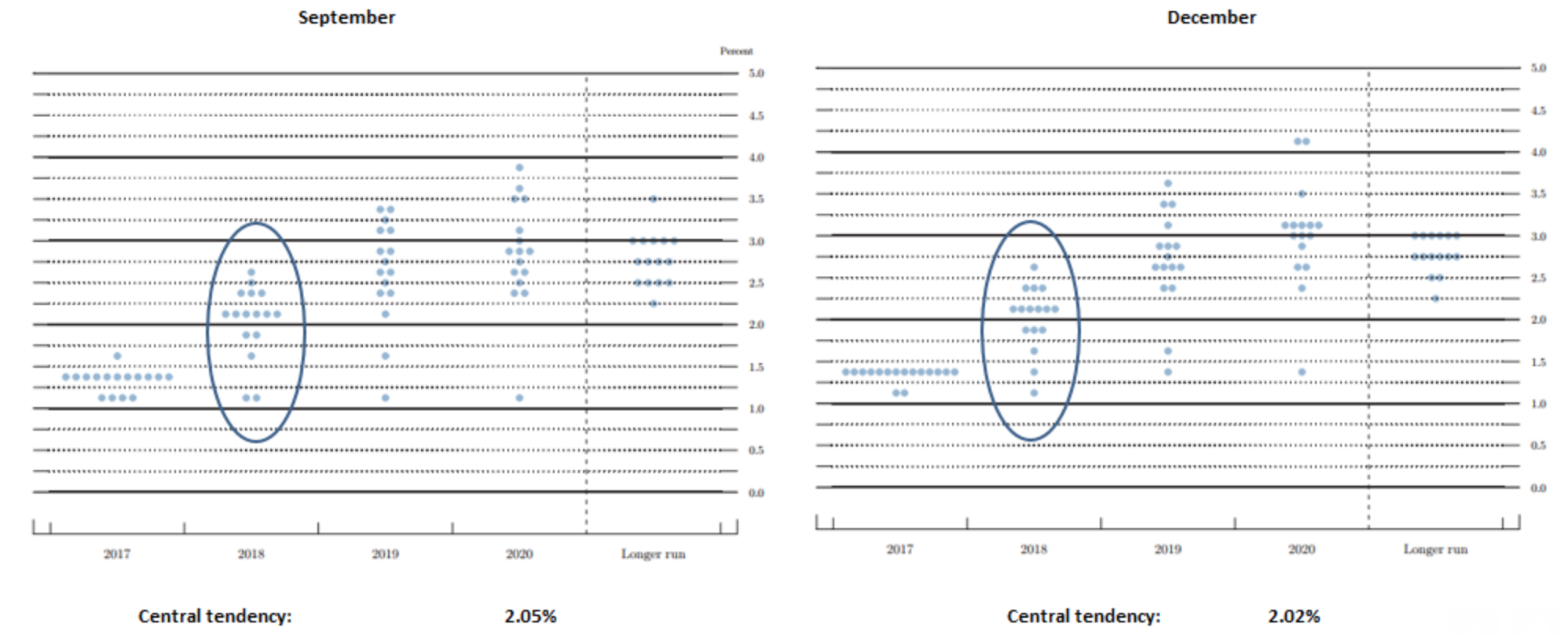

The Federal Open Markets Committee released its new dot-plot, showing its predictions for 2018, which remained virtually unchanged from its September meeting.

Click to Enlarge

(Source: Federal Reserve)

However, the Fed did revise its gross domestic product higher, leading experts to say the Fed will later revise its rate hike forecast from three times in 2018 to four.

“The Fed raised rates at their December meeting, surprising no one,” said Mike Fratantoni, Mortgage Bankers Association chief economist. “However, they did markedly increase their forecasts for economic growth in 2018, and now expect the unemployment rate to average 3.9% in the next two years, well below the long-run sustainable level of about 4.6%.”

“With this optimistic outlook, driven in part by the spur in demand expected from the tax cuts, it is surprising that the Fed still expects just three rate hikes next year,” Fratantoni said. “We think they are likely to revise up this guidance early next year to show four hikes in 2018.”

He pointed out that while two members still voted against the December rate hike, January will see more hawkish votes.

“The stronger job market is likely to lead to faster wage growth, but inflation to date remains below the Fed’s target of 2%,” Fratantoni said. “For this reason, there were two dissenting votes at this meeting.”

“These members preferred to keep rates unchanged at this point,” he said. “However, it’s important to note that voting members of the FOMC change come January, with a more hawkish set of members casting votes in 2018.”

Another expert agreed the Federal Reserve will eventually raise its projection to four rate hikes given the strong economic growth.

“The surprise is that, despite that stronger economic growth, the inflation and interest rate projections were left almost completely unchanged,” Capital Economics Chief Economist Paul Ashworth said. “The median still points to three rate hikes next year and two more in 2019. We anticipate that a slightly stronger rebound in core inflation next year will eventually prompt the Fed to hike rates four times next year.”

One expert explained that these rate hikes will push the 30-year mortgage over the 4% mark, but it could hold good news for first time homebuyers.

“Today’s decision will likely push 30-year fixed mortgage rates past the 4% mark in the coming weeks,” realtor.com Senior Economist Joseph Kirchner said. “Despite decreasing affordability in an already pricey housing market, higher interest rates might have a silver lining for first-time and low-income buyers looking to enter the market.”

“Today’s increase is likely the first of a series in 2018, which could ultimately make it more difficult for financial institutions to sell mortgages and prompt a loosening of qualifying standards,” Kirchner said. “With mortgage qualification being one of the largest barriers to ownership, homeownership may get easier for these groups in 2018.”

And the impact to interest rates in 2018 will be minimal, one expert predicted, saying the 30-year mortgage rates will stay between 3.5% and 4.5% next year.

“Rates are being pushed up by domestic U.S. factors, primarily the Fed’s balance sheet reduction and expected economic growth,” LendingTree Chief Economist Tendayi Kapfidze said. “However, low rates in Europe and Japan limit the extent to which rates can increase in the U.S.”

A report from Trulia explained how the federal funds rate relates to the movement of mortgage rates. It pointed out that an increase in the federal funds rate does not always lead to higher mortgage rates.

“Prospective homebuyers often look to the FOMC announcement on the federal funds rate since they believe that mortgage rates will follow the direction of the rate change,” Trulia Senior Economist Cheryl Young said in the report. “While the federal funds rate is tied to consumer interest rates in the short-run, mortgage rates are not particularly sensitive to the federal funds rate.”