Mortgage credit became more difficult to obtain during the second quarter this year, according to the latest Housing Credit Availability Index released by the Housing Finance Policy Center.

The index showed credit availability decreased to 5.1% in the second quarter of 2017, down from its recent peak of 5.4% in the first quarter this year. But the chart below, which uses data from eMBS, CoreLogic, HMDA, IMF and the Urban Institute, shows credit availability is down from the pre-crisis era, the era deemed to be reasonable lending standards from 2001 to the end of 2003, and even before that going back to 1998.

Click to Enlarge

(Source: eMBS, CoreLogic, HMDA, IMF, Urban Institute)

The decline from last quarter is due primarily by a shift in market composition as the government channel lost market share to the portfolio channel, where lending standards are tighter. With the GSE and government channels, credit continues to expand due to higher interest rates and lower refi volumes.

The HCAI measures the share of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.

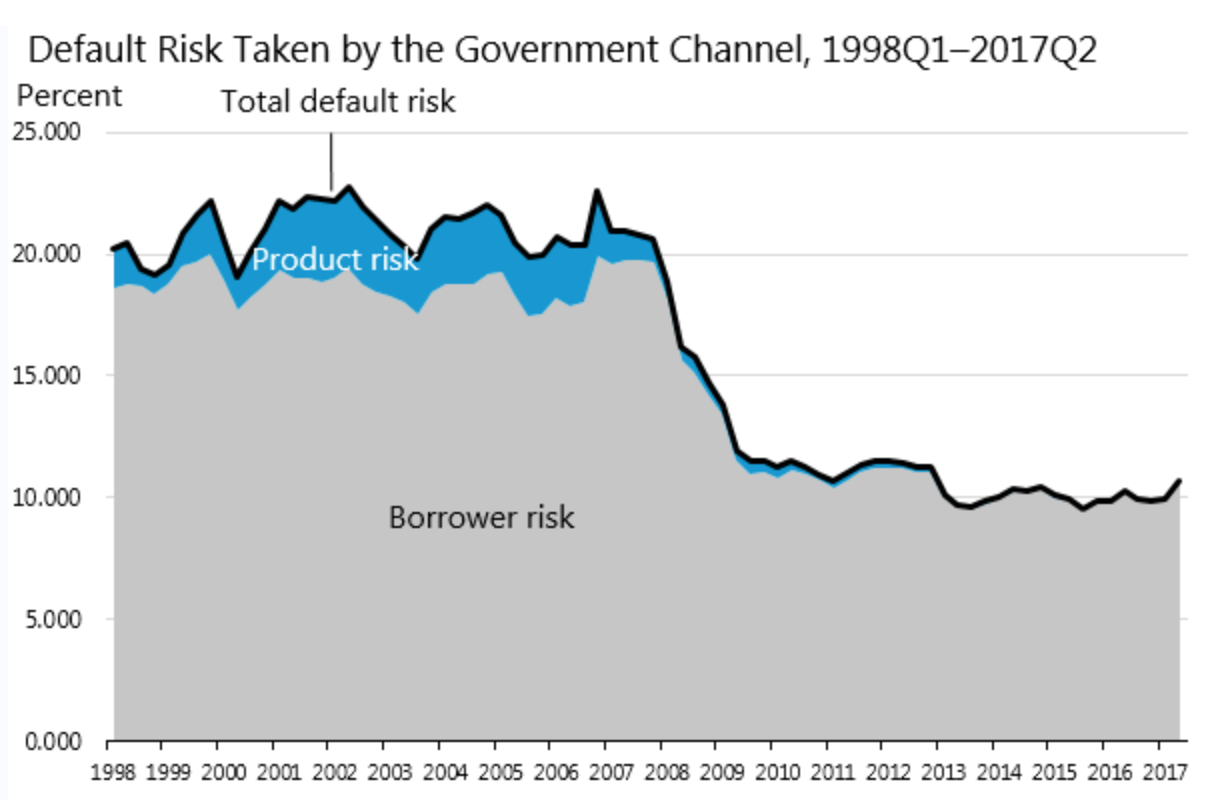

The chart below shows the default risk taken by the government channel, which is much higher than overall risk seen in the chart above.

Click to Enlarge

(Source: eMBS, CoreLogic, HMDA, IMF, Urban Institute)

Within the government-sponsored channel, credit availability rebounded to 2.4 after hitting a low of 1.4 in 2011, but the government channel and the portfolio and private-label securities channel remain at or near record lows.

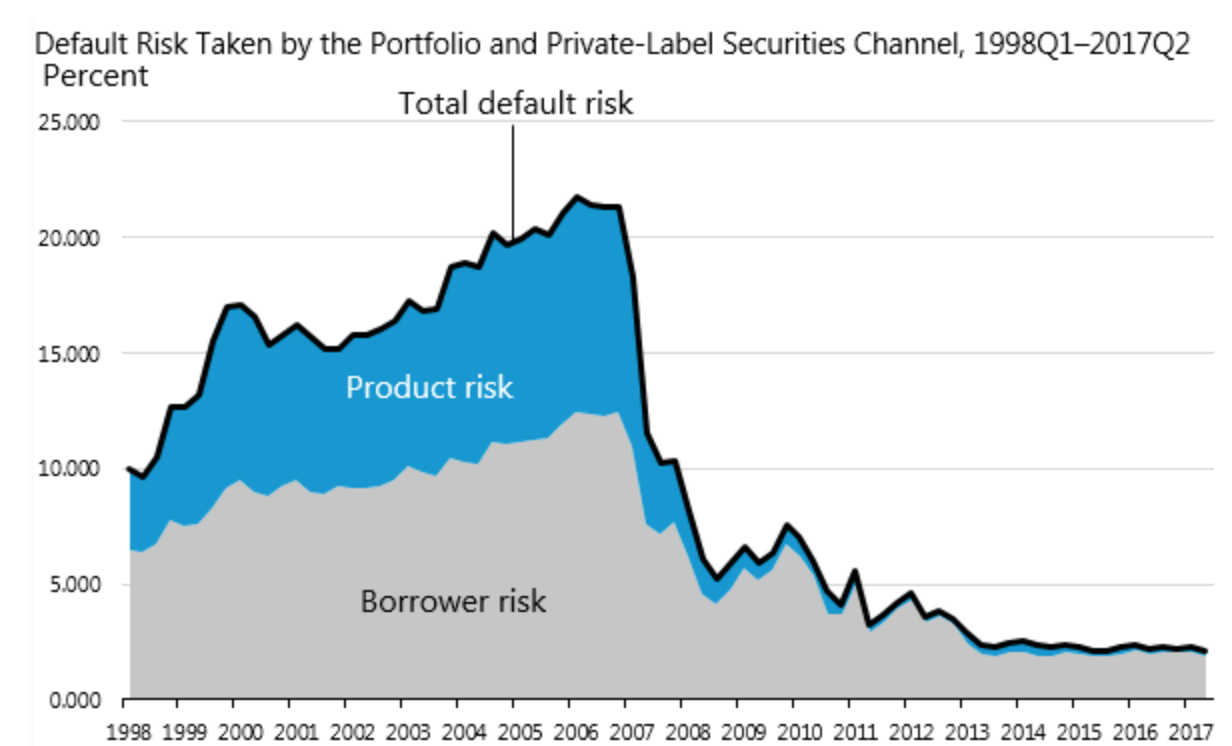

The chart below shows the trend in default risk in portfolio and private-label securities loans, which is not only significantly lower than any point since 1998, but has also remained stagnant since mid-2013.

Click to Enlarge

(Source: eMBS, CoreLogic, HMDA, IMF, Urban Institute)

The Housing Finance Policy Center explained there is still significant space to safely expand the credit box. Currently, even if the default risk was doubled across all mortgage lending channels, it would still remain within the pre-crisis standard.