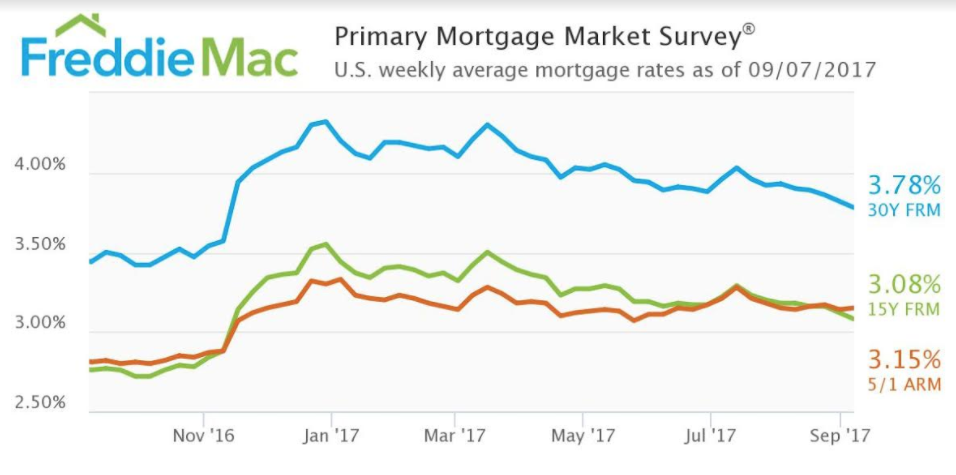

Mortgage rates continue to hit new lows this year as the Treasury yield reached a new 2017 low for the second consecutive week, according to Freddie Mac’s latest Primary Mortgage Market Survey.

“The 10-year Treasury yield fell nine basis points this week, reaching a new 2017-low for a second consecutive week,” Freddie Mac Chief Economist Sean Becketti said.

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage dropped to 3.78% for the week ending September 7, 2017. This is down from last week’s 3.82% but up from 3.44% last year.

The 15-year FRM also decreased, dropping to 3.08%, down from 3.12% last week. This is still up from last year’s 2.76%.

However, the five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly from last week’s 3.14% to 3.15% this week. This is up from 2.81% last year.

Freddie Mac explained the 30-year fixed-rate mortgage followed in the steps of the 10-year Treasury yield, hitting yet another new low for 2017.

“The 30-year mortgage rate followed, dropping four basis points to a year-to- date low of 3.78%,” Becketti said.

One economist pointed out fears concerning North Korea could be keeping mortgage rates low, according to Greg McBride, Bankrate.com senior vice president and chief financial analyst.

“Jitters over North Korea, plus low inflation and the likelihood it keeps the Fed on the sidelines for the remainder of the year continue to push bond yields, and mortgage rates, lower,” McBride said.