Monday Morning Cup of Coffee takes a look at news coming across HousingWire’s weekend desk, with more coverage to come on larger issues.

The digital mortgage revolution is about to take a mammoth step forward, as the nation’s largest mortgage lender is preparing to go digital.

The revolution towards fully digitizing the mortgage application process really kicked off about 18 months ago when Quicken Loans rolled out its “Rocket Mortgage” in November 2015.

Since then, JPMorgan Chase, Caliber Home Loans, United Wholesale Mortgage, Guild Mortgage, and a number of other lenders unveiled their own version of the digital mortgage.

While each of those companies incrementally moved the industry closer to going fully digital, the digital mortgage shift is about hit lightspeed, as Wells Fargo is developing its own digital mortgage platform.

Actually, Wells Fargo is doing more than preparing to go digital. The bank is already testing its own digital mortgage experience and plans to fully roll it out at some point in 2018.

The bank apparently announced its plans to go digital back in May during its Investor Day presentation, but it went unnoticed.

Hearty kudos to the Charlotte Business Journal for catching Wells Fargo CEO Timothy Sloan discussing the bank’s development of its digital mortgage during the bank’s call late last week with investors conducted in conjunction with the release of its second quarter financial results.

“We’re working on our own online capabilities. And right now, we're piloting it for our team members, and so far, the response for our team members who are taking a mortgage has been very good,” Sloan said during the call (transcript courtesy of Seeking Alpha).

“In fact, it has been much better than what our expectations were,” Sloan added. “And so our plan is to end to pilot that for non-team member customers later in the year and roll it out next year and we think it will be a step above anybody else in the market.”

During the comments, Sloan referred back to the Investor Day presentation, where the bank revealed much more about its digital mortgage plans.

At the Investor Day event, both Franklin Codel, Wells Fargo’s senior executive vice president of consumer lending, and Michael DeVito, the bank’s executive vice president and head of mortgage production, provided a sizable window into Wells Fargo’s digital mortgage.

During his presentation, Codel said that the “age of the consumer” is creating high expectations for what lenders can offer to their borrowers.

“Speed, simplicity, transparency and a personal experience are setting the baseline experience,” Codel’s presentation stated.

Codel’s presentation also noted that “72% of homebuyers and 80% of Millennials used their mobile device or tablet to search for a home,” while “54% of those who seek pre-approvals do so online.”

Because of those factors and others, Codel said that the bank is “taking action” to better serve its customers.

In that spirit, Codel said the bank is already testing a digital mortgage process.

As Sloan noted, the bank is currently testing its digital mortgage with Wells Fargo employees, and Codel said that the first round of borrowers liked what they saw.

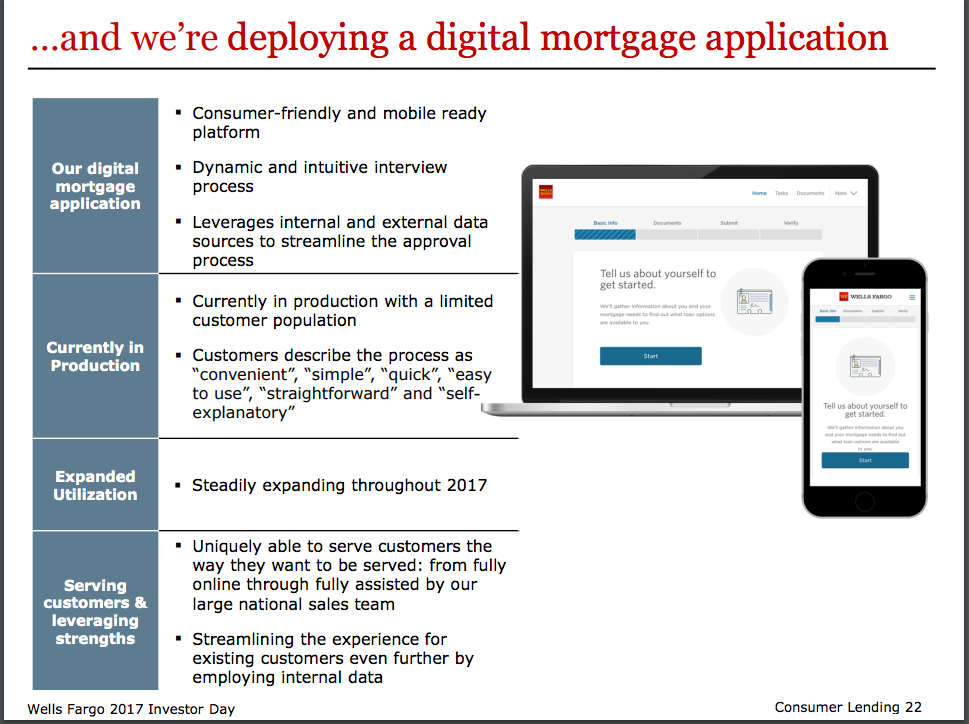

“Customers describe the process as ‘convenient,’ ‘simple,’ ‘quick,’ ‘easy to use,’ ‘straightforward’ and ‘self-explanatory,’” Codel’s presentation stated.

(Click to enlarge. Image courtesy of Wells Fargo.)

Later in the day, DeVito took the stage to discuss in more detail how Wells Fargo’s digital mortgage works and how it’s different from what other lenders offer.

“Strategically, this is larger than an online mortgage application,” DeVito said. “It is a move to broaden our approach to reaching customers as we transform our mortgage origination business, connect our team, our customers’ data, and technology together.”

A full transcript of DeVito’s presentation is available via YouTube because Wells Fargo actually posted DeVito’s speech, but the link is private and unlisted.

As of HousingWire’s review of the video on July 16, the video had been viewed on 355 times, so it’s not exactly going viral, but you can click here (or check out the embed below) if you want to watch DeVito’s presentation in its entirety.

DeVito said that Wells Fargo believes that combining technology with the bank’s team members will allow Wells Fargo to “deliver an unmatched experience that creates real advantages for Wells Fargo customers and a compelling experience for new customers.”

What sets Wells Fargo’s digital mortgage apart is the fact that especially for current Wells Fargo customers, the process is incredibly easy because Wells Fargo can pull in asset information directly from its own systems.

“This is both fast and secure – no documents to collect or submit,” DeVito said, adding that there are benefits for the bank as well, including “improving the quality of information, reducing risk, and limits our need to touch, image, evaluate paper.”

For customers who have assets with other banks, Wells Fargo’s digital mortgage can pull that data directly as well.

DeVito also demonstrated that Wells Fargo’s digital mortgage can connect directly to payroll providers (like ADP, Paychex, and Intuit) to pull a borrower’s employment data.

Then, once the borrower is done entering their information in, Wells Fargo begins considering their application instantaneously, by pulling a credit report, and running “automated decision tools in the background” to evaluate the customer’s application.

And if the customer provided all the appropriate data and is credit worthy, they could have a pre-approval letter from Wells Fargo in “just a couple of minutes,” DeVito said.

So why is Wells Fargo doing this, beyond the growing consumer demand for a digital experience, as Codel noted?

The bank sees significant opportunities to grow its sizable mortgage business from within its own customer base.

As Codel noted, the bank believes it has a “significant competitive advantage” because there are currently with 40 million Wells Fargo households. And of those 40 million households, only 8 million currently have a mortgage with Wells Fargo, while 18 million have a mortgage with a competitor.

Additionally, 14 million of Wells Fargo’s households are not currently homeowners.

Add that up and Wells Fargo sees the development of its digital mortgage as a “source of significant growth opportunity for both mortgage and home equity.

According to Codel’s presentation, in the current environment, just a 1% increase of Wells Fargo customer share in mortgages equals an additional $6 billion in originations per year.

And each percentage point of growth beyond that is another $6 billion in originations every year.

For reference, Wells Fargo totaled approximately $242 billion in originations in the last 12 months.

So while $6 billion may seem like a relative drop in the bucket for Wells Fargo, consider that Citigroup only originated $19 billion in the last 12 months.

And each percentage point of market share that Wells Fargo grabs is $6 billion in originations that’s being pulled away from the rest of the market into Wells Fargo’s already substantial market share.

Wells Fargo’s digital mortgage ain’t no moon. It’s a space station.

And with that, make sure to keep an eye on HousingWire this week for more big earnings reports and every other piece of important news for the housing industry.