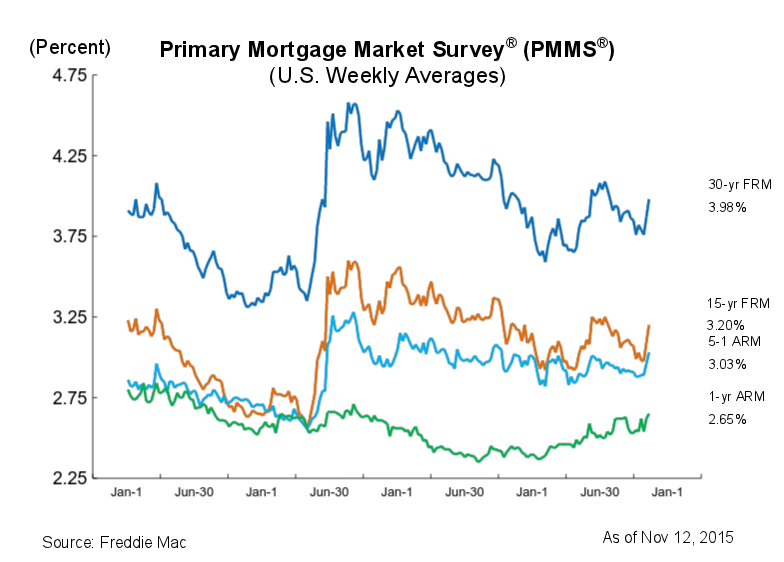

Average fixed mortgage rates continued to trend higher amid market expectations of a possible rate increase by the Federal Reserve and following a stronger than expected jobs report, according to the latest results from Freddie Mac’s Primary Mortgage Market Survey.

Click to enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage averaged 3.98% for the week ending Nov. 12, 2015, up from last week when it averaged 3.87%. A year ago at this time, the 30-year FRM averaged 4.01%.

Also increasing, the 15-year FRM averaged 3.20%, up from last week when it averaged 3.09%. In 2014, the 15-year FRM averaged 3.20%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.03%, up from last week when it averaged 2.96%. Last year, the 5-year ARM averaged 3.02%.

The 1-year Treasury-indexed ARM averaged 2.65%, up from 2.62% last week. A year ago, the 1-year ARM averaged 2.43%.

“The positive employment reports pushed Treasury yields to about 2.3% as investors responded by placing a higher likelihood on a December rate hike,” said Sean Becketti, chief economist for Freddie Mac.

“Mortgage rates followed with the 30-year jumping 11 basis points to 3.98%, the highest since July. There is only one more employment report before the December FOMC meeting, which will have major implications on whether we see a rate hike in 2015,” he continued.