A new blog from Trulia studied how student loans impact saving for a home. After all, Millennials are the biggest and most educated generation.

The proportion of Millennials with a bachelor’s degree was 34% in 2013, up from 24% for Baby Boomers when they were the same age, according to a CoreLogic (CLGX) report.

However, with that wealth of knowledge comes an overload of student debt.

But does that debt burden hinder the ability to buy a home or does the higher income associated with a degree make it easier to save?

In not-so-hot housing markets, the degree is not as helpful. In hotter markets, the degree is nearly essential.

The Trulia blog starts out saying:

To go to college, or not to go? That is a question many millennials ask themselves. A college degree undeniably comes with perks, including better long-term job prospects and higher lifetime earnings. But many millennials who get a college degree must pay back student loans, making it more difficult to save for a down payment in the short run.

As noted in the blog, saving for a down payment is one of the biggest roadblocks to homeownership and having a pile of student debt certainly doesn’t help the situation.

Trulia studied how many years it would take to save for a 20% down payment in different housing markets. For more details on how they conducted the survey, check here.

(Side note: It is a myth that people must put down 20% in order to qualify for a home. In reality, there are many options out there for borrowers.)

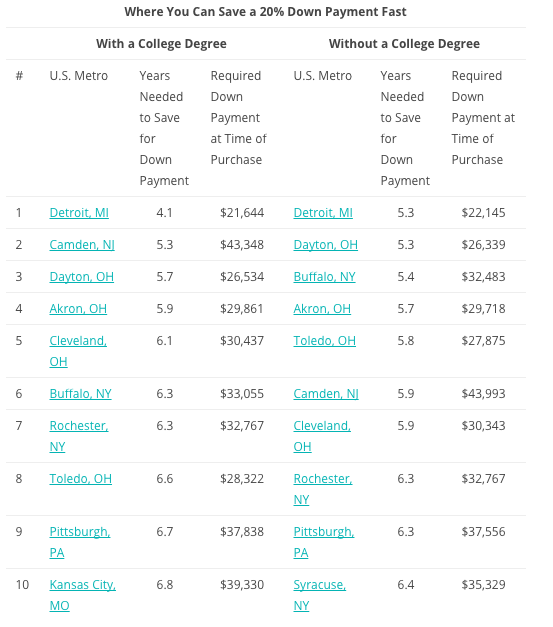

This first chart shows the housing markets where a Millennial will be able to make enough money to save for a down payment in a reasonable time, regardless of whether they hold a college degree.

Click to enlarge

Source: Trulia

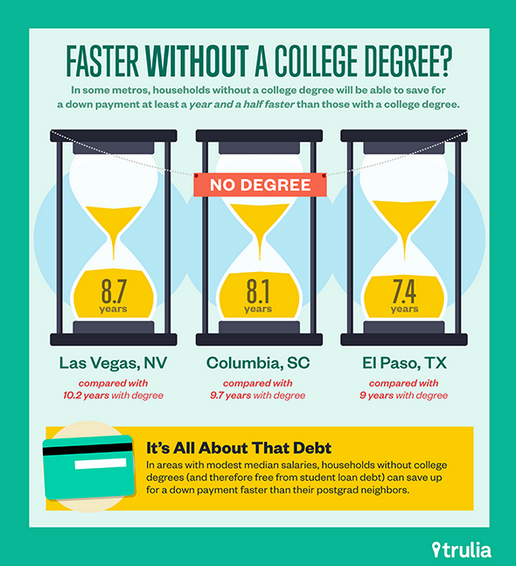

Even better, it is faster to save for a down payment without a college degree in these cities.

Click to enlarge

Source: Trulia

Trulia explained that this is possible for two reasons:

- First, the boost in income that you get for having a college degree in these metros is small.

- Second, households with college degrees typically have student loan payments, which hinder their ability to save for a down payment.

While helpful to know where you can afford to own a home, let’s browse back over our options.

First, Detroit, Michigan. Okay, that one is a fun place to live, especially with all the changes going on in the city.

But that still leaves Dayton, Ohio, Buffalo, New York and El Paso, Texas.

These are places that don’t frequent the lists of America’s hottest cities. Check this list from realtor.com. Besides Detroit, you won’t see any of these cities.

So no, you don’t need a college degree to save for a down payment, but you are left with some interesting cities to choose from.

On the other side, look at this chart of places you would prefer to have a college degree, with the number one city saying its impossible to buy a home without it.

Click to enlarge

Source: Trulia

Now these are the cities that are commonly renowned as the hottest housing markets. And even though you have a college degree, you are still not guaranteed a home. A lot of California cities still post a high number of years required to save.

Plus, if you take into account what a Millennials want in housing, most of cities that you don’t need a college degree don’t make the cut.