It will be about three years until the mortgage lending environment returns to a healthy level and reaches a strong equilibrium.

During an interview with HousingWire, Claren Financial Services CEO Mike Biddle explained that the mortgage environment has been increasing modestly and will reach equilibrium in early 2018, barring new regulations or other scenarios.

Click to enlarge

Source: Claren Financial Services

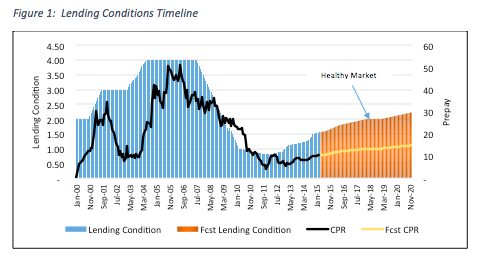

The above chart depicts the lending conditions observed in a recent study on mortgage conditions by Claren. The company took a purely quantitative approach when forecasting the direction of the lending conditions.

“We used forecasted macro-economic measurements and recent market trends to create an expectation that the lending conditions will gradually increase over the next five years,” the company said.

Currently, the market is at a 1.6. “We have had some marginal improvement, which has come pretty recently, and we foresee this to continue to improve. And based upon the forecast of the index, we think mortgage lending conditions will loosen but will never be back to 4.” The chart ranges from 1, which is the tightest, to 4, which is the most lenient.

However, while the market may never return back to 4’s risky lending standards, it will eventually go back to level 3 in seven to 10 years, according to the company. To put it in perspective, lending standards were the tightest toward the end of 2009 and the loosest in 2006.

Biddle explained that government intervention has stifled a lot of the mortgage recovery, with the additional capital requirements and consequences of the Dodd Frank Act.

But moving ahead, an increase in home prices and a decrease in the unemployment rate will loosen lending standards.

According to Zillow’s (Z) latest Mortgage Access Index report, overall, it was easier for homebuyers to access credit in 2014 compared with the prior year. But in the fourth quarter, the index dropped to 69.4, compared to 71.5 the previous quarter. It is still up more than 18 points from the fourth quarter of 2013, when it sat at 51.1.

An Index reading of 100 would indicate that credit has returned to pre-housing bubble levels.

Zillow’s Chief Economist Stan Humphries attributed the decline to the following. “After several years of rapidly increasing access to home loans, lenders are taking a pause. With the mini-boomlet in refinance activity late last year, perhaps there was less business imperative for banks to attract new customers with looser lending.”