Although Bank of America’s (BAC) overall first-quarter earnings are receiving mixed reviews on the stock market, its mortgage lending business is thriving and it continued to decrease its Legacy Assets and Servicing costs.

“Continuing the trend from last quarter, we saw core loan and deposit growth, higher mortgage originations, and increased wealth management client balances," said CEO Brian Moynihan on the bank’s earnings.

At midday, the bank’s stock is down 0.21% and is down -12.68% year-to-date.

Click to enlarge

Source: Bank of America earnings presentation

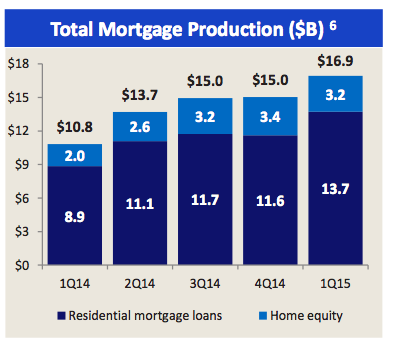

The bank originated $13.7 billion in first-lien residential mortgage loans and $3.2 billion in home equity loans in the first quarter of 2015, compared to $11.6 billion and $3.4 billion, respectively, in the fourth quarter of 2014, and $8.9 billion and $2 billion, respectively, in the year-ago quarter.

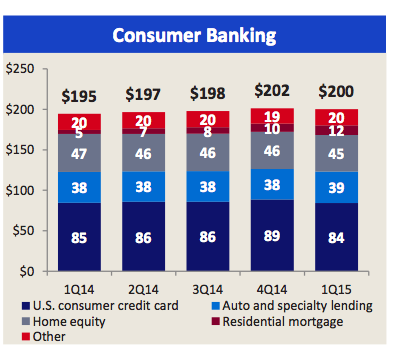

Meanwhile, provision for credit losses decreased $93 million from the year-ago quarter to $716 million in the first quarter of 2015 due to continued improvement in credit quality within the credit card portfolio, which was partially offset by a slower pace of credit quality improvement within the home loans portfolio.

Click to enlarge

Source: Bank of America earnings presentation

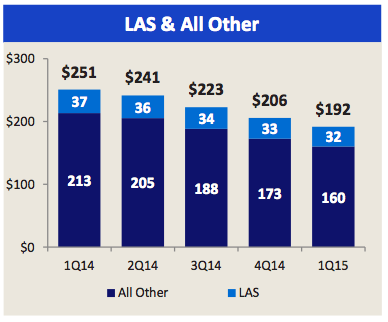

Legacy Asset Servicing recorded a loss of $238 million for the first quarter of 2015, compared to a loss of $4.9 billion for the same period in 2014, driven by lower expenses, primarily litigation expense, and higher mortgage banking income.

Click to enlarge

Source: Bank of America earnings presentation

Bank of America executives were asked on the earnings call if they were taking advantage of the current strong environment for people buying nonperforming and performing loans.

Bank of America responded saying:

We have been using it as an advantage. If you go back and look at the results, we were one of the first out there that started moving those loans in the first half of 2014. We’ve been aggressively doing that, both to take the risk of the loans off as well as to move the servicing.

Overall, as you get further and further removed from the crisis, what is left over, even though at the time when we set up LAS or set up some these noncorporate portfolios, would have been a product or service you didn’t want to continue. Seven years later you are seeing the customers left over have paid. There is a good bid but also we want to measure the economics of the portfolio. Now they are much smaller and the risk is way down, and so we judge that really on the basis of who the customer is, whether we want to roll them into corporate loans at the company and also what the economics of the outside are.

I wouldn’t expect us to change our course. We’ll just look opportunistically on moving in the right direction on both servicing and assets we own too because remember on the servicing side there is also a strong bid. Even the agencies are moving some portfolios