President Obama spent the morning addressing a room full of CEOs during the Business Roundtable.

During his speech, he bemoaned the lack of progress in job creation and wage appreciation. That's a great point to deliver to the nation's employers, granted.

However, the real economic challenge facing America in the years ahead, concerns housing affordability.

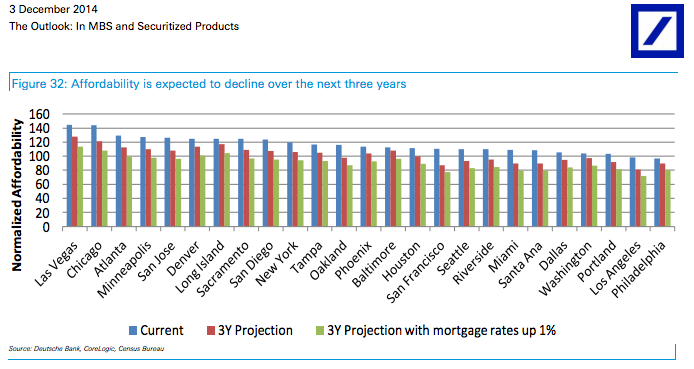

According to the latest outlook report from Deutsche Bank (DB) structured product analysts, the ability of the median-incomed America to buy a home is slipping, quickly.

And with interest rates almost certainly rising next year, there is little expectation that things may improve.

In fact, the analyst estimate that half of the 25 largest housing markets in the United States will be unaffordable to the average American earning the nation’s median income, all things being equal.

Now, add in interest rates rising by more than 2%, which likely take around three years to get to, and ALL of the markets will be unaffordable.

“If rates also rise by 1% then the normalized affordability index falls below 100 for 21 of the top 25 markets,” report research analysts Richard Mele and Ying Shen.

And, below 100 is bad for affordabililty.

Please click chart below to enlarge/explain.

Looking at the chart above, a 1% rise would equal 12.5% higher mortgage payments for those earning $53,000 per year, pushing most markets below 100.

It’s not that much of a stretch to imagine, as interest rates were above 5% a few years ago.

The renter nation is on the way, the pessimist in me wishes to believe. However, the analytics do offer some silver linings.

For one, price appreciation is slowing down. Unemployment is down dramatically from 2009 and mortgage-lending standards will loosen into next year.

The analysts add that in order for the housing market to return to equilibrium two things need to happen: incomes need to stay put or rise and mortgage rates.

And while the former is likely the latter is not.

That leaves only 3 years left for the average American to try to buy a home.