Silver Bay Realty (SBY) reported total revenue of $20 million for the third quarter of 2014, which is a 4% increase over the second quarter’s total revenue of $19.2 million.

But the company reported a net loss attributable to common stockholders of $44.9 million in the third quarter. That net loss equates to a loss of $1.17 per share, compared to net loss attributable to common stockholders for the second quarter of 2014 of $5.0 million, or $(0.13) per share.

Silver Bay attributes the third quarter’s net loss to a one-time cost of $39.2 million to internalize the company’s management.

“During the third quarter, we completed several strategic initiatives, including successfully internalizing management and completing a securitization, that we believe will increase overall shareholder value," said David Miller, Silver Bay’s president and chief executive officer.

"As we move forward as a company, we will continue to focus on growing our portfolio, optimizing our capital structure and enhancing our operational efficiency to grow cash flow."

The company said that because the company is now internally-managed, it believes that investors should see an improvement in operating cash flows through a reduction in corporate-level expenses, while providing a more simplified corporate structure.

Silver Bay said that the increase in revenue was due to an increase in leased properties generating rental income and rental growth.

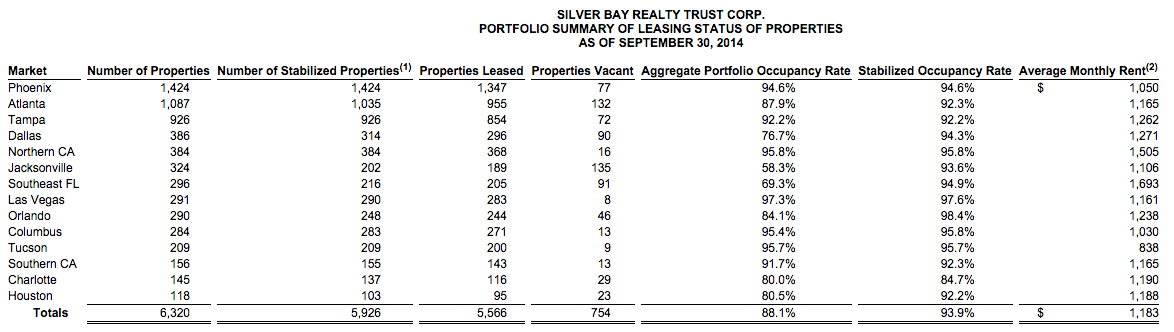

Silver Bay said that it acquired 340 more properties in the third quarter, taking its total portfolio of “stabilized” single-family properties to 5,926.

“Silver Bay reported an occupancy rate of 94% on stabilized properties as of September 30, 2014, which decreased slightly from 95% in the prior quarter,” the company said. “Silver Bay reported an occupancy rate of 88% for the aggregate portfolio as of September 30, 2014, a decrease of two percentage points compared to an occupancy rate of 90% on the aggregate portfolio as of June 30, 2014.

“The company acquired 340 single-family properties in the third quarter of 2014, a 39% increase compared to acquisitions of 244 in the prior quarter. The slight decrease in aggregate occupancy is attributed to the increase in the company's acquisition pace. Silver Bay reported an average monthly rent for the aggregate portfolio of $1,183 for the third quarter of 2014, compared to an average monthly rent of $1,170 for the second quarter of 2014.”

Click the image below for a look at Silver Bay’s occupancy figures.