The latest Securitization Weekly Overview from mortgage-bond analysts at Bank of America Merrill Lynch highlights the difficulty of millennials getting mortgages.

This age demographic joining the mortgage market, in the form of first-time homebuyers, is seen as key to a continued housing recovery.

“First time homebuyers represent the most likely group to drive an expansion of mortgage credit demand, these anticipated delays in household formation growth are also likely to result in delays in increased mortgage production,” according to the report.

However, the lack of credit availability, as well as psychological barriers, is oft cited for the slow pickup in this market.

The BofAML analysts seek to highlight why this is occurring.

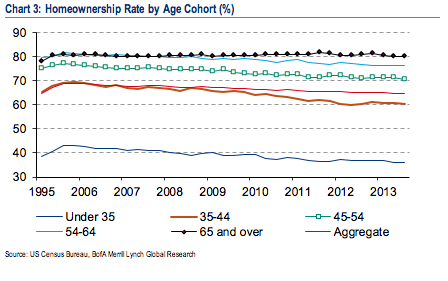

“We believe declining homeownership and labor participation rates have been and will continue to be key drivers of weakness in residential mortgage production,” they write.

Here is a chart showing the decline in homeownership, broken down by age group.

So, unless mortgage credit become more available, BofAML expects a slow economic recovery.

"This expectation of persistent weakness in residential mortgage production is the core factor underlying our continued relatively constructive view on securitized products. We think weak mortgage and housing production is a big part of the “slow” in what BofAML economists call the ”slow growth recovery” for the US economy: the recovery is missing the housing contribution it received in past recoveries."