Colony American Homes is planning to offer a $558.5 million single-family rental securitization. The offering, Colony American Homes 2014-2, will be the company’s second securitization of the year. In March, the company issued its first SFR securitization, which carried a loan balance of $513.6 million.

Now the company is launching its second securitization, which is collateralized by a single floating rate loan secured by mortgages on 3,727 income-producing single-family homes.

The loan is interest-only and has a two-year term with three 12-month extension options.

The pool of homes is spread across seven states, with California (33%), Florida (27.2%), and Georgia (12.6%) representing the largest portion of the pool. The top three metropolitan statistical areas are Los Angeles (12.9%), Atlanta (12.6%), and Las Vegas (9.6%).

Nearly all (96%) of the portfolio’s homes have three or more bedrooms and 94% of the homes have two or more bathrooms. The homes have an average estimated square footage of 1,864 square feet.

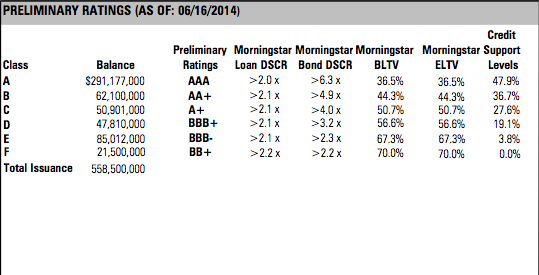

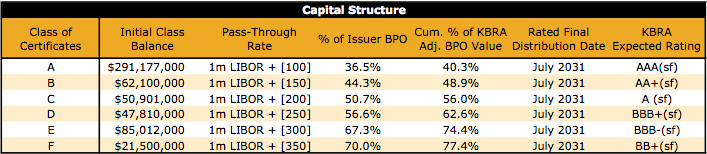

Morningstar and Kroll Bond Ratings Agency have issued presale reports on the securitization and have awarded AAA ratings to the largest tranche of the deal, which carries a loan balance of $291.18 million.

Click the image below for a larger look at Morningstar’s preliminary ratings.

Kroll’s preliminary ratings can be seen below by clicking the image below.

Kroll cites the potential for volatility in home prices as a concern. According to Kroll’s report, the pool of homes is concentrated in regions that experience high levels of defaults in recent years. “As such, a large majority of the underlying properties (70%) were acquired through distressed home sales such as trustee sales (65%) or short sales (5%),” Kroll’s report stated.

Kroll’s report also stated that the broker price opinion values for the homes demonstrate an average home price appreciation of 36%. That’s between 7% and 9% lower than the previous single-family rental securitizations.

“A portion of the property value increases can be attributed to the significant amount of rehabilitation completed by the property manager post acquisition,” Kroll’s report stated. “CAH spent an average of approximately 17.6% of each home’s acquisition price, or about $23,907, on refurbishing costs for each home.”

Kroll believes that there is a risk that the markets that make up the offering could level off and prices could correct, “particularly if supply increases rapidly in the event that investors choose to ‘flip’ properties or holders of distressed properties seek to exit their positions.”

The properties are managed by CAH Property Management, which Morningstar deemed to be an “acceptable property manager.” Morningstar notes that CAH has a “strong technology environment and comprehensive management process” as a positive. But it cautions that CAH has been in business for less than 36 months, so many of its core risk functions are in the early stages of development, undergoing review or in need of formalizing.

Kroll also cited the limited experience of the property manager as a cause for concern. “CAH is in the process of fully internalizing its property management division,” Kroll’s report stated. “Due to the manager’s limited operating history, combined with the fact that almost all of the properties only recently became stabilized, it is uncertain how effectively CAH can manage, maintain, and lease the properties over an extended period of time.”

Both agencies cited the limited performance history for single-family rental securitizations – this is only the fifth such offering — as a concern as well.

The loan seller for the securitization is JPMorgan Chase. The depositor is Colony American Homes Asset, LLC. The lead managers are J.P. Morgan Securities and Credit Suisse Securities. The servicer is Midland Loan Services and the special servicer is Situs Holdings.