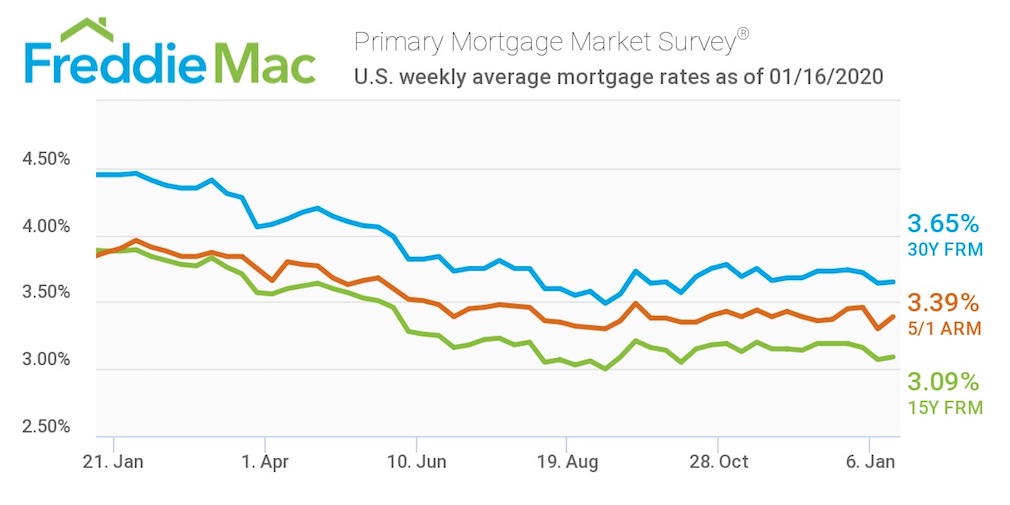

This week, the average U.S. fixed rate for a 30-year mortgage averaged 3.65%. While this percentage is slightly above the previous week’s average, it’s still 80 basis points below the 4.45% of the same week last year, according to the Freddie Mac Primary Mortgage Market Survey.

“Mortgage rates inched up by one basis point this week with the 30-year fixed-rate mortgage averaging 3.65%,” said Sam Khater, Freddie Mac’s chief economist. “By all accounts, mortgage rates remain low and, along with a strong job market, are fueling the consumer-driven economy by boosting purchasing power, which will certainly support housing market activity in the coming months.”

Low mortgage rates boost the economy by cutting home financing costs, which puts more money in the wallets of consumers to put toward the purchases that account for about 70% of America’s GDP.

According to the survey, the 15-year FRM averaged 3.09% this week, inching forward from last week’s rate of 3.07%. This time last year, the 15-year FRM came in at 3.88%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.39% this week, rising from last week’s rate of 3.3%. Last year, the 5-year ARM averaged 3.87%.

The image below highlights this week’s changes: