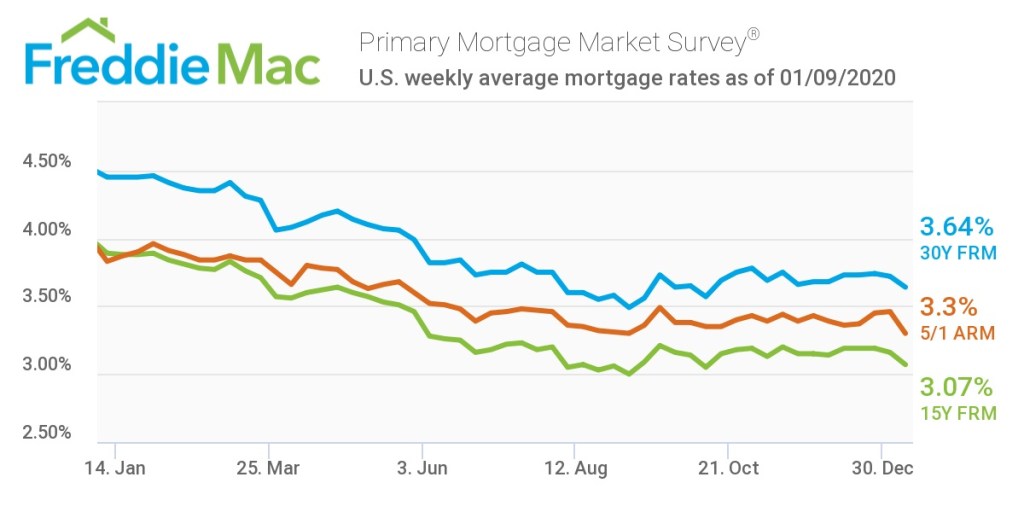

This week, the average U.S. fixed rate for a 30-year mortgage averaged 3.64%. Not only is this percentage below the previous week’s average, but it’s also 81 basis points below the 4.45% of the same week last year, according to the Freddie Mac Primary Mortgage Market Survey.

The decline also brought mortgage rates to lows not seen in three months.

“Mortgage rates fell to the lowest level in thirteen weeks, as investors sought the quality and safety of the U.S. Treasury fixed income markets,” said Sam Khater, Freddie Mac’s chief economist. “The drop in mortgage rates, combined with the strong labor market, should propel a continued rise in homebuyer demand.”

According to the survey, the 15-year FRM averaged 3.07% this week, falling from last week’s rate of 3.16%. This time last year, the 15-year FRM came in at 3.89%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.3% this week, declining from last week’s rate of 3.46%. Last year, the 5-year ARM averaged 3.83%.

The image below highlights this week’s changes: