A judge dismissed a host of claims against Washington Mutual Asset Acceptance Corp. but kept active seven claims that the WaMu subsidiary disregarded general underwriting standards for loans that backed certificates sold to trust funds between 2006 and 2008. Judge Marsha Peachman of the U.S. District Court for the Western District of Washington upheld claims worth $10.8 billion. The Plaintiffs, Boilermakers Nationally Annuity Trust Fund and Doral Bank, allege that WaMu Asset Acceptance Corp., a subsidiary of WaMu Inc., misrepresented the quality of loans that backed such certificates. The complaint was brought on behalf of Boilermakers, Doral and others who purchased interests in WaMu mortgage pass-through trusts. WaMu issued mortgage pass-through certificates for MBS from more than 75,608 sub-prime, first-lien hybrid adjustable mortgage rate loans in 36 public offerings. Claims pertaining to losses on 25 certificates were dismissed because the judge ruled plaintiffs lacked standing to sue for losses related to certificates for which they have failed to identify a purchaser. The court also dismissed claims against rating agencies Moody’s Investor Services and McGraw Hill Cos. Dismissed claims included those that WaMu skewed the loan-to-value ratios to meet certain target values. The court ruled that allegations that WaMu’s credit ratings were misleading were “similarly insufficient” because the plaintiffs failed prove data was materially omitted. Claims against WaMu’s underwriting compliance, purchase and sale agreements, and risk disclosures were upheld and will move to a federal trial. The court order said the “Plantiffs’ underwriting allegations survive dismissal because the statements may be misleading if they mask the extent to which the sponsor’s underwriting guidelines were disregarded. In essence, plaintiffs allege the underwriting standards ceased to exist.” The plaintiffs’ claims of economic loss were also validated. Steven Toll, the co-lead counsel on the plaintiff side, expressed hope for winning the case after hearing the courts denial of dismissal. “This decision is good news for investors,” said Toll, partner at Cohen Milstein Sellers & Toll. “While we are disappointed that the court dismissed a number of offerings from the case, we are gratified that the court has permitted the prosecution of this case to go forward.” Write to Christine Ricciardi.

Judge rules on mortgage-backed securities in Boilermakers-WaMu lawsuit

Most Popular Articles

Latest Articles

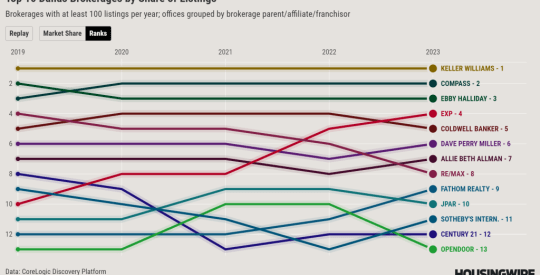

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders