The mortgage mess contributed to the single largest annual drop in homeownership on record, according to statistics released Tuesday by the Census Bureau. The national homeownership rate fell to 67.8 percent during the fourth quarter, a drop of 1.1 percentage points from year-ago levels. CNNMoney reported that the drop, while expected, still represents the largest yearly drop in homeownership since the government began tracking it in 1965. Via CNNMoney:

“It’s an incredible story,” said Dean Baker, co-director of the Center for Economic and Policy Research. “We’re back to where we were in 2002, which is before the subprime nuttiness and run-up in prices. And it’s not clear how much farther we’re going to fall.”

But the drop in homeownership wasn’t the only record made in the housing report — the number of vacant homes for sale leapt up to 2.18 million in Q4, up from 2.07 million in Q3. That fourth quarter number matched the all-time high for vacant sales inventory, previously set during Q1 of 2007.

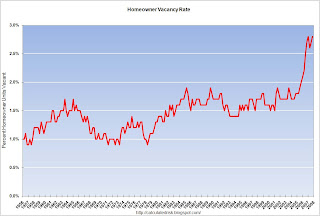

Homeowner vacancy also climbed during the quarter; per the Calculated Risk blog, who offers great analysis on this report, the vacancy rate for homes not for sale is sitting roughly 1 percent above its historical norm. The graph to the right, used by permission, illustrates trending for homeowner vacancies. It’s clear that we have quite a bit of excess inventory to burn off before we can start thinking about a return to normalcy in housing.