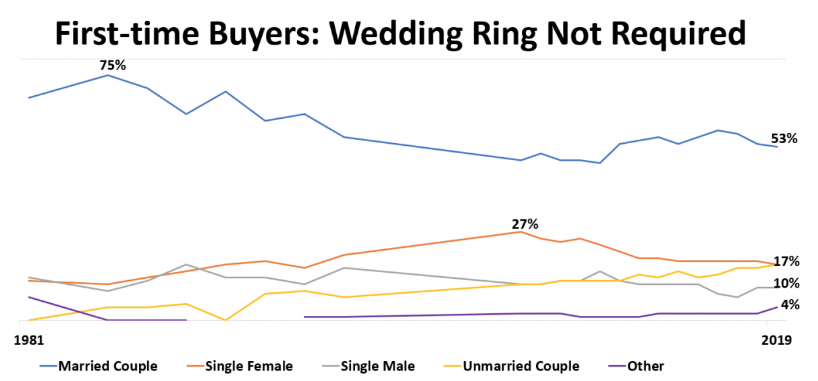

According to the National Association of Realtors, the first-time homebuyer composition is now mirroring the change in marriage rates.

In the 1960s, more than seven in 10 American homeowners were married. Two decades later, in the 1980s, a peak of 75% of first-time homebuyers entering the market were married couples. Today, only 53% of first-time homebuyers are married.

According to American Housing Surveys, 35% of first-time homebuyers in 2017 had never been married, compared to 23% twenty years prior.

Married homebuyers made up 61% of the first-time homebuyers in 1997 and declined to 46% in 2013. But, that percentage increased over the next three years, hitting 52% in 2017.

“This drop is likely due to housing affordability,” Jessica Lautz, NAR’s vice president of demographics and behavioral insights said in a statement.

So while the amount of married homeowners has seen an overall decline in the past few decades, that’s not to say that an increasing amount of people are buying homes on their own.

“It is harder for a single-income individual to enter the competitive housing market the U.S. is facing today. Notably, while single men have traditionally had smaller shares of home buyers, the share of single men has now crept up to 10% of the first-time buyer market,” Lautz said.

More and more homebuyers are purchasing homes in platonic relationships, too. This share has gone up from 2% to 4% in the last year alone.

Why? NAR says unmarried couples and roommate buyers have a little advantage over single buyers helping them to increase their numbers – a dual income.

“Dual incomes allow them to navigate the housing market and perhaps allow them to purchase a home that is at a higher price point where they may face less competition in the buying market,” Lautz said.