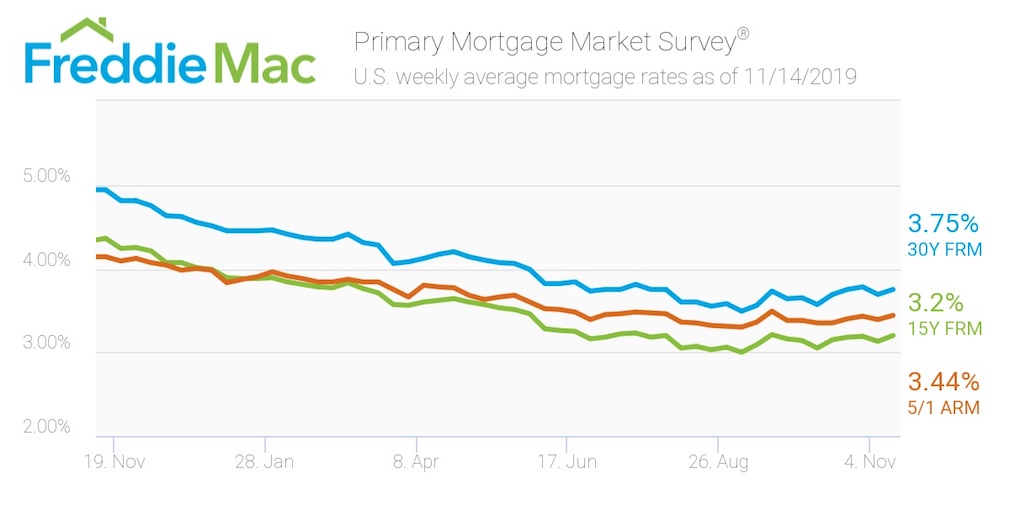

This week, the average U.S. fixed rate for a 30-year mortgage rose to 3.75%. That’s 6 basis points above last week’s 3.69% but still more than a percentage point below the 4.94% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

The modest uptick in mortgage rates over the last two months reflects declining recession fears and a more sanguine outlook for the global economy, said Sam Khater, Freddie Mac’s Chief Economist.

“Due to the improved economic outlook, purchase mortgage applications rose 15% over the same week a year ago, the second-highest weekly increase in the last two years,” Khater said. “Given the important role residential real estate plays in the economy, the steady improvement of the housing market is a reassuring sign that the economy is on solid ground heading into next year.”

The 15-year FRM averaged 3.2% this week, rising from last week’s 3.13%. This time last year, the 15-year FRM came in at 4.36%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.44%, increasing from last week’s rate of 3.39%. In 2018, the 5-year ARM sat much higher at 4.14%.

The image below highlights this week’s changes: