Fannie Mae, which reported a fourth-quarter loss of $2.1 billion, said it needs more federal assistance. The government-sponsored enterprise, which was taken into conservatorship in September 2008 during the financial crisis, said its 4Q loss included $2.2 billion in dividend payments to the U.S. Treasury. The Federal Housing Finance Agency requested $2.6 billion on the company’s behalf from the Treasury Department, more than 80% of which is the dividend payment. Upon receiving those funds, the company’s total obligation to Treasury for its senior preferred stock will be $91.2 billion. Fannie has paid $10.2 billion in dividends to Treasury since its senior preferred stock was issued, including $7.7 billion paid in 2010. So far, the two GSEs have received $131 billion in financial support from the Treasury Department. But Fannie Mae’s and sister GSE Freddie Mac‘s total cost to taxpayers could decline to an estimated $73 billion by 2021, according to President Obama’s 2012 budget. Freddie said Thursday that it would ask Treasury for a $500 million draw. Fannie narrowed its 4Q loss from the year-ago period. The GSE reported a loss of $16.3 billion, or $2.87 per share, for the fourth quarter of 2009. For the full year, Fannie lost $21.7 billion, or $3.81 per share, compared with a loss of $74.4 billion, or $13.11 per share, for 2009. Fannie Mae continued to be the largest single issuer of mortgage-related securities in the secondary market in 2010, with an estimated market share of new single-family mortgage-related securities of 44%. In the multifamily market, Fannie guaranteed an estimated 20% of multifamily mortgage debt outstanding as of Sept. 30, 2010, the latest date for which the Federal Reserve had an estimate. The company financed 2.7 million single-family conventional loans, excluding delinquent loans purchased from its MBS trusts, and about 306,000 units in multifamily properties in 2010. It also guaranteed or purchased an estimated $856 billion in loans, which includes approximately $217 billion in delinquent loans purchased from its single-family mortgage-backed securities trusts. Fannie said it modified 403,506 loans during 2010, including permanent modifications under the Treasury Department’s Home Affordable Modification Program, or HAMP, up from 98,575 in 2009. These figures do not include modifications in trial periods. Loan modification volume was more than four times higher in 2010 than in 2009, as the number of borrowers who were experiencing financial difficulty increased and a significant number of HAMP trial modifications became permanent HAMP modifications, the firm said. Fannie did 75,391 short sales and deeds-in-lieu of foreclosure, up from 39,617 in 2009. These workouts dipped in 4Q (15,632), however, compared to 3Q (20,918) due to weak market conditions, the company said. The company acquired 262,078 single-family REO properties through foreclosure in all of 2010, compared with 145,617 in 2009. As of Dec. 31, 2010, the company’s inventory of single-family REO properties was 162,489, compared with 86,155 as of Dec. 31, 2009. Write to Kerry Curry. Follow her @communicatorKLC.

Fannie narrows 4Q loss, asks for more federal help

Most Popular Articles

Latest Articles

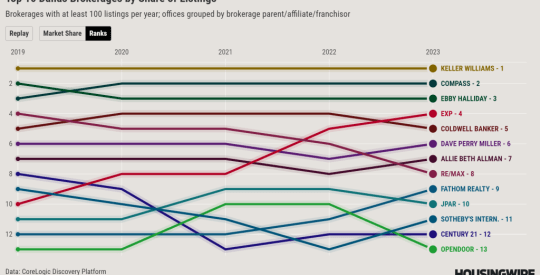

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders